No idea if this is accurate but I got a chuckle out of this:

Pretty random but David Zaslav seems like a parody of a comically overpaid American media CEO. He just decided to not release at all two $50 - $70 million movies that Warner Brothers already paid for, not even to streaming. He seems intent on nuking HBO Max, which has the best library by far of any streaming service. Everyone hates him, he’s incredibly arrogant and oh yeah he’s literally getting paid $700k per day.

Efficient markets!!!

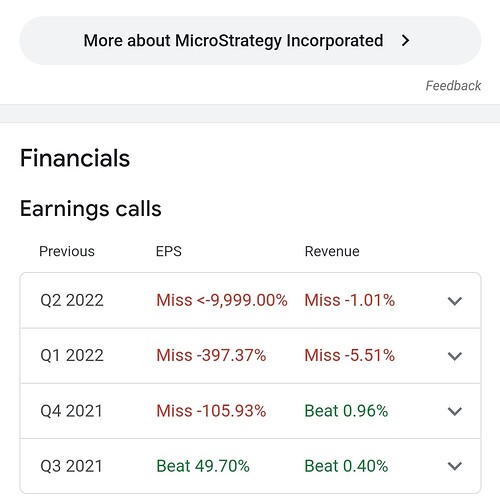

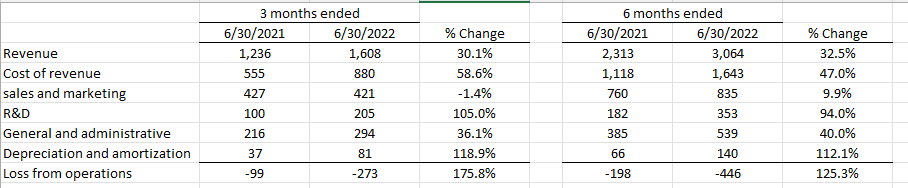

I don’t see what the strategy is? As of June 30th, MSTR had roughly 130,000 bitcoins (bitcoin?) that would currently be worth about $2.98 billion. On top of those bitcoin holdings, there’s an underlying business that (for the 6 months of 2022 at least) is operating at roughly breakeven on an annual revenue rate of about $450 million.

Current market cap is about $3.7 billion, so if you break out the bitcoin holdings, the underlying business seems to be valued at about $800 million.

I don’t know the company at all, but I definitely don’t understand the notion that the stock is a zero if bitcoin doesn’t moon. Am I missing something?

They’re pretty darned efficient for David Zaslav.

Oh, recently I skimmed something that I thought said 60% is index funds and 20% is OMGTRIANGLE algorithms. I probably misunderstood it and idk if I can find it again.

The optics of this are incredible. Let’s completely bury the two DC movies starring women POCs while moving forward with a DC movie whose star seems to be completely batshit crazy. Like who the heck is hyped to go see this Flash movie starring a guy who might be a sexual predator?

https://twitter.com/danaschusternyc/status/1555151127909376002?s=21&t=rt8m3x18zJFOCwq9O1gxYQ

https://twitter.com/dcu_direct/status/1554991272343048193?s=21&t=rt8m3x18zJFOCwq9O1gxYQ

Not putting these directly on HBO Max seems indefensible.

I think I’d rather see a movie about an actor who loses touch with reality and starts an Icelandic cult than another superhero movie.

This article from May talks about retail investors now investing more in index funds than active funds. But institutional investors would not be included in this comparison.

Did you read the Tweet thread in the post I was replying to? Pretty sure it was a Riverman post. Their latest earnings call was bullshit, they had negative cash flow last quarter and tried to bullshit around it, and the market is grossly overvaluing their business. They’re levered up on Bitcoin, so they could be forced to sell some of it at a big loss if it crashes farther, which gives them a significant risk of bankruptcy before it goes to zero.

The tweet thread seems right up your alley, but I haven’t gone and confirmed any of the numbers or anything

[I have no reason to defend MSTR and I’d certainly never invest in a company whose sole strategy seems to be to own bitcoin. I’m just attracted to financial statement and valuation talk like a moth to a flame.]

-

I’m generally a Bloomstran fan, but I thought most of that thread was nonsense. I totally don’t understand the discussion about quarterly cash flows or the idea that they’re covering them up. I think it’s always been the case that firms present their Income Statement/results from operations on a quarterly basis, but their cash flows on a year-to-date basis. As a couple of examples, you can see that with Chipotle or Coca Cola.

-

Is the market overvaluing their core business? Maybe! I don’t really know much about it. But I do know that they seem to have really high profit margins, which suggests that they might be able to crank up their cash flows if they choose to cut a bunch of their discretionary R&D and marketing spending. [Again, I wouldn’t buy this company!]

-

The biggest issue is the claim that “they could be forced to sell” some of their bitcoin. As of 6/30/22, they have about $2.4 billion in long-term debt and about $2.7 billion in total liabilities. But most of that debt isn’t an immediate concern. Their 10-K shows that $2.15 of their long-term debt is made up of notes that are due in 2025, 2027, and 2028. Moreover, $1.7 billion of that (the 2025 and 2027 convertibles) bears interest at either 0.75% (the 2025 notes) or 0% (the 2027 notes, but there’s also a reference to special interest in certain circumstances that I’m not looking up). So the debt is no real issue for them for the forseeable future.

My point of all this is that there’s no real strategy related to the idea that a levered-up MSTR is going to go bankrupt if the price of bitcoin goes down a little. They don’t actually have much debt servicing costs, and their big principal payments don’t happen for at least 2.5 years from now. And, supposing they do need to sell bitcoin when those payments come due, it’s completely irrelevant that they’d be selling it at a loss. At current prices, they have more than enough to satisfy all of those payments.

[I can’t emphasize this enough, I wouldn’t buy stock in this company. Gun to my head, I’d much rather short it than buy it. I just don’t think there’s some kind of magical arbitrage here related to a combined position in MSTR and bitcoin.]

First, an interesting update on QIWI that I know you’ll be interested in. The CEO, Sergey Solonin, has set up a holding company in the Marshall Islands to buy back the American shares and is offering $2.50, so I’ll read the 37 pages of legalese before officially accepting but almost certainly will. It’s trading at th equivalent of $4.85 on the MOEX, but I think the general consensus is that the MOEX valuations and RUB to USD exchange rates are bullshit right now. My guess is that QIWI is still worth a lot more than $2.50 a share, and maybe even more than my initial investment, but the likelihood that I’ll have no way of ever realizing the actual value is high enough to just take this offer and be done with it.

This will represent a 65.5% loss in the position for me, but I was able to make that and more off my WEAT trade that was hedging the risk of the war, so I’ll end up having a worst case scenario come to fruition and still escape the position profitably.

No clue how this is getting around sanctions, it seems blatantly obvious that it’s just transferring the shares back to a Russian oligarch in a sweetheart deal, but I guess it’s going to work if the SEC has let it get to this point.

You basically have a Russian-born CEO who is still a Russian citizen creating a holding company in the Marshall Islands to buy back shares of a Russia-facing Cyprus incorporated company that’s under sanctions that are supposed to prevent the sale.

And it didn’t take them that long to figure out this workaround.

Now onto this other thing…

I have no dog in this fight either because I haven’t done the research on it yet, but I think he said they changed the way they reported it this time in order to make a positive instead of negative comparison.

If they bought bitcoin on margin, would that show up somewhere in the filings in a way that would be easy to interpret? That seems to be Bloomstran’s claim. That they’re going to get a margin call if it drops below a certain amount.

Fair enough, this makes me not want to take the time to research this when I have some other stuff to look into.

By the way I’d say this offer from Solonin certainly validates my theory that QIWI has quite a bit of value left. He knows the true value right now better than anyone, could basically lowball it as much as he wanted and offered $2.50 a share.

Also, these sanctions in this case are directly benefitting a Russian oligarch. Huge fail by the Biden administration. Hurting American investors and helping a Russian oligarch.

Yes, am definitely interested in any and all QIWI updates. It looks like the tender is for only about 19% of the shares, so I wouldn’t count on having all of your shares repurchased.

As far as I can tell, they reported exactly the same way in their 2Q 2021 earnings announcement and 10-Q filing.

I don’t see any evidence of this. They have pledged some of their bitcoin as collateral on their outstanding debt. But nothing I saw in their filing even hints at the possibility that changes in bitcoin price could trigger early repayment.

Overall, it seems like buying MSTR is comparable to making a levered bet on bitcoin.

I know Microstrategy used bitcoin they own as collateral for loans to buy more bitcoin. No idea how that plays out with the stuff you guys are talking about, I don’t think I’ve ever even looked at an earnings report.

Did you perhaps intend to say that they used leverage to broaden their investment portfolio as part of their cutting edge blue ocean strategy? Because that sounds a lot more exciting than taking some loans to purchase more craptos.

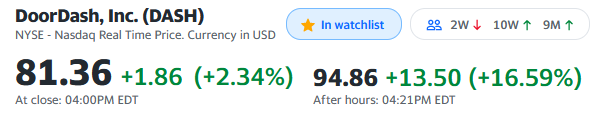

Welp, DoorDash has reported quarterly earnings

Considering they just skim a fee for each transaction and don’t really need any actual assets to operate this business, you’d expect that scale should work in their favor - the more revenue they generate the more profitable they are (or the closer they are to profitability).

But no, they manage to ramp up their spending substantially more than the increase in revenue. I also continue to be amazed at how much they spend on R&D. I assume they have some secret Batman division like Wayne Enterprises did?

Oh, obligatory after-hours quote:

Fair… I’m not sure how it’ll work, because larger institutional investors or uber-wealthy people with huge positions probably have better options than this. Like converting their ADRs to actual MOEX sales, holding them there or selling them at the market rate there, and then attempting to convert from rubles → ??? → dollars. But I’m not sure off the top of my head what % of the ADRs are held by people who may have those types of options.

Looking forward to the documentary in a few years about how they were DASHING to the DOOR with the skimmed profits by paying some holding companies ridiculous amounts of money for R&D that was actually just cycling back to themselves.

So they’re making the same mistake Ryan did when he figured out the financials for the Michael Scott Paper Company?