i don’t know if i’m funding terrorism with ammunition or i am the terrorist but there’s an analogy somewhere

tbf the other way now, you bought some bitcorn in 2018; one half a bitcorn for 8k, on the way down during the crash; i told you not to eat a loss and that it would be profitable but you might have to hold for a long while; without going back to 2p2 to find the posts i can tell you exactly when, because i know the bitcorn chart like the back of my hand (lol nobody knows what the back of their hand looks like and that’s a shitty ass colloquialism)

so the subtext to a lot of this is one side got burned by crypto years back (and yeah even with me telling you that, you got burned by that heinous crash) and is incredibly biased, and the other side has super noobs absolutely reeking of new money stench and incredibly biased in the other direction; and yet, that’s not being acknowledged as any sort of driving animus, because one thing i’ve learned in my years is that people will default to being deeply insincere no matter the context

which is fine, i’m in no place to judge whether being deeply insincere is bad, if it helps one get through the days; the only wrinkle is that it results in thoroughly ridiculous arguments/debates/discussions

There’s stuff exactly like that for NFT scams. Where there’s some setting that looks correct but isn’t (due to the scam design) and then poof all gone. It’s been posted itt.

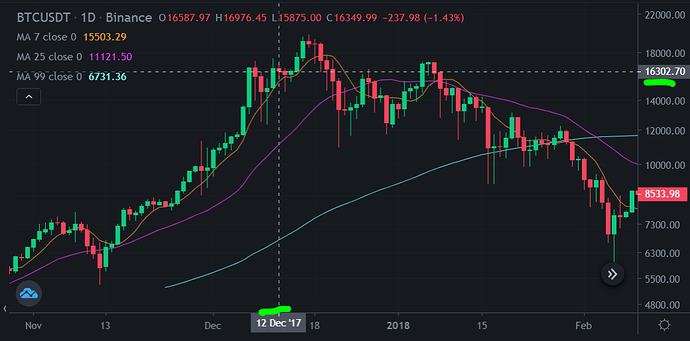

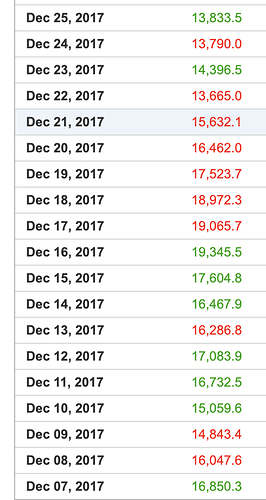

I bought a half a BTC at the top for like $10k, literally stating the whole time that I was just doing this to make the top happen. Then I sold a week later, as soon as coinbase would let me, for like a $200 loss. I did basically nail the top for a few years. It was all documented on 22 and I believe re-pasted itt.

I didn’t get “burned by crypto”. I never intended on holding unless the thing went straight up, and I was always going to sell the instant it pulled back. Again, this was stated in the thread. When BTC stalled at $20k I sold as fast as I could.

This is why I don’t do crypto now. I don’t believe in it at all. Every tiny downturn I’d be sure the bubble is popping and want to sell. It’s not worth the aggravation for me.

Here you go:

So BURNED!

how could you think i was trying to insult you rather than empathize with you?

and how the hell is this not being burned:

you exercised a tight stop loss, well played

but that’s sounds exactly like getting emotionally burned by the volatility of an investment that still has produced generous returns on average

btw yeah this is exactly how i remember it, i just remember it being half a bitcorn for 8k not 10k

also my bad for bringing this up as i made the assumption it had never been discussed; the phrasing made it appear as if you were saying you’d never been involved

No problem. Just wanted to make the record clear on what I did and didn’t do.

I don’t invest in things I don’t believe in for precisely the reason I described. Every tumble and I think the bubble is popping.

lol actually to make it more clear, and i feel like i should say upfront that this isn’t a burn or a gotcha because it makes you look more sharp and savvy:

lol i’m serious that i can tell somebody the price of bitcoin any given week and almost any given day from memory, going back years, and i was just checking if my brain isn’t deteriorating

because i knew “suzzer didn’t buy the absolute top like a doofus” and in fact you were a good 20% off of the high for that cycle, not bad at all

larger point is that some people bumble into things at the right time and some people bumble into things at the exact wrong times and it colors their perception going forward, immensely

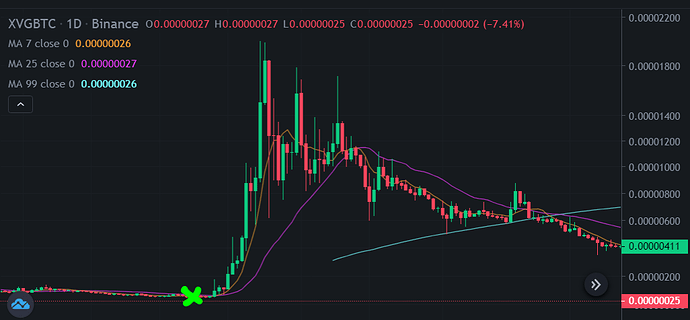

in 2017 i bought some random shitcoins a week before they did shit like this:

and it colored my outlook immensely

Actually I just checked my bank statements from Dec 2017. Looks like I took out $8k to coinbase on Dec 8th and got back $7600 from coinbase on Dec 14th (nice rake there). So you were right about the $8k. I missed an extra $1k and selling at the tippy top by 2 days.

If I had the money and the time I would buy a monkey jpeg just to create the top of the market. Let me know when fidelity is selling monkey jpeg etfs.

I forgot how much I missed 6ix and his stream of consciousness crypto trading blog.

Same except I never forgot.

It’s also redic how much basic price movement of a stock can change someone’s perception of the company regardless if the price is warranted. A brick and mortar video game store selling games that are free while burning money isn’t desirable at $3 a share but is the next standard oil company at 300 just like the sweet little rosacea milady nft becomes a good buy at the price of a house. Nobody seems to care or realize that bubbles have generally ran its course for a long fucking time but looks like a short laughable blip in the rear view mirror that they’d never be dumb enough to partake in.

So is this basically the equivalent of The Joker burning $34M in cash?

https://twitter.com/dapperSBD/status/1517766015974662149

Lol at naming your input parameters for a function called _bid - amount and value. Amount of what? The bid? Then wtf is value? I guess it’s numberOfBids based on the rest. Good example of how naming your variables well might keep you out of trouble.

https://twitter.com/dapperSBD/status/1517766019204321281

https://twitter.com/dapperSBD/status/1517766022375256064

So in actuality bidIndex should be called something like totalNumberOfBids, and calculated accordingly. Do I have that right?

Do crypto programmers ever unit test or run simulations?

Also global vars all over the place. Are smart contracts threadsafe? IE - are they only called by one source, or lock out any other sources while executing?

Ok got it. But now this has me confused again. Why 3500?

https://twitter.com/dapperSBD/status/1518043106997784576

Imagine being that single person who everyone on the team knows is responsible for this.

like I don’t know the first thing about this language but lol 5 mutations to globals and no return value?? How can you keep track of that?

Smart contracts are apparently giant state machines. I guess you have to since the blockchain is the database.