Ah ok, I didn’t know about the 30 day thing. And thanks for the link!

If you’re concerned about your savings not lasting because of bad luck with returns, it doesn’t seem terrible to buy an annuity to cover whatever minimum standard you need (along with SS) and gambool with the rest.

yeah people gotta read the fine print out of those type of things

some of that stuff is insured but I doubt any of those insurance things can cover one big company going out of business, they’re all massive at this point.

I think they invest relatively conservatively, are heavily regulated and would be near the front of the line for a government bailout. Probably good in pretty bad environments short of your central bank getting sanctioned…

As mosdef said, you can get that option. There are tons of other options you can add on that are probably -EV but reduce variance. For example, there is commonly an option for you to be guaranteed to get your investment back. So if you die too early, your heir will get a check for the amount you paid, less any payments that you received. But if you live a long time, you will still get your annual payment.

Proper allocation is going to be personal and align with your own utlity value - how each % of money actually helps compared to max returns. So I’d probably back you in your interest to follow a 100 - age from a 30,000ft view more than others here.

I mean, you play poker. It’s like being >50 having your entire life savings and all of your future income when being dealt AA’s and having an opponent who covers you jam with KK’s pre. It would just be correct to fold for certain folks despite missing out on max equity.

People just can’t bring themselves to do this in a low interest rate environment. Like if I go look at a large Canadian insurer’s annuity calculator right now, and punch in $100,000 as my single premium lump sum for a 65 year old male today, it tells me I could be an annuity paying about $5,400 per year guaranteed for life. The astute saver, or their advisor, will note that that implies that instead of buying an annuity, if you could invest the money yourself you would only need to earn 5.4% per year to replace the annuity income AND preserve your original capital of $100,000. Even people that know that they have to take some investment risk to attain a return of 5.4% are probably willing to take that risk in exchange for the upside, and their are many: you might earn more than 5.4%, if you only break even on the 5.4% you’ll still have $100,000 to give to your kids when you die, if you have an unexpected $10,000 expense in retirement you could dip into the $100,000 to pay for it. These are big considerations for retirees.

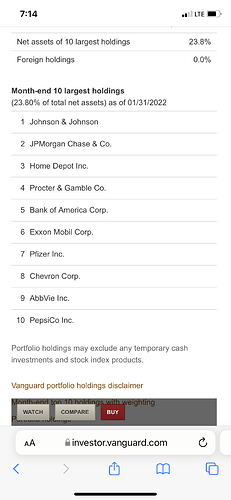

Right. Vanguard has a high yield stock fund that pays 3%, and you still obviously own the equity if/when you die. The top 10 holdings are below, these are not speculative firms:

This is exactly why annuities don’t work when you think of them as investments instead of insurance. The insurance company selling the annuities has rigorous capital requirements where regulators force them to back the annuities with very secure assets (mostly bonds). So from a pure investments perspective, OF COURSE they are going to underperform against a portfolio where you have total freedom to select investments.

Usually if there is any role for annuities at all, I would say that you would get there by first optimizing your asset mix, and then using annuities in place of bonds. So if (and only if) your optimal asset allocation at retirement include X% in bonds would I then start considering annuities. As a substitute for bonds, annuities make more sense since then you are doing a more realistic apples to applies comparison on the yield, and the annuity comes with some advantages over bonds (the guarantees).

But even then the annuity seller is really just packaging a bunch of shit you could buy yourself.

They can actually do a little better because they can access some mortgages and private placement bonds with slightly higher yields than can be affordably obtained by a retail investor. So as a substitute for a retiree’s fixed income portfolio, annuities are not bad.

And the annuity provider gets to take advantage of the law of large numbers so that it’s payouts are fairly predictable, while you only get to live once. I’m not recommending that anyone get or not get an annuity. But I do think it’s a useful option to consider to evaluate how much you really care about locking in some income stream for life.

ETA: this discussion would be very different if there were no Social Security. So I think most of us can agree having some source of annuity income is pretty good!

Guaranteed income for life is a wonderful thing, but paying fair price for it in a low interest rate environment and long life expectancies is not. That’s why DB pensions were so good for employees and so bad for plan sponsors - employees were getting the value of the guaranteed income for life but they didn’t have to fully pay for it themselves, employers were paying for it. That’s why private sector DB plans are so rare now. In the retail annuity space the guaranteed income for life is a great thing, but when you have to pay for the guarantees out of your own pocket they’re not nearly as attractive.

I’m assuming $0 for social security in retirement based upon what I expect to save. Social security reasonably likely to be heavily means tested for 15 year + time horizon.

Man I think means testing is pretty unlikely for Social Security. Olds vote, especially affluent olds, and it’s literally their own money.

It is very unlikely but people have emotional and politically driven ideas about what’s going to happen to social security. If someone wants to play around not having social security when they retire that’s fine, but it’s kind of like “planning” for the stock market to return 0% over 20 years. Like, it could happen, but it’s not really planning it’s more like risk management via stress testing.

Means testing social security is a terrible idea. If you want to soak the rich you remove the cap on payroll taxes.

Yeah, this.

I also assume zero SS. But I don’t think it’s actually going to happen.

Whynotboth.gif

Obviously I understand all these arguments, guess I’ll just set a bookmark for 2040 and check back :)

Means testing is terrible both in theory and in practice. The problem with rich people isn’t that they get too many benefits it’s that they don’t pay enough in taxes.