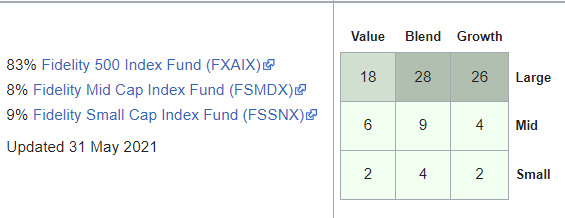

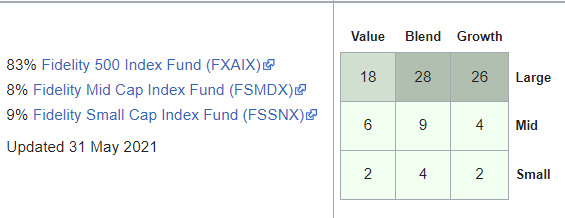

This is fine. Just be aware that you will be somewhat overweight US small and mid cap based on market cap weightings.

Market cap weight would be 58% 500, 6% mid cap, 6% small cap

https://www.bogleheads.org/wiki/Approximating_total_stock_market

This is fine. Just be aware that you will be somewhat overweight US small and mid cap based on market cap weightings.

Market cap weight would be 58% 500, 6% mid cap, 6% small cap

https://www.bogleheads.org/wiki/Approximating_total_stock_market

Doesn’t this boil down to having a slightly more aggressive / risky portfolio? Which I’m fine with at this point.

Maybe very very slightly. The risk factor for small stock is pretty much negligible if you are buying an entire small cap index with zero value screens.

not great, Brandon

It’ll get revised to +4% in a couple of months no doubt.

no problem, we’ll just lower interest rates!

So if the TWTR sale to Elon goes through, it will have lost to the S&P over its publicly traded life. The IPO was at $26, would sell at $54.20, +108%. The S&P in the same stretch is +132%. It’s far worse for people who bought it on the first trading day, they paid over $40 for it most likely.

wait are stocks up again today because the GDP shrank and that means a less aggressive Fed?

is the data broken up by state or industry?

yeah they’re probably going to actually do my joke

The tech comp frenzy might not last much longer based on these earnings. 60% of FAANG saying they’re done staffing up.

Here’s your chance to shine: Amazon reported a big loss on the very predictable marking-to-market of their Rivian holding. The stock is indeed down. If it’s down because of the completely immaterial Rivian effect, then you should be able to step in and make a quick 10%!

at this point in general if you are buying you’re just betting on they won’t keep raising interest rates, otherwise it’s foolish

of course some specific dart throwing can work out but otherwise just gonna go down overall people are pulling back

Complete bloodbath. Yikes.

S&P 500 lost over 10% in April.

I still think it’s overvalued so it’s not a play I’d make. I do find it amusing that the stock rocketed off the first earnings report with Rivian and plummeted off the second, when all of this was basically known information since that last one came out, but there were of course other factors too.

I’m hoping to be able to get a bargain on Amazon stock in a few months, no interest in it at current levels.

I have been eager to find out what Qiwi has been up to, and they’ve finally updated their financial statements. Spoiler alert: they do not hold very much U.S. dollars or Euros:

stonks

I swear if my portfolio ever gets back to that same ceiling we’ve bounced off like 9 times now, I’m gonna pull a cuse and try to time the market.