Yeah, I know it’s Scott Adams, but he’s not wrong.

She’s in marketing and doesn’t know much about financial stuff so she isn’t sure if this is like actively managing investments for people or flat fee service helping them pick tax advantaged accounts and putting stuff in the proper allocation.

In other words I’m not sure yet if she offered me an interview as a snake oil salesman or an actually helpful person.

So I asked for details and a ballpark of what it pays. Doubt I’ll be interested because I doubt it’s the second one and pays well.

From looking at their site there’s also a chance it’s the helpful kind but on an annual fee structure but with an extremely low fee like 0.1% or something, which I think even you might think is reasonable lol…

Like what percentage would you pay someone to just handle putting stuff in the right accounts and re-allocating regularly for you? As a convenience service it’s not worthless, just not worth what most people would charge.

Adams is the perfect example of the paranoid type who sees standard bullshit in one field and concludes nothing can ever be trusted in any field.

Vanguard charges 30 bps for advisory.

EDIT: And I just love that the business is such that investing trillions of dollars in every asset class in every market is basically free, but talking on the phone for 30 minutes?? That costs way more!

Yeah I mean I think having someone rebalance for you monthly or when you hit a certain ratio, and being willing to pay for that service seems fine - as long as it’s very cheap relative to your investment. Because it’s not that difficult. It’s like having someone clean your house, shovel your snow, cut your grass, etc - except if they fuck up it could be costly.

Paying someone to assist with target dates and tax advantaged accounts makes sense too, as long as it’s a flat rate. That in particular has real value for a huge percentage of people who get confused going through all fine print.

I also feel like I could be fine at those things and if they pay enough I’d consider it, though I doubt the offer will be good enough because you don’t have to be a genius to do that work.

On the other hand paying 2% or more (let alone 2 and 20) of your annual total portfolio to have someone manage your investments is pretty ridiculous. Especially when that person is a friend of a friend of the marketing person who got an interview without any direct financial experience.

But I’d actually enjoy that work, and I’ve always had an itch to see if I could beat the markets just like I wanted to see if I could beat sports betting (no), poker (yes), and political markets (lollll yes).

So if that’s the work and they offer and it pays well it’s a moral conundrum of sorts. But I currently am actively investing my money, so… I can make an easy case I’m putting my money where my mouth is. That said if the markets crash I’ll be mostly in index funds so…

The real moral conflict is if they want me to go get a bunch of clients and push -EV advice like buy TSLA down their throats. Then I hope the offer isn’t good enough to make me think about selling my soul lol… Doubt it would be. I do ok now and I value my soul, so…

At this point the odds I ask for an interview are below 50%, let alone the odds I get an offer if it gets that far, so not worth worrying a ton about.

An amazing thing about the psychology of investing is that you can (and I have) sit an otherwise intelligent person down and conclusively demonstrate exactly how badly they’re being ripped off and they still won’t fire or even question their advisor. Because they’re “nice.”

Sell, sell, sell!

Apple released monster earnings and the stock went down. Then it went up. Like $60 billion of market cap swings every 20 seconds. Lol stonks.

Something irritating, and my fault for not doing enough research:

I have a taxable account with Vanguard, where I’m invested solely in a Target Date fund. I’ve historically thought of this as a pretty ideal setup - just a combination of low-fee index funds that rebalances over time.

The problem is that this year, there was a significant amount of selling in those Target Date funds (reportedly because Vanguard lowered the minimum balance requirement for institutional funds, leading to a big transfer from individual funds to institutional). Those sales led to a much larger than expected (and much larger than historical) capital gains distribution - not because the underlying index funds had a lot of capital gains, but because the umbrella Target Date fund had to sell a lot of the underlying index funds. This capital gains distribution was somewhere around 10-15% of my portfolio balance. Discussion here.

So basically I screwed myself by buying the Target Date fund in a taxable account, because if I had just owned the component funds (which would be very simple to do), this tax hit wouldn’t have happened. Blech

This is a pretty massive screw up by Vanguard and people on Bogleheads are rightly super pissed. They should have seen this coming when they changed the minimums.

This is weird. I would have thought that the investor and institutional shares would have been different series of shares in the same fund, but it seems that’s not the case (yet)?

This wouldn’t be a problem for normal VG funds, since their ETFs are separate share classes of the same fund, so they can purge capital gains via heartbeat. But there are no target date ETFs, so that’s out too.

It should still have been possible to avoid this tax hit by having the Individual fund contribute underlying fund shares to the institutional fund and then distributing the new institutional fund shares to the investor who wants to move over. But maybe the docs didn’t allow it and/or 401k rules made it a problem.

They must have just whiffed on this issue and not anticipated the big outflow, because the problem goes away if you just merge the funds before you change the eligibility requirements (I think).

Imagine having money in a hedge fund that goes down 55% in a year a basic index fund was up 30%. Lol hedge funds

but i thought they were supposed to outperform when the market is tanking?

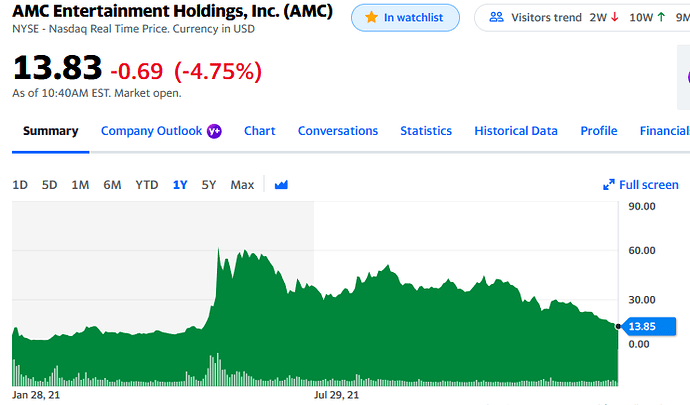

Never ended up shorting this, but I wonder if I would have had the balls to hold the short as it got up to $70/share.

better question - would your broker even allow you to continue shorting once it got to 70?

2 things would trigger a problem:

- Insufficient equity in the account

- The owner of the borrowed shares pulling them back

The first is mostly under my control. If I take, say, a 100 share short position at $22, I’ve got cash of $2,200 and a liability of $2,200. If it goes up to $70, I’ve now got a -$4,800 shortfall. (This isn’t really accurate because the required maintenance balance is for the overall account, and brokers also impose greater than 100% equity requirements on very volatile stocks. But the general point is the same.) So as long as I can maintain sufficient equity in the account, either by adding additional cash or by taking out a relatively small initial short, this isn’t a big risk.

The second is harder to quantify. Presumably the reason I wasn’t able to short in the first place was because lendable shares weren’t in high supply. So if I were to initiate a short, and then something were to reduce the supply of shares (e.g., the meme gang on reddit decides to all make sure their AMC shares aren’t held in margin accounts and those shares become no longer eligible for lending), the broker could force buy the shares back and I’d have no recourse.

I probably would have shorted something like $5k or so, and it’s really hard to believe that I’d just sit back casually and watch that turn into a $17k position and a $12k loss. “Sorry, mrs. spidercrab. I just burned a high-end Disney vacation shorting a movie company.” At the same time, I would have felt like a stone moron for buying it back at any point.

If you ever decide you want a real job please don’t have it be financial advisor.

I actually feel like I would really like helping people financial planning and investments, but it’s hard to make a living as an advisor if you’re not pushing bad expensive products for the kickback, er, commission.

I could definitely see a late stage career switch when/if I attain financial independence where I would be a financial advisor that doesn’t need the money. That’s more like being a coach then a sleazy salesperson which I think could actually be fun. Maybe I could start a small financial literacy non-profit or something.