Well I’m definitely not one of those people, but I’d be very interested in a way to scale down the whole operation and make it work for a salaryman like me.

It only really makes sense if you have a heavily concentrated position in a highly appreciated stock.

Yes, this is the problem I’m specifically trying to address.

So if I do my experiment with Wells Fargo, what should I ask for exactly? Would it be a “secured line of credit”?

Also what is the going interest rate for this kind of thing? The ones I’ve seen online in the last ten minutes look terrible.

If the stock is unrestricted and saleable, pretty low interest rate. It is a pretty good loan to make, you are collateralized by the stock and put in a 40 percent margin or w/e and can just sell it down if you have to and get your money back. Usually still has recourse to other assets. I looked at this at one point for very different reasons (and like 9 less zeroes) but the stock could only be traded in trading windows so couldn’t get a loan. Before the bank knew that complication were dying to do it at a very low rate.

Also the taxes not as much of an issue if the margin call comes into play as the stock isn’t as appreciated at that point.

This interest was definitely deductible before the last tax reform, not sure if it is now.

Can’t wait for the executive privilege claims after he sat for an hour-long interview with the National Review.

if you’re rich enough to do this, they will have a “private banker” suck your dick, you don’t have to know the exact magic words to unlock the loans, they will basically set it all up for you.

Your line of questioning is really confusing, like the idea that there’s a bunch of people in the banking industry looking to cater to rich people never occured to you?

My private banker calls and leaves voicemail like once a month. I never return his calls.

time to boycott golf imo. only municipal courses for me from now on

No that obviously occurred to me. What I’m trying to figure out if there is a way to take advantage of this method on a smaller scale. Small enough that I could do it (i.e. very small) and it would make sense .

Schwab lets you take out a Margin loan and the minimum account value is only $2000. You can borrow up to half the value of the account. The interest rate is like 8% though. I think super rich people would pay way less interest but Schwab doesn’t publish those rates.

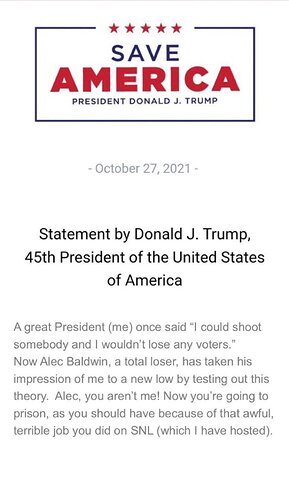

The parenthesis, lack of !!!, and “Alec, you aren’t me” make me lean fake.

rofl at the very last bit

That’s way too witty to be real

Onion