I’m talking about TVs and video games and speakers and stuff like that, not home office supplies.

those are the most important home office supplies

So if I could show you data that demonstrated that demand for these products spiked globally and not just in the US would you be satisfied that it was not primarily due to US stimulus checks?

From WSB:

Cramer said bear market is cancelled, so we all know what’s gonna happen.

The reverse Cramer, FUCK.

I thought the “reverse cramer” is a sex position. No?

Yes it’s when someone tells you that they will blow you and you end up getting fucked in the ass.

ETA:

The “Reverse Cramer” is actually just having sex with your wife. As opposed to doing some coke while her and her male escort take turns pissing in your mouth while both pounding the table to BUY BABA at 300. That’s the Cramer.

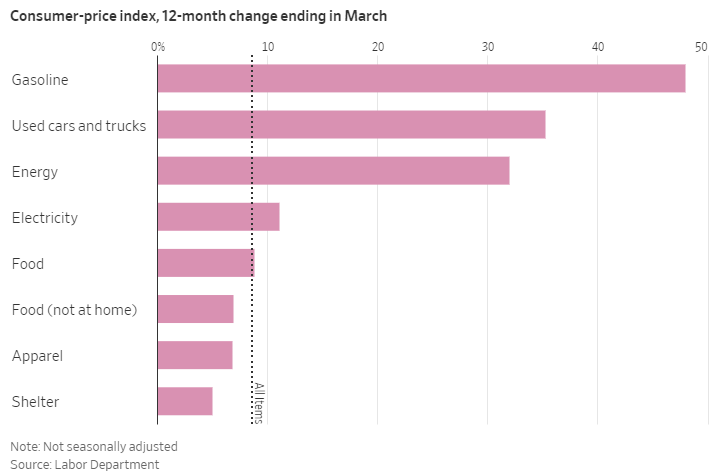

U.S. Treasury Series I Bonds, or I Bonds, will offer annual interest payments of 9.6 % , based on the bond’s latest inflation rate calculation, which is tied to March’s consumer-price index. Prices rose by 8.5% year over year in March, the fastest pace since December 1981, according to the Bureau of Labor Statistics.

The interest is compounded every six months and reassessed in May and November each year. The bonds haven’t always been hot sellers, but that has changed with the surge in U.S. inflation gauges.

Over the past six months, nearly $11 billion in I Bonds have been issued, compared with around $1.2 billion during the same period in 2020 and 2021, according to Treasury Department records.

Don’t like 60% of Americans essentially have no savings and another 20-30% have like less than 6 months expenses saved?

Can I buy this through Fidelity?

No. Only treasury direct. Took me 5 minutes.

Do the Treasury Direct I Bonds expire after 1 year or can you hold them longer than that?

Like Riverman said, you have to buy it through a government website called TreasuryDirect. It’s a bit of a pain to use, but worth it. Limit of $10k per person per year, more or less.

They keep earning interest for 30 years, but the rate depends mainly on inflation.

More info here:

Not gonna work out of an IRA.

Oh wait - limit of $10k. I can put that together.

I bonds are an awesome place to put emergency funds (that would otherwise be earning like 0.1%) WITH ONE BIG WARNING:

You can’t access the funds, at all, for 12 months. So don’t take the $20k emergency funds that you and your spouse have put together and might actually need, and lock it up in ibonds. You need to make sure you’ve got other liquidity available.

this is why i was shocked when i saw in the housing thread that 30% of houses sold in America in 2021 were bought with cash. so on one hand we have over half of Americans that cant afford a $400 emergency car repair but on the other hand we have a shitton of 400k+ houses being paid for in cash. are these just the top 2-3%/corporations buying up 30% of houses?

Seems like a great place to park a future house down payment as well.

i know this is a meme but it would still take 20+ years at the current i-bond interest rates to make up for missing out on the last decade of stonks

House flippers. In my neighborhood I couldn’t even look at fixer-uppers because they were all getting snatched up by flippers who could offer all cash.