Commodities aren’t about value they’re about swings. If there’s less steel made elsewhere X is still a really good play. ie oil is high but if russia is a no go should keep going for a little while.but you can’t hang on to it forever it comes back down eventually.

I don’t think X is about swings. It’s not a pure commodities play, far from it. Their profits will be cyclical to an extent with swings in steel prices, and that will impact stock prices, but there is also the element of the quality of their business, their balance sheet, their implementation of new technology in their production, etc, plus the effect of reshoring due to the pandemic and now due to this war as well.

regarding the point of most people you are absolutely right–I know a dude would go in about anything, a mining company with no mine, some gas thing that was promised as environment or more efficient I don’t remember the details–anyway this entire company projects/plans/etc–all ended up being literally one dude in his parents basement who they went after for a lot of shit cause you can’t actually do that. He’s absolutely awful with money wish he would just hand it over to some bank dude.

stupid part is it’s all his broke pals too it’s like dude, if they don’t have money why are you following their genius money making ideas they’re all old, there’s a track record here.

tons got rekt with did doge or gme or w/e when we were all no no no and no.

There’s a ton of people who just hand something to the bank guy or would never withdraw or do anything better “because he’s nice”

Right, like the percentage of the population that’s putting 5%, 10%, 20%, or god forbid more into dogecoin and GME and the WSB stock of the week would be waaaaaaaaaaaaaaaaaay better off paying 1.75% to have someone to call up before they do it to explain to them why it’s a terrible idea.

Anyone diamond handing it on GME for 20% of their roll is never going to hire this company in the first place.

Well, maybe some of the people who diamond handed it on GME for 20% of their roll will hire a company like this now.

But the model seems more like: contract with a fortune 500 company, give people good advice for “free” and in 5, 10, 20 years when some of them save/invest well and/or get promoted, then they have large amounts of money, move them over to the other side of the business and run their money for them - but not like a hedge fund, just allocating it properly and keeping it in index funds and rebalancing and minimizing their tax exposure.

advisor: “I see you have 10% of your retirement in TSLA, if this drops by 30% you could potentially lose 3% of your retirement, I would advise against this”

client: “ok thanks”

advisor: “Your welcome, now that will be 1.75% of your retirement.”

I think you’ll get very little advice like that from an advisor working for a company that manages employer sponsored plans. Even if it’s good advice to encourage people to eliminate concentration risk by selling a big position in TSLA, if they listen to you but then TSLA goes up the advisor’s company has to deal with pains the ass ranging from getting yelled at to getting sued. That’s not good for them.

Usually for these employer sponsored programs, if you call up the advisors and say “Hey, I work at ABC Company and I have been there 3 years and don’t know what to do with my 401(k)” the advisor won’t start giving you investment tips. They’ll go through a KYC type of questionnaire and get a bunch of data about you into the system (your age, your gender, your risk tolerance, your other assets and liabilities outside the plan etc.) and then they’ll show you what kind of retirement income you’ll have under different future savings rate and investment return scenarios. This is theoretically useful information but there is a bad tendency in the industry to design these models so it looks like people always need to save more or they won’t be able to retire until they’re 75 or something, trying to scare them into increasing their savings rate. There is a conflict of interest there for companies that collect fees as a percentage of AUM, obviously. The conflict is even worse when you get people at retirement looking for help drawing down their assets in retirement but the advisor gets paid more when the account balance is bigger, so they discourage people from taking money out.

Is any of this worth paying for? It depends, but probably not. The guidance from the advisor is typically so superficial that most of the time it won’t outweigh the cost of paying for it. The only time advisor advice is usually worth paying for is if you are heading into retirement with a reasonably good picture of what your financial situation is going to be, and you pay a fee for service advisor to run a model that is tailored to your very specific situation and models out all the tax implications of drawing down your money in retirement in different ways. These advisors charge a big one time fee (could by a couple of thousand dollars depending on how complex your situation is) but they don’t have the same conflicts of interest around your account size or products chosen. And many people make simple mistakes in retirement, like choosing an inefficient date to start social security, that cost them way more of a lifetime than these advisors charge to generate a point in time plan.

Sorry for being such a dick, this job could be a good fit where you can comfortably sleep at night.

1%+ AUM fees are outrageous but I acknowledge they are worth it for some people.

It’s better than charging 175bp to move from a 80bp mutual fund to a 3bp one.

Based on the description in the original post, the 175 bps fee is for “discretionary asset management”. That’s not a cost minimization service where they would recommend index funds, usually that’s more of a “white glove” service for people with over $1 million dollars where the advisor meets with the client regularly, gathers their investment preferences, goals, and risk tolerances, picks a portfolio for them (usually using the firm’s centralized portfolio management tools), generates all the reporting on the investments, and they are empowered to make trades on your account so they will also do administrative and tactical things choosing what things to sell when you need money (and employing little tax tactical things like managing the capital gains recognition) and preparing all the tax files and sending them to your accountant, etc. It’s basically a “we’ll take care of everything for you” fee where they run your account, deal with the taxes and accounting, coordinate among things like your personal account and your corporate account (for small business owners), put you in touch with estate lawyers or insurance brokers if you need them, etc. etc. etc. Is it worth 175 bps? Probably not, but lots of people are utterly incapable of handling this stuff themselves and they will either not do it (which has it’s own terrible implications, you don’t want to be a person with over $1 million in investable assets and no will, for example) or do it in a really poorly coordinated, patch work way. I do think most people would be much better off paying a few basis points for simple index funds and hiring a fee for service advisor to do all the other stuff.

Paying an AUM fee is even more insane when you’re rich and can pay by the hour.

Places like Goldman, UBS, etc. that dominate the $10 million and up space charge at least 1% a year, often more, plus you have to pay your own lawyers and accountants.

These people literally pay $100,000 or (much) more per year to trail the index. It’s nuts. “But they get me into private equity.” Come on.

Separately, if you HAVE to do AUM, a good bank trust department is probably better than almost any advisor at a fraction of the cost.

I agree with you, I’m just explaining what the service is. In the HNW space, nobody pays 175 bps for portfolio management only, or pays that much for product. The value proposition, such as it is, turns entirely on customer service and taking care of the little things so that the rich person can enjoy being rich and not be trying to figure out how to optimize tax loss harvesting or sending information to their accountants so their taxes can be filed.

As I mentioned, they could get all that by just hiring a fee for service person that would do all the customer service stuff for $5,000 a year and invest them in low cost index funds. This is a big financial services opportunity out there that is likely going to catch on at some point. I think the main reasons it’s not happening are very stupid reasons, like the expensive services have better branding. If you book an appointment with a HNW discretionary asset management firm, you’ll get a meeting in a glitzy office building with expensive looking furniture. If you book a meeting with a low cost fee for service advisor you’re likely to get a meeting in his home office or a space in a mall shared with a dentist or something. The HNW clients want to feel like they’re getting Special Access to a thing that only they can buy because they are Special People.

There are probably even more who have their entire 401k in the “safe” U.S. Treasuries fund when they are 40 years old. Those people really need the advice/prodding to put their money in the market.

That’s a great point, didn’t think of that conflict in this model.

No worries, I don’t think I’m going to be pursuing it unless the compensation is amazing, it’s just going to be tough to take less money to work 50% more each week and 25% more weeks of the year.

But it’s nice to know that if there’s a bad variant and I want to bring in a paycheck from home without playing online poker (which I don’t enjoy nearly as much as live), or if I burn out on poker, or if I need the stability down the line, there’s this guy I already talked to about a position that I would be good at that they’re hiring for fairly often.

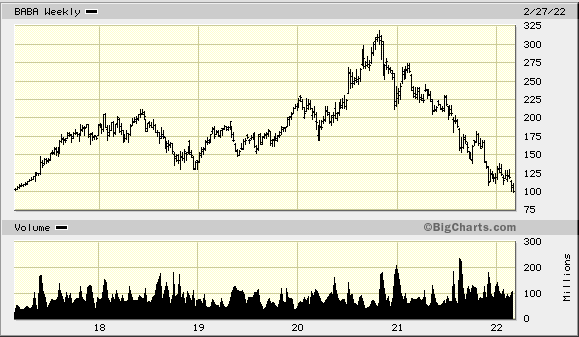

So this is all still true, and BABA is now down to $100 per share, which is the lowest it’s been in 5 years:

It continues to be super duper tempting to close my eyes and ride on Munger’s coattails with this one.

Lol at Munger being 98 years old and doubling down on BABA saying it’s a long term play.

If it gets down to $80, I’ll be seriously interested. Right now it looks like a long-term bet on China’s economy, which is probably a smart bet, but that’s a geopolitical play, not just a value play. Right now it’s close to being a pure value play, but it’s not quite there.

Of course, Munger is way better at this than I am, assuming he’s maintained at least like half his intelligence from age 40 to the age of 98, so my point is not to say I’m better at identifying value than him, just that I think this goes beyond the types of plays I feel remotely qualified to make right now and he’s betting on China to overtake us and Alibaba to be the Amazon of their economy.

The one thing that would make me more keen on it as a geopolitical play now despite a lack of expertise would be if I knew they were going to be able to tap into the value of some of the cheap resources China is about to access through Russia, so maybe I’ll dig into that a bit.

Ehh, even though he’s probably not going to be around to see it come to fruition, that doesn’t mean it won’t factor into his legacy. Same goes for whatever shopping spree Buffett goes on in the next few years.

Maybe that’s why he doubles down rather than bail now. The price will almost certainly be higher at some point in USD terms. How long is too long? Or is he going to be right no matter what when it trades higher because people will be able to claim he would have geniusly sold some hypothetical top decades from now