Bout tree fiddy stacks of high society worth

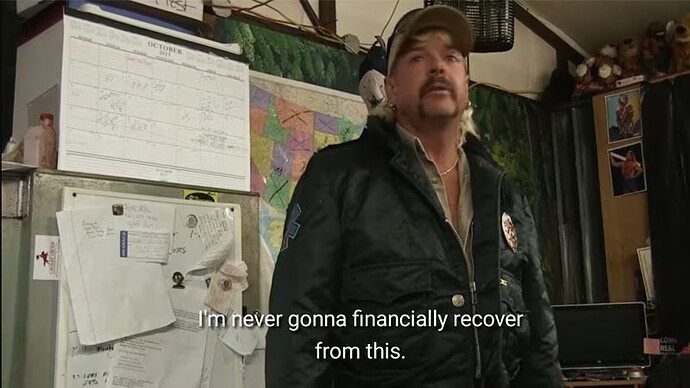

“I’m in quite a big hole right now,” Thacker said. “I’m probably going to have to file for bankruptcy.”

Thacker told CNBC he “would encourage people to still invest in crypto.”

“I probably would give them some different advice at this point,” he said. That advice would come with the warning, “Here’s what I learned, don’t make the same mistakes I did.”

Bhagamshi Kannegundla said he first heard about FTX in an advertisement featuring comedian Larry David that aired during the Super Bowl.

“I was like, oh my goodness, there’s all these big name people utilizing FTX,” Kannegundla said. “So I was like, OK, hey, I think I’ll be safe using this.”

Less than a year later, Kannegundla was out $174,000, representing around 60% of his crypto portfolio, from FTX’s collapsed.

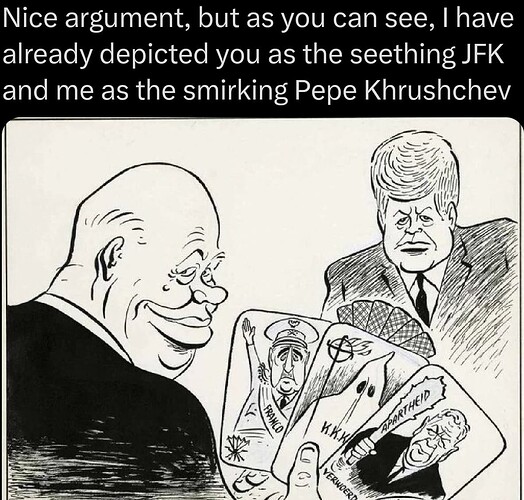

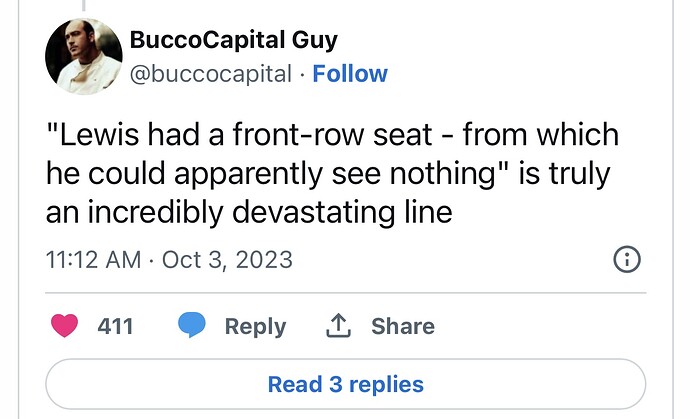

Michael Lewis’s Going Infinite is released today. I reserved it at my library, but I’m afraid it’s going to be a flimsy look at FTX’s fall rather than a deep, critical dive. I suspect that when he was embedded at FTX, he was actually planning on a very positive puff piece like The New, New Thing (which was very not good), and the timing of the FTX collapse saved him from looking like a complete moron.

Lewis has been getting roasted on Twitter for defending SBF on 60 Minutes.

not sure that’s a fair description of Lewis during the interview. he definitely has sympathy for Sam and it’s probably fair to say he liked him personally, but the (poor) description how ftx came to be, Sam’s “management style”’ and of the fraud he’s accused of isn’t the same as defending him imo.

thought Lewis was goofing on him actually

Oooofff, this review kind of confirms my fears that this book is not going to be great.

https://x.com/jenszalai/status/1709003422001754492?s=46&t=5Y4DrgHazxMWQ9paU0HR7w

It’s very funny that the only subject Michael Lewis was ever able to muster an appropriate level of skepticism towards was himself.

There were certainly people in this forum that felt that NFTs represented something more tangible than anything having to do with “fiat” (stocks, bonds, etc), or that at worst it wasn’t any more or less of a scam than trad finance based on fiat.

Lewis was the guy who wrote a bunch of good books. moneyball/wallstreet stuff/etc

and then he started talking and you realized he sucks he just has connections (blind side/this)

He also panders to his subjects/connections. Like in hindsight the Blind Side was a puff piece on how great the Tuohys were. Even Moneyball was basically a Billy Beane PR piece (and I think Beane is great and have enjoyed all his books).

well that stuff is being an ahole but this was probably most telling to me from that article

“Other parents who had lost children told him that he’d be overcome by anger and guilt, but he wasn’t”

I caught the ‘60 Minutes’ interview with Lewis and, as an admitted fan of his, I found it somewhere between confounding and infuriating. Him actually taking the absolute trash concept of “effective altruism” seriously was even more infuriating than his complete blinders with regard to SBF.

This excerpt from that review pretty much sums it up, part of which was in that tweet you quoted:

Lewis, who traveled back and forth from the Bahamas, where Bankman-Fried was based, had, in the months leading up to the disaster, a front-row seat — from which he could apparently see nothing. “As late as the final days of October 2022,” he writes, “you could have ransacked the jungle huts until you were blue in the face and have had not the faintest sense that anything was amiss.”

"Not the faintest sense”? That April, Bankman-Fried had given an infamous interview to Bloomberg’s Matt Levine in which he all but admitted that the cryptocurrency industry — the linchpin of the Bankman-Fried edifice — was like a Ponzi scheme.

The way he was talking about Bankman-Fried, he sounded as if he were presenting a prize to his star pupil. “You’re breaking land-speed records,” Lewis said. “And I don’t think people are really noticing what’s happened, just how dramatic the revolution has become.”

. . . the author’s questions were so fawning they seemed inappropriate for a journalist. Listening from the packed auditorium, I started to question whether Lewis was really writing a work of nonfiction or if FTX had paid him to appear. (Lewis later told me that he was there as a reporter and that he was not compensated.)

This is not good news for SBF:

Months before the collapse of FTX, some of its U.S.-based employees discovered the so-called backdoor that Alameda Research allegedly used to withdraw billions of dollars of customer funds from the cryptocurrency exchange, people familiar with the matter said.

The employees who made the discovery reported it to the boss of their division, who discussed it with one of FTX founder Sam Bankman-Fried’s lieutenants, some of the people said.

But the problem never got fixed. In the summer of 2022, the leader of the team that raised concerns about Alameda’s special privileges was fired.