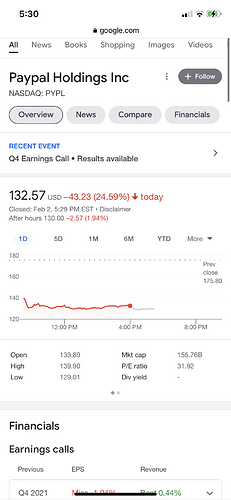

They were all the way down below $150 for a little while after hours.

I’m starting to think it’s going to be like a rolling wave of these overinflated companies crashing 20% or more off even mediocre earnings news, capital cycling into value, the indexes only losing a little, and we trudge onward. Then they ramp back up but not quite as high and we get another round of it.

In theory that could happen for a long time and the end result could be a ~flat S&P for a long period, more reasonably priced stocks overall, and a rotation into value.

Obviously the bottom could drop out on the whole thing any time, nobody knows.

So the crash is off?

Depends how you look at it. It could be a rolling bear market for 10 years where the bubble stocks get crushed each time they disappoint on absurd earnings goals, the S&P gets hit less, and money rotates into value as the S&P gets some of it back.

The S&P is down 5% YTD, TSLA -26%, NFLX -28%, PYPL -27%. But the S&P was down like 10-12% at one point this year.

I could see the S&P churning quite a bit, and ultimately only dropping like 25% while some of these bubble stocks lose 50-90%.

The S&P has a P/E of 26. If earnings increase 6% a year the next three years between growth and inflation, and the S&P loses 25% that’s a new P/E of 16. But if you looked at the 500 companies you’d see major differences.

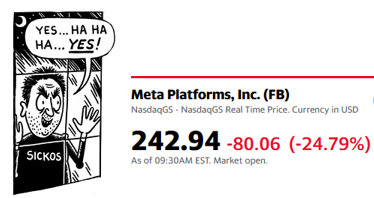

$200,000,000,000 gone in 15 minutes.

Feels good dumping PYPL and doesn’t own FB at all and still isn’t buying here. Oh it feels so good.

PYPL isn’t that bad was just way overvalued, valued as a super mega growth stonk and well it’s not that

S&P might not go down that much and the same still happens to the rest–some wall street people finally recognizing that they valued some stonks as super mega growth just aren’t quite that. Some of those stonks had just completely absurd P/E ratios.

The only staggering part is how they behave like crypto and just massive down numbers at once. It’s like the **** did you think was going on

Right, but I do think the broader markets are still somewhat overpriced. That can be made up for by trading sideways while inflation and earnings catch up or with a crash… Or perhaps since the government will bail S&P companies out and we all know it, they’re worth a higher multiple.

But the real wealth is the friends we made along the way.

“By the way,” said the frog, as they swam, “I’ve been meaning to ask: What’s on the other side of the river?”

“It’s the journey,” said the scorpion. “Not the destination.”

Tough day for the “yes I know Facebook is evil but I’m staying for the options” crowd.

Also lololol they bought back $20 billion of stock right before announcing horrible earnings guidance!

Seeing FB stock decline is fun, but it’s because of a decline in users? Maybe it is actually starting.

And Apple dropped the banhammer on them:

During Meta’s earnings call, both CEO Mark Zuckerberg and COO Sheryl Sandberg pointed to Apple’s App Tracking Transparency feature, introduced in April 2021, as the chief problem facing the company’s ads business.

App Tracking Technology asks users if they want their apps to have the ability to track their activity across the web. Turning the feature off keeps company’s like Meta from being able to learn more about its users, which impacts ad targeting.

Without accurate ad targeting, advertisers will shift away from services like Meta and spend their advertising budgets on other platforms or services.

“Apple created two challenges for advertisers,” Sandberg explained. “One is that the accuracy of our ads targeting decreased, which increases the cost of driving outcomes. The other is that measuring those outcomes became more difficult.”

Wehner laid out the problem in starker terms saying the company will miss out on $10 billion due to iOS’s privacy settings.

“It’s a pretty significant headwind for our business,” he said. “And … we’re seeing that impact … in a number of verticals.”

And it’s not as though there’s any quick turnaround in the cards for Meta. According to Sandberg, efforts to improve Meta’s ad optimization capabilities is a “multi-year effort.”

They don’t disclose IG users, but I wonder if that’s still growing while FB stagnates. Not sure if that’s good or bad, but IG has always struck me as having less compacity to be totally evil. Not no capacity, just less.

I would gladly trade a quarter of 2% of my stock portfolio (and more) to rid the world of the scourge on society that is Facebook.

![The Big Short (2015) - Shorts turn the tables on Wall Street [HD 1080p]](https://img.youtube.com/vi/F3goSYkVPNE/maxresdefault.jpg)