big bounce just now, makes sense being a big weekend but this is still so ridiculous and stupid going up/down over 10% in minutes all the time

You’re going to have more fomo than ever for btc this time around (barring a severe depression) what you definitely won’t have this time is the enough collective capital available to shoot up the price. So unless hedge funds start chasing loses by buying spec crypto currencies, the fomo would just get slowly eaten away until it bottoms.

I don’t think the FOMO will kick in until it’s on its way up. The people who bought at 50K and sell at 15K will see it drop to 10K, recover to 20-25K and say “I can’t miss it this time, it’s going to $75K or $100K” and they’ll get back in. Give or take. But they may also sell at $50K this time if there’s a blip on the radar.

I’m starting to think that the chances that it’s the world’s most long lasting and cyclical pump and dump are pretty good in the current iteration, but I don’t think it ever goes to zero either.

I think there are value propositions but there are also weaknesses that can be exploited to turn it into a pump and dump.

The top 3 for criminal use is USD, Bitcoin, Monero. Bitcoin you need to make sure never to use an exchange that requires KYC. Bitcoin price isn’t really relevant for criminal use as it had no issues running SilkRoad and all its other criminal uses when it was below $100.

Are you guys worried people will stop playing black jack too?

It’s actually maddening that Celsius can just “halt” customer withdrawals for 6 days now, giving out nearly zero information.

They ran out of money and are looking for a bailout… Who’s gonna bail them out? All their depositors are going to wiped out.

And these charlatans can just move on without any consequences.

I believe their liq price has been lowered a bunch of times so someone has been bailing them out. I agree with you though, I wish we could just be done with it

I think a lot of people will pile back in with fomo regardless of how many times they have been burnt. That is just human nature.

I thought this article made a ton of good points.

I had never thought of the problem being something like data suppliers vs data verifiers.

Most of the issues that block chain purports to solve are issues with the data verifying middlemen of our system. But it’s so rare that those are the problems that actually occur in these systems. If a supply chain or land registry have bad data inputs due to fraud or something else, those being on the blockchain vs a centralized system makes zero difference.

The short answer is “my assessment of the current mentality of the cult”. The long answer is… I think I’ve said a bunch of this before but my thinking on crypto has evolved over time so I’ll lay out my whole thesis here.

I disagree with the doomsayers that web3 is basically useless, but this doesn’t really matter as I agree with them that the price action is speculatively driven and unmoored from any actual utility. It’s like how electric cars will obviously be a thing, but this doesn’t help in understanding the price action of Tesla. So I think my view on the utility of crypto matters only insofar as it makes me more apt to believe that people would buy crypto for reasons other than “selling to a greater fool”.

I think crypto, and in particular BTC, is a cult. I think “virtual cults” are an interesting new phenomenon and that crypto, Tesla and QAnon can be put under this heading. This means that my next disagreement with doomsayers is that previous manias are the best way to analyse this one. In fact we have already seen that they are not; the price of pets.com didn’t go soaring up again after its initial crash.

The salient features of crypto which cause the cult-like characteristics are 1) personal tying of one’s identity to crypto (go on crypto Twitter and have a look around) and 2) no agreement on what failure would actually look like. I’m sure I don’t need to go into how reluctant cultists are to accept that prophecy has failed. When exactly is it going to become clear that BTC has failed? What would that look like? I mean it’s legal tender in a country, doesn’t seem like we are on the brink of general agreement that it’s time to pack it up.

So that’s my answer to suzzers ongoing question of “why would anyone step in and buy this thing and stop it going to zero”. Like, Jesus said he would return within the lifetimes of his audience (Matthew 16:28, Luke 9:27) and it’s 2,000 years later, why would anyone still believe he is Coming Soon and we are in the End Times? I don’t know. You tell me. I just observe that this is how people behave.

So why am I looking for 4-digit BTC as a buy point? Guesswork. And trying to guess how large groups of people will collectively behave is extremely difficult. You know, sometimes you’re like “lol there is no way this fraud JD Vance is getting the nomination” and then you turn out to eat shit. With BTC having been up to 50K, sub 10K is around the time I think enough people start being like, the Second Coming gotta be soon now. Right? Right?

My other thesis on this stuff is that unless you’re going to be some kind of crypto day trader, you have to at least be a semi-believer to play the game. Non-believers are too skittish and will bail at the first sign of trouble.

If the next BTC runup contains a higher percentage of non-believers who are just looking to make some quick gains, it might not have much legs.

Sort of like in the early days of IPOs - people were hoping to buy and hold the next Amazon. By the time Facebook IPOed, I heard a lot of chatter about just turning a quick buck.

Again if this was the 2nd coming I’m with you but this will be the… 8th coming? 8th massive crash and then 7 bounces right after? Will there really not be an 8th? If not, what’s changed? Obv markets suck and inflation etc but really, this time it won’t go back up because… reasons? IDK.

I just tried to make a buy of 1 eth for “fun” but didn’t want to go through the KYC crap so cancelled it. It would have been my 2nd crypto transaction ever. My first was buying BTC when it was at $350.

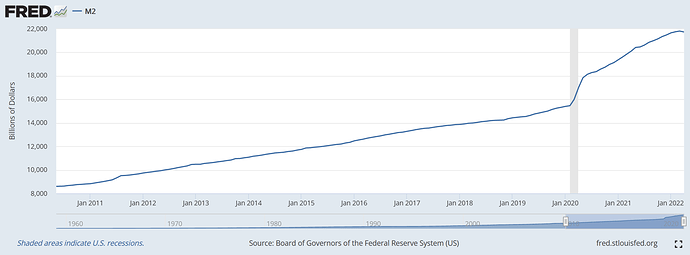

I think crypto will survive and eventually reach new ATHs because the money printer will go BRR again, but right now it isn’t and that is different from the rest of BTC’s lifetime.

Fair enough thanks for the info, did not know m2 was that drastic.

This is disgusting. In the same way that it would be disgusting for a senator to promote investing in an individual stock. Hope AOC primaries her.

My pessimism isn’t specific to bitcoin. If the Dow Jones hits 37k in the next year bitcoin could reach 50k again. I don’t see how that could happen either. The market is a different game now and it’s forced to operate under a set of completely different rules that I personally feel isn’t quite understood yet.

Bitcoin hasn’t experienced a legit recession yet in any of those 8 crashes.

Obv markets suck and inflation etc but really

But really this is plenty. You thought that it was outside the economy somehow? It can go up again when the Fed or tether go brr again.

I think that the recent inflation issues are gonna provide a lot of ammo for crypto bros moving forward once prices settle.