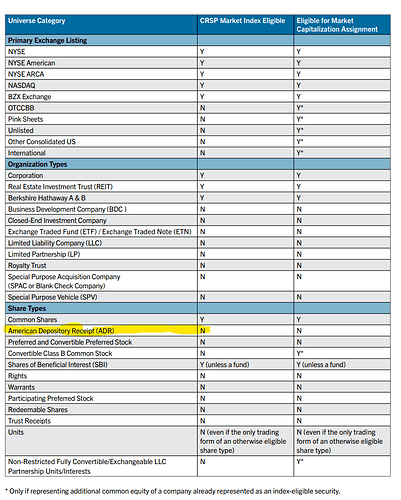

You don’t get foreign ADRs with broad Total US Market fund (such as VTI, ITOT, etc).

I didn’t know that. Thanks.

Is it though? Every country has different business climate, different stances regarding property ownership, etc. I don’t really feel all else is equal as an American investor between owning shares in an American business and a Chinese business

I am not saying that the US business climate is the same as ex-US. I am saying that you are being fairly and equally compensated for differences in risk as predicted by EMH+MPT.

In the case of US, you are paying $23 for every $1 of trailing earnings, and for ex-US you are paying $12 for every $1 of trailing earnings.

When I say they are ‘pretty much equal’ from a EMH+MPT perspective, the only differences not accounted for in theory that I am thinking of are:

a) slightly higher costs (incl. more non-qualified dividends) associated with investing ex-US

b) black swan events where a US based investor may be treated differently (to their detriment) than a domestic investor (aka your money gets stolen by a regime)

It seems people generally understand the idea that the best company doesn’t necessarily make the best investment. It all depends on how much you have to pay for that company. Price vs. value and all that.

But I feel like I’ve seen a ton of recent boglehead discussions about US vs. non-US investing, where people don’t feel comfortable applying the same logic. American exceptionalism is great, unless it’s priced too richly.

There are good reasons a dollar of earnings for a U.S. company is worth more than a dollar of earnings for foreign companies though. For all our dysfunction we have the deepest, most transparent, most liquid capital markets in the world. Taxes, rule of law, relatively low corruption, best military, etc. matters.

I’ve traded Treasury Derivatives for 12 years now and I still can’t figure out why the markets react the way they do.

Powell comes out on Wednesday and says “We need to be patient and see continued evidence of inflation coming down.”

Market rallies because they think a March cut is coming.

Powell says on 60 Minutes Sunday night “We need to be patient and see continued evidence of inflation coming down.”

Market breaks because there is now a lower likelihood of a March Rate Cut

I don’t know if anybody has it figured out. Or else everyone would be doing whatever they were.

Few things amuse me more in finance news than the backflips headline writers (and I guess the whole industry including 24/7 CNBC, etc.) do to “explain” the day’s market movements. “Stocks fall on worries of continued inflation” inevitably followed by “Stocks rise as investors brush off inflation concerns” the next day.

Correct. Efficient markets ftw.

Higher discount rate applied to ex-US earnings = higher expected returns moving forward

Yeah I mean it’s sort of like saying, “there’s a reason that the Celtics are heavy favorites over the Pistons. they’re way better at every position, etc etc”. But whether the Celtics are actually a good or bad bet is another matter altogether.

[Bill Simmons voice]

Listen, VXUS is a sneaky good “nobody believes in us” investment. It just is.

Are we sure the US is exceptional??

This whole forum operates on the thesis that the USA is more corrupt and broken than is generally understood.

If that’s true (and I think it is) we literally have something which is likely to significantly mispriced.

Very significant chance that being broken for citizens is great for shareholders.

Right, we don’t even have fucking mandatory maternity leave in this country. Minimum wage is $7.25 an hour or some shit. Antitrust barely exists. I could go on.

I don’t really agree because “generally understood” refers to a lay person, whereas markets are priced by experts.

I would note though, that the invest 100% in US, 'American exceptionalism" crowd takes the opposite view (i.e. USA #1 is so star-spangled awesome that no market could ever possibly price it properly relative to ex-US).

True, but it’s corrupt FOR the people who own most of the stocks. So the corruption is generally pro-corporate and good for holders of US equities

I dont think US equities are mispriced or that we are experiencing some fragile boomer bubble thats going to burst as soon as someone realizes that it was all just artifically driven up to the max before the olds die off and leave the youngsters a mess to clean up.

Its a global market thats all tied together and markets like the ftse or the nikkei that has been kicking ass isnt solely priced the way it is to make some folks rich.