My boat is named PPP.

The huge plumbing company over here got $170k in free money for PPP when business was completely unchanged by covid. Such bullshit.

They sure as fuck means tested me and my wife and we got $0

Can confirm the people I know who took ppp money didn’t have any business slow down or business was booming. Money went to second houses, boats, stonks, whatever.

800 billion to wealthy business owners and in return we got the worst inflation in 4 decades.

Too poor confirmed

The dumb thing js. Even if they means tested it

Im a CPA. I’ve seen a lot of bs

All these businesses would have “lost” money during the time period in question and just pushed that revenue to 2021 or 22 or etc

They did means test it. Large businesses weren’t eligible and mostly didn’t get any

How large did it take to qualify as large?

Look, if you couldn’t play the PPP loan game you probably just suck at financial stuff period. I’d hate to see how bad tax planning is for those that couldn’t get a loan under PPP.

That’s great and all, but I’m not sure it answers my question.

Unless it is your way of saying that iron81 is incorrect.

The point is “if you have to ask” you don’t qualify as too large

First PPP was for businesses under 500 employees.

Second PPP was for businesses under 300 employees and also had a very weak gross revenue reduction requirement.

What many of us consider small businesses are actually micro businesses.

Again, that’s nice and all, but doesn’t answer my question. I’m not curious about whether I qualify as too large. I was just curious about what the requirements were.

Thanks. One other thing I am curious about is how they consider employees. For example if you have a bunch of partners (as in a law practice, for example), how is that handled. If they don’t get a W2, then they are not an employee?

There were some requirements

If you had a w-2 emoloyee making 100+. Only the first 100 counted in the calculation. There were some other requirements for owner and partners.

But really all these businesses got 3 months of free payroll

There was talk about on the tax return, not counting the cash received as income, but also disallowing the expenses that was paid using the money

Lol that didn’t happen.

Like solar installation is a micro business?

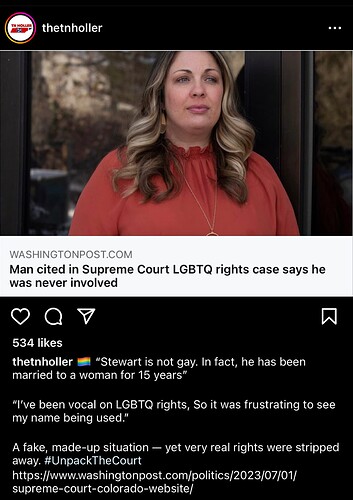

When you refuse to make a gay wedding site, that you were never hired to make, for someone who isn’t even gay, what do you do? Sue!

I got a ppp loan and had it forgiven as a self employed individual. I did almost no work to get it. My bank approached me about it (they got some fixed $ amount for each loan they processed). The application took very little time and effort. I didn’t really need it, but I qualified and certainly wasn’t passing up free $. It was basically $ straight into my pocket.

I had dudes trying to create an S corp on Monday so they could apply for PPP loan on Tuesday. I told them that’s fraud and you can’t do it.

Others had no payroll at all. So they wanted us to fabricate payroll reports for the prior few years so they could apply for PPP loans. No thanks.