I would absolutely agree with you when you say that it is destined to fail. That discussion has been had already. It’s the impact on debt ridden younger folk after a wave of inflation that we disagree on. Paying down debt right now for those who can could minimize a lot of pain in the future.

we are talking about specifically idiotic thing like borrowing multiple times your networth to buy equity. which is comparable to what happened with housing crisis for example.

There’s also the fact that if the rate goes up, the risk-free return rate goes up, and then the value of stocks is supposed to come down accordingly. Right?

Plus what you pointed out about leveraged investor positions.

Plus, how many companies are carrying way more debt than healthy/usual, and presumably rolling it over at very low interest rates? When it comes time to roll it over and they’ve got to pay a couple more points of interest, that’s coming out of their profits.

Like just go look at balance sheets… I don’t have the historical reference because I wasn’t looking at balance sheets 10, 20, 30 years ago… But man alive if the liabilities don’t seem pretty fucking high even for blue chips.

Like, KO is a famously stable company to invest in, right?

Total Assets (less goodwill and intangibles): $62,206 million

Total Liabilities: $68,427 million

Annual Earnings: $8,810.

Of their liabilities, about $40,000 million of it is debt. Now, I have no idea how that’s structured or when it has to roll over, and it’s obviously not going to be all at once… But just for argument’s sake and to kind of take a 30,000 foot look at the situation, let’s say they had to roll it all over at once and pay an extra 2% in interest, that’s $800 million off their profits, which is about a 9% decrease in annual earnings.

Now obviously they aren’t going to go under, but they’re currently trading at a P/E of 29. If the market decides in its correction that 20 is a better multiple, and their earnings have also dropped by 9%, they’re now worth $37 a share, nearly a 40% haircut from the current price, which is currently still near an ATH.

And they’re one of the more safely run companies that’s probably not leveraged nearly as much as some others.

Let’s take a look at the same numbers for a more leveraged company, Colgate-Palmolive (CL).

Price: $83.67

Earnings: $3.13

P/E: 26.7

Total Assets Less Goodwill/Intangibles: 9,476

Total Liabilities: 15,289

Total Debt: 7,696

Annual Earnings: 2,638

Tangible Book Value Per Share: $-6.90

So if they have to pay an extra 2% on their debt, that’s a 6% cut to their earnings, if you combine that with a drop in their P/E to say 15, which would be pretty reasonable… That’s $44.13 a share, about 50% from their all-time high. It’s crazy to me to think about the fact that it takes two years of earnings to offset their tangible book value and they’re still trading at a multiple of 27.

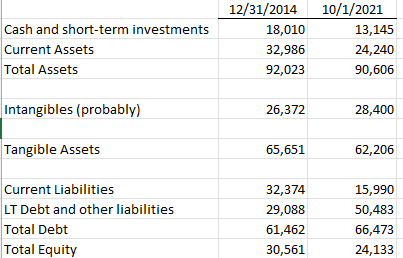

That said, I don’t have a historical reference, so let me get one at least a recent history reference for one of these companies just pulling the oldest balance sheet available on the SEC website and comparing it. For Coca-Cola that’s 2014. I did this myself, so if anyone actually checks and any numbers are off please let me know.

Now 2014 was also a low interest environment, of course, but just since then Coca-Cola’s assets are down significantly, liabilities are up significantly, and their share price is a 21% worse deal based on earnings. Like this is a company that went from a net tangible book value of around $4.23 per share to -$1.44, and investors are now taking an annual return of 3.4% versus 4.1%.

And again this comparison is only to 2014, which was a low rate environment… and this is widely considered one of the safer and conservatively-run companies.

I pull up balance sheets and I just see company after company with a negative book value, significant increases in debt that don’t appear to me to be justified by enough offsetting earnings growth, trading at absurdly high P/E ratios. Like, KO increased liabilities by 17%, decreased assets by 19%, and earnings went up by 28%. Well, shit, cumulative inflation since then is about 18%.

Adjusted for inflation, their liabilities held steady, their assets dropped by 32%, and their earnings went up by 8%. Like the difference in assets/liabilities adjusted for inflation is a hit of over $40 a share in current dollars, and I’m supposed to be so happy that their inflation adjusted earnings per share are at $2.04 instead of $1.89 that I pay a 21% higher P/E multiple?

So circling back, if the rate goes up, you have the following forces in effect:

- Risk-free returns go up, so stocks are supposed to go down accordingly

- Leveraged investors may have to sell and cover

- Leveraged companies may have to cut into profits to service debt

Your recession risks here seem to be more tied to knock-off effects such as financial institutions being too leveraged and going under, pension funds going under and states being forced into austerity, and some general disruption to the job market (like if say DoorDash goes under and all the drivers get laid off, and all the local restaurants have to higher delivery drivers, the churn is bad for the economy when multiplied across numerous companies).

I still think there’s at least a chance to avoid the recession in this scenario, and at least a chance that even if we do have one the pain is concentrated more on the people who can bear it.

On the other hand, if the rate doesn’t go up and inflation continues, you have:

- Decreased consumer spending power and/or increased wage costs

- Increased cost of goods/supplies

So that means a decrease in profit margins, which would pull the P/E back down to a more historically justifiable number even if stocks stayed at the same nominal prices. However, if the inflationary cycle continued and decreased consumer spending power persisted, that would be very bad news for our consumer-driven economy and would almost certainly cause a recession, right? And it would almost certainly cause a lot of pain among the bottom 50-75% of income levels.

I dunno, @boredsocial, I’m not so sure that allowing sustained inflation in a consumer-driven economy is going to work out so well. I think that even the “painless” correction of allowing inflation to lower the P/E ratios and bring the stock market back in line is just about stupid human emotions.

If I have a million dollars invested, and I can buy 16 luxury sedans with that, and my P/E is 30, and a year later I still have a million dollars invested, but I can only buy 8 luxury sedans, and my P/E is 15, am I happy with the situation? I lost the ability to buy eight luxury sedans!

On the other hand, if I have a million dollars invested, and I can buy 16 luxury sedans with that, and my P/E is 30, and a year later I have $500,000 invested, and I can buy 8 luxury sedans with that, and my P/E is 15, should I really be any less happy?

Like it’s purely an emotional response, right? Fundamentally that wealth in terms of purchasing power has to go, because it was never really there, it was a bubble-driven illusion.

I used cases like this to justify a similar structure on a federal contract I worked for nearly 10 years. Except in that entire time I was never called in, and it was recognized that fully paying for an hour on call was bullshit. So the comprise was logging one hour of work for 3 hours on call. The effect was I wasn’t paid more, but I only showed up for about 10 hours/week of actual work, pulled in a reasonable 40 hr/wk salary, the government was satisfied that they had people covering their ultra rare contingency, and the workforce was obviously happy with the arrangement.

That number is way higher. I mean shit man, you don’t have to be an idiot to run a fund on tons of leverage.

Let’s say I’m managing $100M for you, and I’m making 2 and 20. If I don’t use leverage, maybe I return $8M to you in profits and I make $3.6M. If I use leverage maybe I make $15M for you, so I take $5M. If I lose, no matter how much I lose, I get $2M.

Why wouldn’t I use leverage? Out of some sense of moral responsibility for my clients? I mean, fuck, if I don’t use leverage they’ll go down the street to the guy who is returning twice what I’m returning!

I think I’m reasonably good at connecting the dots broadly speaking, but I don’t know how to put a number on like how big of a drop the deleveraging would cause. But I know that Wall Street only believed COVID was a big deal for like two months of the entire pandemic, then we rained some stimulus down and made it all ok.

In fact, part of the problem IMO is that COVID was more serious than Wall Street thought it was.

The S&P was at about $3,400 pre-COVID. It’s now at $4,400. In many ways, the long-term effects of the pandemic on the economy are just now starting to rear their heads… We papered over the one-year or so drop in consumer demand, but what about the supply chain issues, the cost of goods, shortages of goods, shortages of labor? Those are real world problems for businesses that don’t seem to be reflected in the numbers.

Hey @boredsocial if I’m running Wal Mart and I need to get 1,000 widgets from a port in LA to, say, Phoenix, given the current supply chain/logistical situation, how much more am I going to pay as a percentage than I was a couple years ago? (That’s of course assuming I can get them to the port in the first place at a similar price to a couple years ago, which is a whole other thing.)

It seems to me like the problem is that the citizens of Illinois have decided on a flat income tax rate of 4.95%, rather than a progressive tax, and that they have decided they want more nice things than they are paying for.

This feels pretty close to morally correct to me. The main problem is that a lot of the people who set the dominoes in motion to lead to this calamity will be dead or moved to another state before it gets to that, and their kids/grandkids will pay their tab, plus interest plus inflation.

In mid to late March of 2020 during the pandemic, there was a billionaire investor on CNBC being interviewed. He was talking about how the pandemic didn’t matter economically, it wasn’t a big deal, it wasn’t going to cause much death, it wasn’t going to shut anything down, it wasn’t going to overrun hospitals, it was just a cold.

I’m thinking, “Holy shit, this guy is incredibly stupid. He’s a billionaire and he manages a massive fund and he’s on here spouting off pure insanity??? Like how is he this much in denial, look at what’s going on in NYC it’s a disaster right now. Where does this moron live, Iowa?”

He lived in fucking Manhattan. He was just that oblivious/stupid or flat out lying to try to influence investor sentiment, take your pick.

Not paying all the short bets and not being held accountable for grossly underfunding the pension systems seems to be more than stupid human emotions is how I push back there.

There are a TON of promises that have been made. The teachers are just one of a great many examples. One of the main reasons I hate Boomers so much personally is that it hasn’t escaped my notice that most of societies promises were made to the Boomers by other Boomers and the person who is supposed to pay these promises off seems to be me.

Basically devaluing the USD softens every promise made in USD. This means pensions, 401k’s, mortgages, and student loans all get softened quite significantly. It makes the entire debt load of the nation XX% lighter.

The kind of cheap plastic crap from China they’ve been selling in Walmart our entire lives is definitely 3-5x more expensive than it was in 2016 when you take into account tariffs, logistics, and rising costs in China. If the product in question cost less than 10,000 for a 20’ container before, the wholesale cost of it existing before Walmart buys it is up 8-9x.

If we’re talking about more expensive stuff it’s less of a disaster than that because it’s a lot easier to absorb an extra 20-30k in transportation costs if the product is worth more. But for those importers the big problem is that it now takes 100+ days to get something from China to the US which means that any variation of a Just in Time supply chain is now a huge liability that is hammering the living daylights out of your top line.

But the cheap commodity people are just waffle crushed.

definitely politicians are also at fault and will get away with it by severe underfunding, I’m just stating IL’s pensions were impossible in the long run even if they did and the people in the end who got screwed is everyone else, same as it ever was.

Progressive tax stuff doesn’t really work on a state by state basis, rich people just move and then the state actually loses net tax revenue.

Yeah IL is going bankrupt lol. I think that’s obvious to anyone who is paying attention. The best thing that could happen to IL right now is for inflation to tick up high enough that it makes their pension shortfall affordable and raises the pay of the existing teachers.

One of the main reasons I left KY was that I didn’t see any way the entire state didn’t essentially turn into Detroit over the next 30 years. Every major industry is old/problematic, the pension situation is a ticking time bomb, and taxes are already high despite services being absolutely garbage.

Basically despite Mitch McConnell doing very well personally the state he represents is fucked.

Good lord, I just pulled up their actuarial report for June 30, 2021 and after a year in which their pension fund returned an astounding 25% (yay!) it brought their funded ratio all the way up to … 46%. A few more years of 25% annual returns and they’ll almost be solvent!

This is tough to do with public sector pensions because they are usually indexed to increase with inflation. I took a quick look at Illinois and interestingly their pensions are indexed at a flat 3% per year (so they’ve actually been growing faster than inflation for many years) so I guess if you can run inflation hotter than 3% for a sustained period, that would slowly chip away at the pension deficit. Probably not enough though.

Your tax revenues go up with inflation. You still have to pay the shortfall, there’s absolutely no getting out of that with how IL’s laws are about that. The laws in most states for that matter.

Right, basically Boomers voted for politicians that gave them nice things and cut their taxes. Now, sure, their tax cuts as middle class earners were next to nothing compared to the highway robbery being perpetrated by the wealthy, but they figured “Whatever, at least I get a little something out of it!”

They’re basically trying to kick the can down the road until they are dead and gone, and leave the rest of us with their bill. They’re dine and dashing on the entire US economy.

They’ve also taken a 10-20 year advance on the stock market returns by creating a bubble through shitty fiscal policy, which is basically money they’re stealing from future generations too.

Sooner or later the consequences have to arrive, and I’m a fan of them arriving before the Boomers all bite it, because I’d like them to pay at least part of the tab, and I’d like them to feel some goddamn remorse, which they will only feel if they personally suffer.

Like, my Dad’s a great guy overall, but whenever economic topics come up and we discuss it, his end conclusion is, “Thank God I’m going to be gone before I have to deal with any of this.”

Like, gee, thanks Dad! I’ll feel really warm and fuzzy remembering you said that as my generation spends the prime of our working lives trying to put out this dumpster fire.

You know who what does give a fuck about fundamental investors? The long run. One way or another man, one way or another. But I mean, sure, maybe we can punt it another 5-10 years down the road and see an even bigger crash by %.

Did they put a gun to the governor or state legislature’s head when the deal was made? Seems to me like they negotiated a fair market rate for their services, but the people who cut the deal with them decided to make their kids pay later instead of picking up the tab.

Like why do you think it’s guaranteed? Someone at the teacher’s union was smart enough to know to do that! They were accepting future payment for current services, and they knew not to trust the politicians to give it to them. So they said fine, you want to underpay us now and make up for it on the back end? OK, make that an ironclad guarantee and we’ll take it.

I mean, how much would you take in 30 years to cut your current pay by 40%? That’s probably in the ballpark of what the deal was.

I mean you can say the state fucked up and made a bad deal, and in the long run they did, but all the principles in the deal made out great! The teachers got hooked up on the back end, so they were happy, and the people who agreed to pay them that passed it off like a bunch of deadbeats. Just look at the incentives, it was a great deal for everyone at the bargaining table and nobody gave a fuck about people dealing with the fallout.

Incentives, man.

I am debt-free and I feel like a moron, to be honest. Man if I could, I would love to have taken out a massive loan in 2021 dollars and pay it off at 2021 interest rates with 202X dollars.

Obviously it depends on rates, and I’m not saying floating credit card debt at 20% or whatever is good. But like, I don’t see a ton of sense in paying above the minimum payment on a low interest loan right now. That’s your inflation hedge, right there.

Like inflation is GOOD for people who are debt-ridden.

I mean, it’s not like in 2006 and 2007 everyone thought the people who did that were morons. They were perceived as geniuses. Oh and by the way, most of the INDIVIDUAL people who did that made out just fine.

Like, have you seen the Big Short? The dude they meet in Vegas who was flipping credit default swaps like crazy was making BANK. Millions and millions of dollars. Like I’m sure his job disappeared in 2009 or whatever, or his income dropped like 95%, but he banked millions of dollars by basically selling people a tremendous volume of dogshit and taking his cut.

The problem is that the incentive structures for these people line up for them to gamble. Just like the incentives for Jim Kramer line up for him to yell BUY BUY BUY a couple days before the bottom is going to fall out. There’s a reason everything on CNBC is always like, “This is a great buying opportunity!”

Turn on CNBC Monday morning and watch like two segments and two commercial breaks. You’re going to hear a disproportionate amount of coverage about great opportunities to buy, great investments to make, etc. Then see who’s advertising with them. People who want to SELL you stocks. Like, I see a QQQ commercial almost every time I watch their coverage. I don’t think QQQ is going to keep advertising with CNBC if the anchors and analysts are screaming that you should sell QQQ because it’s overvalued.

Likewise, viewers don’t want to be told how to not lose money, they want to MAKE THAT MONEY BABY WHOOOO! It’s just human nature, if you talk to two investment managers and one is like, “Hey listen, this market is way overheated, the move now is to stick with some foreign value stocks, some bonds, some cash, some commodities, and reduce exposure to stocks. You won’t get a huge return, but your downside risk is lower.”

Then the next guy is like, “Listen, this market only goes up. Tesla is going back to $1,400 a share, we have some inside info. I was actually on the phone with Elon last week. Anyway, you know what’s cooler than buying TSLA at $940 and riding it up to $1,400? Leveraging yourself so you get higher returns when it goes up to $1,400!”

That’s why 90% of people are going to say some version of what the second guy says. Then when the market crashes, oh well, almost everyone was wrong. “Who could have seen that coming? Hardly anybody!”

Yeah I mean the right move was to pay them a fair salary then OR to pay them less and plug the difference, or close to it, into the pension fund. But that’s no fun.

New Jersey has a pretty progressive income tax, and also high property taxes. It definitely influences people who have a choice between, say, NJ and PA or NJ and DE. But plenty of rich people still live there. Like, how far do you really want to commute into Manhattan? Or in this case, Chicago?

Work from home could obviously have a big impact on that long-term.

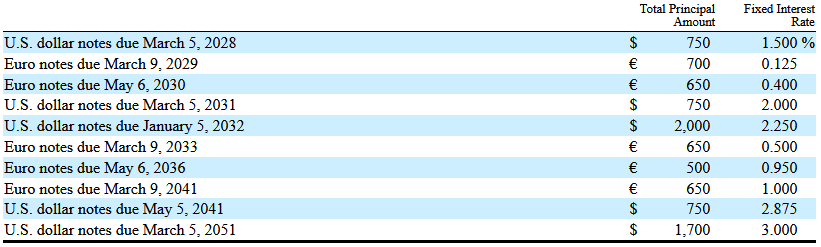

I really don’t understand the point you’re making with Coke. It’s true they have a lot of debt, and in the last year or so they’ve issued about $10 billion worth. But here are the terms of that debt:

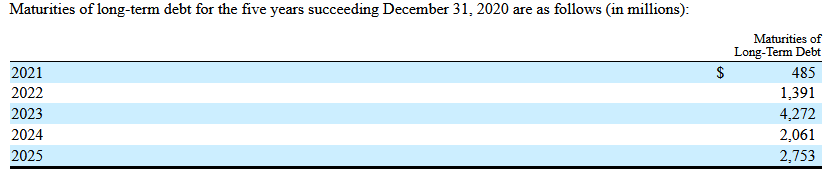

They’re incurring between 0-3% interest on debt that has 10-30 year maturities. Taking on that kind of low-interest, long-maturity debt seems pretty amazing to me, and not very risky at all. Going back to last year’s 10-K, which has greater detail, shows that they have relatively small amounts coming due in the next 5 years:

That’s about 1.5 years’ worth of earnings coming due, in total, over the next 5 years. It seems like you’re inventing completely unrealistic catastrophes–they have to immediately refinance all $40 billion at an extra 2%?–to come to the conclusion that they’re overvalued.

And yes, if the current P/E ratio of any stock is X and the market decides that actually .7X is more appropriate, then there’s going to be a big decline from the current price. But that’s tautological - if the market decides that the stock price should be lower, it will go down.

Later you compare 2014 to more recent years and say:

I’m not sure where you’re getting this. Their capital structure looks very similar to me, except that their liabilities are now long-term in nature:

(I think you just ignored the firm’s current liabilities, which have gone down substantially during this period of time.)

And yes it’s true that “investors are now taking an annual return of 3.4% versus 4.1%” if you define return as the earnings yield. But that’s just another way of saying that the P/E ratio has gone up.

As far as Colgate goes:

What does this even mean? Why would earnings have to offset tangible book value?

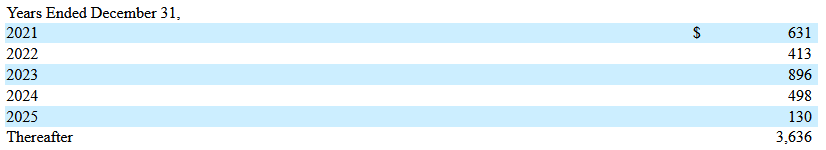

If you’re concerned about their ability to repay their debt, this is what they have coming due in the next 5 years:

It’s almost exactly equal to their annual after-tax net income. This seems like not a problem at all.

I mean, I don’t have an opinion on whether Coke or Colgate are good investments at these prices, but your overall story doesn’t seem to have anything to do with financial statements or risk or leverage or cash flows. It’s just “P/E ratios seem too high, and if they go down then the stock price will go down, too.”

A recession would likely lead to deflation and deflation increases your debt load.

I used to think these horribly underfunded state pensions would get a federal bailout eventually but now I’m not so sure.

I think that they will try to mask it if ever comes to that, like all the liabilities and assets will be sent to the Social Security program and the funding deficits will be covered by increasing everybody’s SS payroll taxes. It would be objectively unfair but by spreading the cost around that way instead of doing a direct wealth transfer they will get away with it.

Not that I’m advocating for this, but theoretically one way we get out of this mess is by the boomers all biting it sooner than expected.

Thought COVID stimulus was funneled to bailout some of these problems? Are the deficits just too large to even put a dent in now?

Lol all the Republican states are taking the COVID money and passing income tax cuts