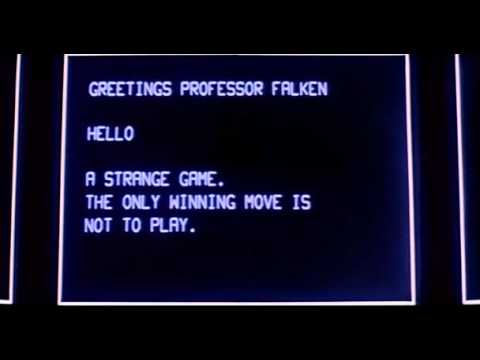

After years of lightly studying options trading, my dad repeatedly pushing me to learn the game, and wanting to do it deep down but always finding an excuse to procrastinate…just dipped my toe in the water for the first time with two July 16 $8 contracts. If this meme is a winner you’ll probably have me hooked for good.

Quad witching today, be careful out there

Yeah this has very much been my experience with FIRE.

I don’t have an opinion on FIRE itself or the “influencer” people advocating it (or whatever they are doing).

What I do think is really valuable, is highlighting different ways to approach retirement and financial success. Because there is a message that it basically looks one way, when in reality there are lots of ways to be happy.

I’m one of those folks who very much values maximizing freedom and time over security. Sometimes it can be a bit odd or anxious, though, because most of the advice out there recommends prioritizing the other way.

So, I think it’s nice to see a movement of people advocating for new approaches.

Absolutely. The key is to find what works for you, and sadly also to develop a keen eye for bullshit. This is true of “traditional” retirement planning and FIRE. Both are loaded with snake oil salesmen, the FIRE crew BSers just have a more modern brand and know all the right “wellness” buzzwords. FIRE folks do indeed have a lot of great ideas like having high savings rates, taking investment risk, and separating ones striving for fulfillment and validation from one’s job. This is good stuff! Where they have issues is when they say stuff like this (actual quote from FIRE blog dude) about what FIRE Really Means:

“Complete freedom to be the best, most powerful, energetic, happiest and most generous version of You that you can possibly be.”

Ok buddy. This is all very nice but I want my investment plan to involve dividend yields, expense ratios, and standard deviations. Not marketing language from GOOP.

Are these guys actually selling anything? Or are they just monetizing their YT streams? Are they giving specific investment advice?

The part you highlighted doesn’t really bother me, even though like you I think it reeks of bs salesmanship. … Because in some ways it’s true. But if this dude is saying it to sell something specific, yeah that bugs me.

I don’t think we’re disagreeing. I look at MarketWatch and they run articles like, “My wife and I own our home, have 2M in savings, and each have pensions for 100k annually. She says we have enough to retire, but do we?” … And then the advice is always, “Yeah, maybe, but hey work a few more years just to make sure.”

Which probably works for the type of folk who usually reads MW (wtf am I there) … it’s also the advice my dad would give, but it’s not the advice that would make me happy.

Anyway, rambling. Like I said, we’re not disagreeing. I do think that more people need to hear that it’s ok to approach things in a way not totally informed by nonsense capitalism ideas. My end game probably looks like a tiny house on some land I own, spending my time living simply … and I’d like to get there in the not-distant future. So I find a lot of encouragement in hearing different approaches.

I think its all over the map. Some people aren’t selling anything, some are trying to monetize social media streams, some are probably trying just establish a brand. I dont think any of them give specific investment advice, they’re not going to be set up to do that.

Oh yeah we’re not disagreeing at all. I laugh my ass off at the You Can Never Actually Retire crowd too.

The biggest hurdles for me with investing have been:

-

Automating savings and continuing to do it even when the amounts seem meaningless relative to my goals. If you plan to spend $100,000 a year in retirement you probably ultimately need about $2.5 million. Saving $6,000 a year in a Roth, for example, seems like it’s a drop in the ocean, and it sucks because those contributions are most impactful when made in early adulthood, when you could definitely use the money. Even knowing that your money will double roughly every 10 years, if you’re 30, that $6k being worth $48k at age 60 isn’t super motivating (to me).

-

Accepting that simple isn’t bad. In fact, the more complex your investments, the higher your fees and the lower your overall return, in most cases. I have my entire taxable portfolio in life strategy funds. Arguably, that’s tax inefficient, but it’s the cost I’m willing to endure for knowing I won’t be tempted to tinker around and getting automatic rebalancing.

-

Accepting uncertainty. This would be a lot easier if we knew when we were going to die. But we don’t. And it makes me bitter than I’m going to have to work and save longer to make sure I’m ok even if I live to 90+. It’s easy to fall into “I could get hit by a bus” thinking and take that extra vacation or whatever, but you have to actively fight it.

There are a lot of similarities between saving/investment success and weight loss/healthy living. Daily habits matter more than Bold Resolutions. Its why so many people fail on both fronts.

Are you kidding me? Learning #1 and #2 was the most liberating thing for me. That I could just automate my savings by dumping some set amount out of every paycheck into low expense ratio mutual funds (took me a few years to learn about expense ratios, oh well), and that it was basically an unbeatable savings plan was so freeing. Don’t have to worry about that shit. Set it and forget it, just keep saving just keep saving just keep saving. Worry = gone.

Yeah but that’s very unintuitive for most people. People like the idea of a One Neat Trick that results in instant gratification.

Woops

Also fwiw I think the existing individual economics thread is this one, though there might be another:

https://unstuckpolitics.com/t/individual-economics-in-the-age-of-covid-19/2236/1095

TBH I think the best setup would be three separate threads:

- one for the “economy” aka the general stock market happenings

- one for individual economics for serious adult business

- one containment thread for all of our stupid meme stock bullshit

- one for individual economics for serious adult business

- one containment thread for all of our stupid meme stock bullshit

thinking those are separate is the reason you’re never getting to the moon

I don’t think we need a mod to move posts, but I’ll retitle this thread to be about the economy and stock market (since it’s in the politics category) and will start a separate meme stock thread in Sundry Chitchat for containment.

you too can retire at 35 like me if you follow this one simple trick:

1.Have a spouse that makes 80k and doesn’t want children.

DINK households are hugely overrepresented in the fire community. A lot of the advise they give out has the same feeling of boomers saying millennials should just stop eating avocado toast when the real answer is they should have been born 40 years earlier.

Way ahead of you, and Sugar Momma makes more than 80k. She puts up with a lot so that she doesn’t have to do any of the dishes. Cha ching.

I do 95% of the cooking, probably why she keeps me around.

I made about 2 million after taxes on meme stonk calls in january and as of today I’m done working.

…

I’ll slowly put most of it into an sp500 fund over the next 2-3 years. After digging into bonds I decided that I’d rather just have cash instead and use that to buy any major dips that come up. I want to keep my withdrawals in the 2-3% range since that seems to be best for making a nest egg last forever.

Lololol, wtf? Youd have to live 835 years to make 500K. How can people be so fucking stupid?