Taxes are going to become hell once Bitcoin becomes the default currency.

More noob questions:

Does coinbase report anything if you just move it to another wallet (I think that’s what they’re called)?

How hard is it for an American to just hold bitcoin somewhere that doesn’t report to the IRS at all?

we probably shouldn’t talk about ax-tay aud-fray openly

Oh lol gotcha, but it’s worth mentioning that I’m not sure it’s an actual literal figurative pyramid scheme either. Like, everybody knows multilevel marketing is a total pyramid scheme in practice but it does a few crucial things in theory to not be illegal (which doesn’t even work in all jurisdictions).

btw don’t think we don’t know you’re about to sell and crash the market you paper-handed so-and-so

That’s why we full-throatedly advocate for fully paying any and all taxes owed.

If you bought 1 BTC back in the day for a hundred bucks, and you fund an online sportsbook account today with a thousand bucks by shipping .02BTC, my understanding is that you’ll need to pay long-term capital gains tax on the appreciation of that .02BTC from being worth 2$ to it’s current value of 1000$.

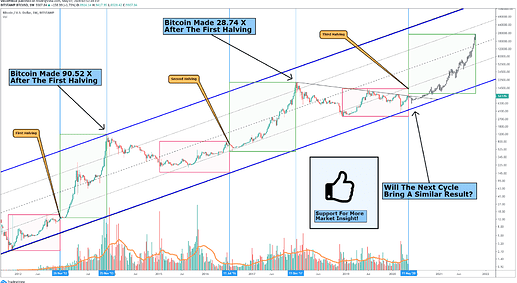

What are the indicators you’re all paying attention to in order to determine the length of this cycle? Obviously there are some important new factors (e.g., institutional adoption, further crypto tech maturation), but this bull run has already lasted longer - chronologically - than the last halving run.

I don’t think it has but it’s definitely close to the end, so everybody is basically on the same page, give or take some weeks to months:

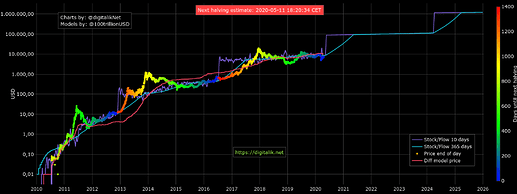

The StF model is controversial but it’s held up eerily accurately:

I found it interesting when Edc posted his plan because it pretty much mirrored my pricepoints, another confirmation that a lot of people are on the same page.

I actually got super rekt last year because I sold some BTC for Predictit powder at 13.5k thinking I was the smartest sonofabitch around, thinking worst case scenario I could buy back at 15k lol after I scooped up the Predictit profits. Point being, I think pricepoints are better to keep track of that elapsed time.

Similarly I sorta rekt a friend of mine when I told him to sell at 18.5k last year. He was itching to sell and beat the pullback and buy back lower, so I told him it was a good time that morning, with a conservative reentry point between 16 and 17k. The next day I asked him if he bought back and he said, no, obviously, huh. I said it already dipped to 17k and is back over 19k.

This is when I first really noticed how much faster things were moving (even more than the Predictit example) and that saying “ok I’m gonna sell it August/etc no matter what” is highly risky. There’s an argument that this stagnation over the past weeks is reverting back to the “correct” timeframe but I think it’d still be more efficient to establish a pricepoint regardless.

Thanks man; that makes sense. Really appreciate your time and thoughtfulness.

Funny I made almost the exact same mistake.

Deposited a large amount of btc to place a bet on biden in right before the election. By the time the bet was graded btc had already rose 43% since wagering and I barely even made any profit. At least they didn’t wait til inauguration to grade  Lesson learned. Fortunately I rolled that profit right back into btc.

Lesson learned. Fortunately I rolled that profit right back into btc.

My opinions on the current state of the BTC markets have definitely shifted more short and medium term bearish. I’ve taken profit on most of my position over the past few days. Still holding ETH and LTC positions as I think they have higher risk/reward currently, but proceeding with caution.

“Up 20 percent today, how bad could selling here be? I can reevaluate a reentry when it dips a few percent I mean what could possibly happe-”

“-FUHHHHHH”

lol, I was wondering if I was the only one.

That’s nuts, how much did you lose?

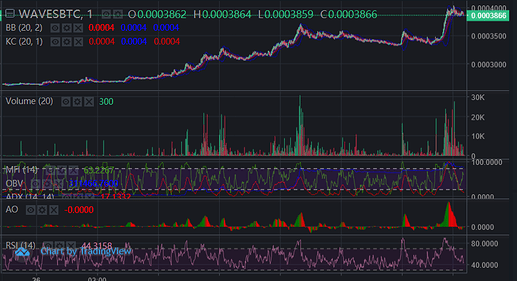

I don’t believe that you guys can’t read the graphs. A pokerbro bro of mine swears he can’t read them either, I’m like, dude you crush highstakes and use pokertracker, shut your mouth.

The end game for taxes for crypto is probably going to be something akin to the FBAR foreign asset system with reporting requirements, punitive penalties for failure to report holdings, and an amnesty offer with heavy penalties for those who owe back taxes and come forward voluntarily with the wrath of God and jail coming down on some of the worst offenders that dont in order to set an example . The next infrastructure bill likely will come with beefed up IRS staffing and a focus on compliance, crypto is going to be a major focus.

The 1040 question on the 2020 return about whether taxpayer had reportable crypto transactions y/n is the first step (will make pursuing tax fraud cases easier)

Who can read a graph when none of the axis are labelled?

I don’t know uk tax rules well enough to say anything.

What if I have no access to records of the dozens of small-dollar trades I’ve made, especially during the last bubble? Can I just say “all of this value is taxable” if I ever convert my portfolio to USD? I’m not trying to avoid taxes but I’m also not trying to track down those records, which I have no clue how to do or where to start.

Im not an accountant, but based on past experience, yeah,if you cant show basis you’d likely effectively get taxed as if there is a zero basis. If they really ever dug deep those past trades were taxable events whether they converted to USD or not, but if they are small dollar wouldnt worry too much about it.