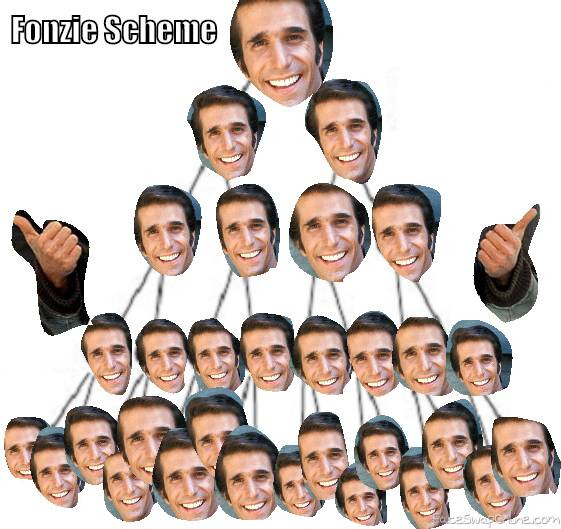

Is no ponzi the new no collusion

Yeah it definitely helps prove crypto is an a-ok asset class when the $30 billion disappeared due to garden variety fraud (stealing deposits) instead of a subset of fraud (ponzi scheme)

hey, we don’t really know how the money disappeared yet for sure, other than what that one girl is leaked to have said, but it’s still kinda unexplainable.

I hope it’s something super weird like he has a 200 million dollar furry suit collection or something

Ponzi schemes sometimes begin as legitimate investment vehicles, such as hedge funds that can easily degenerate into a Ponzi-type scheme if they unexpectedly lose money or fail to legitimately earn the returns expected. The operators fabricate false returns or produce fraudulent audit reports instead of admitting their failure to meet expectations, and the operation is then considered a Ponzi scheme.

This might answer it:

Ok gotcha, we were talking about that in the discord. When Alamoeba was first starting they offered big private investors a “15% no risk guarantee swear to god cross my heart” return, and if that return wasn’t coming from their advertised trading strategies, lol obv total ponzi. Even if they had a losing trading strategy by market making FTX but was made profitable by it aiding in FTX becoming a profitable exchange, thus legitimately making the money to provide the return, it’s still a ponzi because it relies on duping the investors as to where the return is coming from.

This is separate from the recent Yield Product they were offering to the public, the 5-8% return one. If you recall I have a strong bias against all yield things and believe them to be all ponzitastic to various degrees, either as stated or in spirit. At the very least predatory in not stating the risks and showing how the math is funky, as in something like, “stake eth and receive %420.69 in notaponzicoin” which could very well be legit provided eth and notaponzicoin don’t crater in value, and the investors didn’t actually make a return at all.

The ponzi discussion is so wild because the people screaming ponzi are kinda sorta obfuscating and hurting the spirit of their own argument: FTX stealing user funds isn’t a ponzi, as the people keeping trading balances weren’t promised a return as part of a scheme. It’s worse, they weren’t promised anything, they were just robbed!

Yeah I was gonna add how legit operations can do a little ponzing here and there to paper over rough patches, or go from legit to full ponzi over time, etc, but the post was already long.

Levine has the now even more infamous “I consider myself pretty cynical” exchange, but he was still speaking figuratively and about the types of coins that had ponzitastic tokenomics. These were supposed to be where a big part of the FTX/Alabama profits were coming from. In hindsight though “I’m in the ponzi business and business is good” is so fucking amazing.

Levine GOAT

Meanwhile in crypto I just don’t hear a lot of stories like that? I am not saying it is impossible, or even that unlikely; I am just saying that I’ve never really heard of it happening. Oh I mean I have heard many many stories, in crypto, that have the same rough shape, “run on the bank” stories. But the ones I have heard are all subtly different. They go like this:

- A crypto firm owes $100 to customers or lenders.

- The firm’s balance sheet shows $200 worth of stuff.

- Somebody notices that the $200 worth of stuff is just a piece of paper with the words “this is worth $200” scrawled on it in crayon, and points that out online.

- The customers or lenders read this and, sensibly, demand their $100 back all at once.

- The firm tries to shop its scrawled piece of paper to raise the $100, and gets bids for it of zero dollars.

- The firm cannot raise $100 to pay back its customers or lenders, and implodes.

- But it had $0 worth of stuff, so this seems like a pretty reasonable result, though of course bad for customers.

hey look at these fake shitcoins we invented based on air

you’re just typing words now man

Rivermang delivering with the “money sucks cuz people keep trying to steal it from me” scorcher.

Yeah it definitely helps prove crypto is an a-ok asset class when the $30 billion disappeared due to garden variety fraud (stealing deposits) instead of a subset of fraud (ponzi scheme)

200 million dollar furry suit collection

The firm’s balance sheet shows $200 worth of stuff.

What are these “balance sheets”? If they aren’t audited financial statements then what’s the point?

Imagine how disappointed I’d be if I tried to talk about my “FTX/Alameda pretending to be a ponzi to hide just blatant robbery theft of billions of dollars” hypothesis.

These balance sheets are just excel spreadsheets made up by SBF.

These crypto firms don’t want to be audited. None of them do except maybe coinbase which is in the USA.

Coinbase is a public company, so they file audited financials.

Not sure where to put this, and I don’t want to shock anyone - but I think the national Libertarian party has gone full stormfront.

This is SBF on Meet the Press a few months ago. Normally, people don’t shake so hard the chair moves.

Are we sure there wasn’t a signaling device in his pants?

This is the kind of thing where, ok, setting aside my general lack of knowledge about crypto, I don’t want my money or investments tied up in entities that are not audited. Even the private placement market in Canada has audited financial statements for the LPs that you sign up with to invest your capital. Every bank is regulated and audited. I can accept that there are economic possibilities for crypto / decentralized finance, but they (issuers, exchanges, any party to the transaction) should conform to the fundamentals of audit and disclosure.