He was smiling the entire time, he knew one day he would break free and end us all

Nazis supporting nazis. You love to see it.

EO leaked, and it’s absolutely nothing.

https://twitter.com/JacobOracle/status/1501384378315857923

send it

Lol an auyomatic 3 K bump

It’s weird. I love all of Rian Johnson’s movies except The Last Jedi which is one of my least favourite films of all time.

Well that’s the one he made intentionally bad as a troll so it had the intended effect.

european socialists trying to CANCEL crypto

What I imagine your reaction looked like…

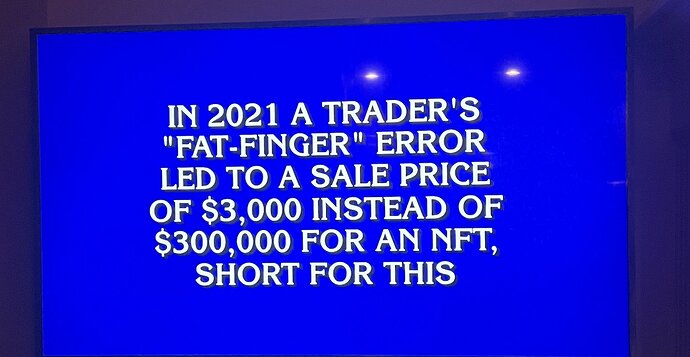

$1000 clue??? c’mon!

thats kind of a bummer though, jeopardy says not enough people have heard of NFTs to make it an easy one haha

lets hope it wasn’t like the dave chappelle triple stumper

OH WOW THAT’S AWESOME NOW MAKE IT FIGHT MICHAEL EISNER ON MTV

I’ll allow it!

Not posting this as a dig - it seems to be a well-sourced article about how El Salvador’s bitcoin revolution is going. I don’t think any of this is surprising and just points to bitcoin being terrible as a functional currency, which we all seem to agree on anyway.

Can someone explain this to me? What happens if the hedge fund wins this bet? I mean, other than them making money.

The article is light on details, but trying to fill in the blanks.

They are shorting a stablecoin - which means if the stablecoin works it’s value is $1. Often stablecoins are backed 1:1 by actual dollars or other assets. However, Tether is less clear on what assets are backing USDT. This doesn’t necessarily matter so long as investors consider USDT to be worth $1 (if it falls below $1 investors can just buy it back to $1). However, if people lose faith and there aren’t sufficient assets backing USDT, the floor could completely drop out.

The hedge fund is betting this will happen and shorting. It’s an asymmetrical trade since the downside is limited - there is essentially no risk USDT goes above $1 - so the cost is just your cost of capital and whatever fees you have to pay to borrow USDT to short. However, the upside is huge if USDT crashes.

I guess I’m asking what happens if Tether crashes.

It’s value falls below $1 and the hedge fund makes money (same as shorting a stock). Not sure exactly what the question is?

I would think it might be better to just borrow USDT and sell it. Quick googling show that for instance on Celsius you can borrow USDT for 6.71% APR with a 50% LTV requirement against USDC. Not cheap but not terrible if you really think USDT is going to crash. Of course this is also secured borrowing, so you have to tie up your capital holding USDC as collateral (and trust that USDC doesn’t also lose it’s peg).