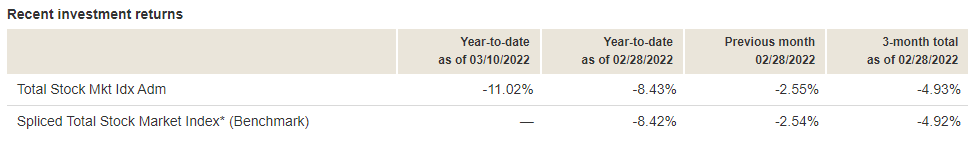

Being a vanilla VTI investor these days, I don’t check my account very often, but I did today. Definitely not great.

Looks like the new consensus allocation may be 110 or 120 minus age. Probably a bit better, but still think too conservative. Really, it’s the type of thing where everyone is different. Tons of other factors - things like job security, current assets vs. income, family, health issues, etc.

I guess using 120 - age is ok if you want to just not think about it, but it’s the type of thing that you should be able to do better than with just a bit of analysis.

Yeah I mean if the market crashes I’ll go 100/0, and I’ll stay that way until the market returns to historical averages on most metrics. Then I’ll re-evaluate and it’ll be a combination of age and what percentage of net worth my retirement accounts are. The greater my net worth outside them the more I’m inclined to keep them 100/0.

But I do also plan on/hope to be retiring pretty early, so we’ll see what I’m thinking once I’m 40, 45, 50.

Lol wtf 100-Age is some boomer stuff. I can’t believe that’s a real recommendation? I don’t even think those target retirement funds go that wild. I personally can’t imagine holding a single bond, I guess if you’re conservative I could see like a 80/20 ratio of stocks-bonds if you’re like a few years from retiring maybe? IMO holding bonds is lighting money on fire, it only makes sense when you have enough money that you can have it burn away annually without running out until you’re dead.

Me replying to spidercrab about it above:

Well… Could end up digging deeper into this one on Sunday, I guess.

i think even boglehead consensus has moved to something like 110 minus age

It’s a taxable account so my ability to rebalance is a bit limited. I will be working on some tax loss harvesting, though. It’s a fucking pain in the ass because I’ve got to make sure all my dividend reinvestments are turned off in multiple accounts and then I have to remember to turn them back on.

That’s why these two are a perfect pair for tax loss harvesting.

Eh there is a very small difference in expected return between 100/0 and 80/20. I don’t think it matters much either way, but I recommend the 80/20 portfolio for behavioral reasons.

VTI is also US only. I think the comparison you’d be looking at is VXUS (international) or VT (total world).

The truth is that none of these asset allocation rules of thumb are valid. You’re as likely to make a catastrophic mistake following them blindly as you are to make a catastrophic mistake by paying no attention to what your asset allocation is.

In reality, people need to bring their overall financial position to the table to make that kind of decision. Age is nowhere near enough information to use as a benchmark. Consider these people:

A: 50 years old, makes $200,000 per year, married to spouse in the public sector with a DB pension, owns their home, has $500,000 is savings

B: 50 years old, makes $80,000 per year, divorced, does not own a home, has $50,000 in consumer debt and no savings

Let’s assign them the same asset allocation strategy!

Yes, and the appropriate asset allocation glidepath is pretty tricky because it’s all about sequence of return risk, and its nothing like age in bonds or whatever. More likely you want your AA to be at its most conservative right when you stop your accumulation phase.

Sequence of return risk is truly a bitch and is why 401k plans replacing pensions really fucking sucks.

Well, they only suck for retirees. They’re great for the investment industry.

Sequence of return risk is pretty much the only retirement worry that I have. The problem is that it is very difficult to build a big enough buffer to not have to worry about it.

Same.

Of course I could just dial back my spending but I really don’t want to.

For this reason I kind of like “10 years spending in bonds, rest in equities,” but if equities truly crash it would be impossible for me not to rebalance out of the bonds.

Exactly. Which means to really feel good you need more than 10yrs. And before you know it, you’re one of those bogleheads that you always dunk on.

The thing is that if interest rates remain super low then bonds aren’t really “low risk” because a rate increase can wipe out a chunk of your bond portfolio anyway. Maybe less downside risk than equities, sure, but without the commensurate upside either.

I actually wonder if the theoretical optimal strategy in a low interest scenario is to hold only equities and puts that hedge against catastrophic equity downside risk. If you allocate a lot of capital to bonds, you are effectively paying for that “insurance” against the downside by sacrificing a ton of expected return, it might make more sense to just directly buy the insurance via puts. This might be one of those investment strategies that cannot be effectively implemented in a normal retail account.