If they’re only going to be #4 in their industry I don’t really see the need for intense antitrust scrutiny. It’s not like Visa is buying American Express or something else that would really impact consumer choice in banking and credit cards

I’ve had good customer support experiences with Discover, while Capital One is staffed by demons. Disappointed.

This is an interesting case. Guy’s company is being bought by Pfizer, which he knows will increase the value of a rival. He buys options in rival with no inside information and gets charged with insider trading. Not sure what I think of this.

Did he make the trade before the purchase of his company was public knowledge?

Lol charging anyone with insider trading while congress critters are still allowed to amass fortunes in the market.

As far as I know it’s been standard for a while in Canada that insider “industry” knowledge still counts as insider trading knowledge if it is not public. When I was an actuarial consultant my biggest client was Canada’s largest bank, and when we were working on highly confidential projects like M&A work we were instructed not to trade in ANY Canadian bank shares.

Hey, thats no way to talk about AT&T Time warner aol hbo discovery nexstar tvn scripps harpo hasbro liberty media golf digest mediaworks new zealand takahayal entertainment eurosport

What do you have against small businesses just trying to make it in this crazy world?

Yes, but the deal had been publicly rumored in the press.

This is REALLY close imo.

Does news confirming rumors move stock prices? If so, then having that certainty before it becomes public is inside knowledge.

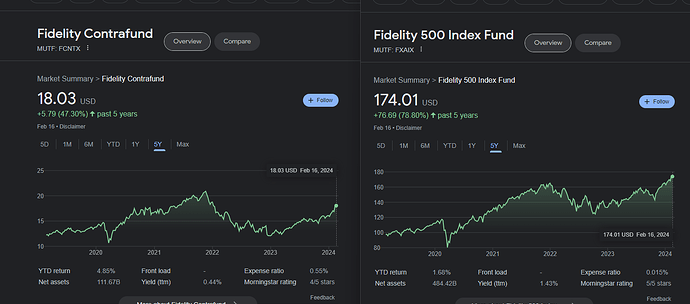

Compared to what? Hasn’t everything done well since COVID?

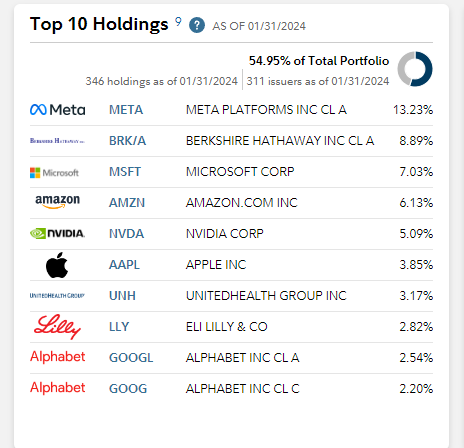

Looked at the composition and it’s heavily weighted in a few stocks that look pretty good.

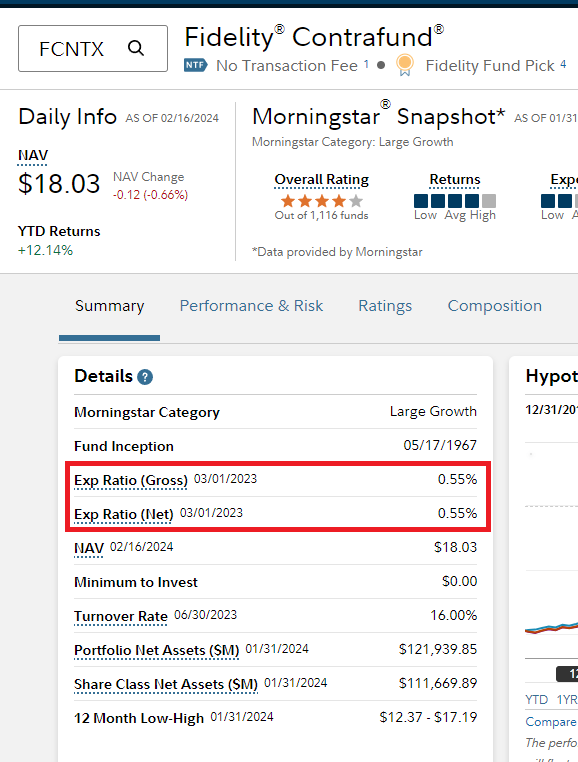

Then I saw the expense ratio.

If you’re locked into Fidelity, I would check out FXAIX (S&P 500) (or FSKAX, total market). It has outperformed the contrafund over the last 5 years by a hefty margin and the expense ratio is only 0.015% (27% of the contrafund)! Can lol at 5 years or whatever, but that expense ratio of 0.55% would eat up any ROI if it did actually outperform the index.

My goal is to have my eggs in as many baskets as possible and hedge as much as possible in case he market goes down. Obviously all boats go down, but maybe some go down less than others. One big index fund scares me.

I thought the idea is that Contra does well when the market does bad. But looking at those holdings, they don’t seem very contrarian to me, and I’m thinking the big gains come from Nvidia. Hmmm. Might be a good time to unload.

I don’t share the single index fund concentration concern. I think you might be right to unload Contrafund, but all the spinning plates make it hard for me to tell. As long as you’re making money ![]() Micro

Micro ![]() oft

oft

Sp500 is at +45% in that time. I don’t see any way a basket of whatever beats the wealth aggregation. Apple and Berkshire are sitting on enough cash to buy entire sectors.

At some point they actually will.

Looks like pretty clear cut insider trading to me. He didn’t bet on his own stock but he still placed a trade on another company 7 mins after he supposedly got wind that Pfizer was going to buy his company before the info went public.

It’s an area where things get blurry when insiders make trades on other companies with information that they hold before others but really can’t get pinpointed hard enough to classify it as insider trading. This guy clearly pushed that shadow trading too far.

What if the competitor’s stock sank because the market decided they were the loser in some sort of pharma arms race because Medivation was being acquired with massive backing from Pfizer, and the competitor was not? Doesn’t seem an unreasonable possibility, and he certainly wouldn’t be charged if he lost $100K.

That said, this guy had an MBA from “a top business school”, 15 years experience in pharma and pharma investment banking, and was one of 12 people to hear personally from the CEO of a $14B acquisition. He must’ve been making pretty good money, and probably was going to benefit nicely from the acquisition. Seems awfully dumb to put himself in potential hot water for “just” $100K.

I mean, it would be like having access to your opponent’s hole cards and calling someone’s all-in with K2 when they have Q2 and losing.

I guess it all depends on where the SEC wants to draw the line. None of these guys are going to make obvious trades that break the law when you can just go down the convoluted web of trading in other parts of the sector with info that isn’t public but has no real cut and dry correspondence to the other company. Who knows how the SEC operates but I’d imagine that they routinely see these grey areas consistently happen with impunity and they wanted to hammer down on something that seemed so blatantly obvious - which it clearly was in this case, imo.

Let NVDA cook.

Up 8% after hours

Yay me for not unloading my Contra fund yet.

My desire to avoid cap gains taxes on selling my NVDA stonk is really paying the fuck off. Of course, the inevitable consequence is I’m going to hold too long. Gonna cash some out this week for sure. Well, maybe.