Not everybody. Rich people should get tax cuts because when they have lots of money and spend it, that’s Actually Good because it stimulates the economy. When other people have lots of money and spend it, that’s a disaster because inflation is Actually Bad.

STONKS

Sold all of it a couple hours ago

I’m not selling till the giga bounce whenever the fed cuts interest rates.

It’s a coiled spring begging for some lame ass .25 rate cut. Hear me now, believe me later.

Holding Tesla right now would certainly give me the willies. When the entire EV market is showing signs of a slowdown and a loss of interest, toyota invests and makes legitimate headway in the range of their batteries which becomes a key point of interest in a necessities market. Ford of course is fucked.

My cure for inflation has always been to raise taxes. Apparently that’s a non starter in the USA.

We have a SPENDING problem right. It’s like when you ask your boss for raise and your boss says no, just spend less money. Problem.solved!

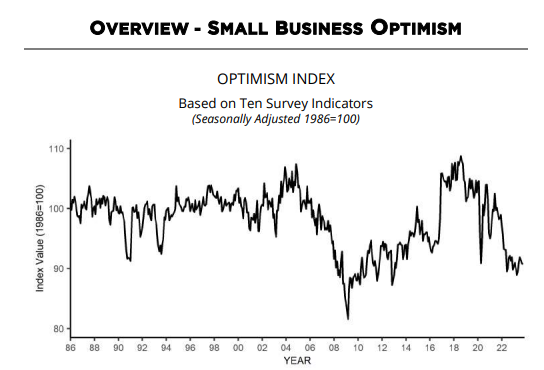

The National Federation of Independent Business (NFIB) Research Foundation has collected Small Business Economic Trends data on a monthly basis for the past ~35 years. The Optimism Index is close to the lowest point ever over that time, with only the financial crisis period being worse:

What I think is interesting is that it’s consistent with the recent “vibes vs. data” argument regarding our current economic situation. Broadly speaking, people seem to think the economy is terrible even though if you teleported economists from 1983 to a Mission Impossible-style airlocked room and showed them only hard data, they’d probably say that the economy looked quite strong.

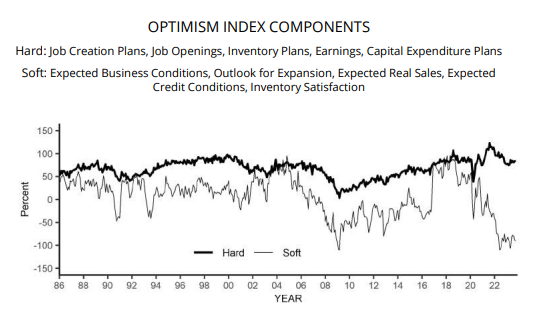

When you look at the components of the survey, where they break it down into hard vs. soft indicators, you see a bigger divergence than ever before:

This seems like one of the most important questions/issues for the 2024 elections: If the hard economic indicators are accurate, what will it take for people to change their mind on the state of the economy? And if the hard economic indicators aren’t accurate, what’s missing?

The bold new leadership of one Donald John Trump!

All I’ve got –

- The experience of unexpected inflation creates negative sentiment out of proportion to reality.

- Unaffordability of housing has large impact on negative sentiment.

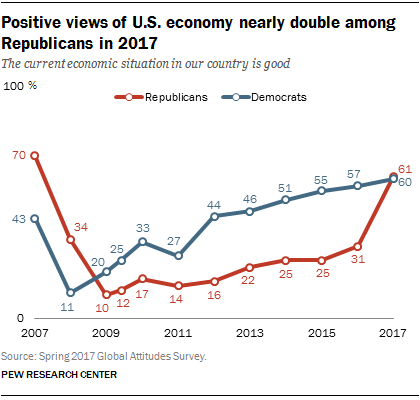

- The nature of right-wing partisanship leads to right-wing people expressing maximum negative sentiment when polled (as a form of political speech) in a way that did not exist in the past.

There’s a pretty robust pattern in academic research where managers–when they report their results–tend to take credit when things go well, but blame external factors when things go poorly. Maybe that’s intentional and opportunistic behavior, but maybe it’s ingrained human nature.

I can imagine a world where individuals feel/behave in a similar way (where wage growth is internal and inflation is external), and the difference between the two only becomes evident at high levels of inflation. Even when wages keep up (as they have), and even when wage growth and inflation are to some extent mechanically linked.

Scenario 1:

Inflation 2%

Wage growth 2%

Change in real wages 0%.

Perception: The administration must be doing a good job, because the thing that they control (i.e., inflation) is reasonable.

Scenario 2:

Inflation 8%

Wage growth 8%

Change in real wages 0%.

Perception: The administration is doing a horrible job. Thank god that I have been able to earn (totally on my own!) this outsized raise that lets me barely keep up with this Bidenflation.

Probably banning social media.

These feel very truthy.

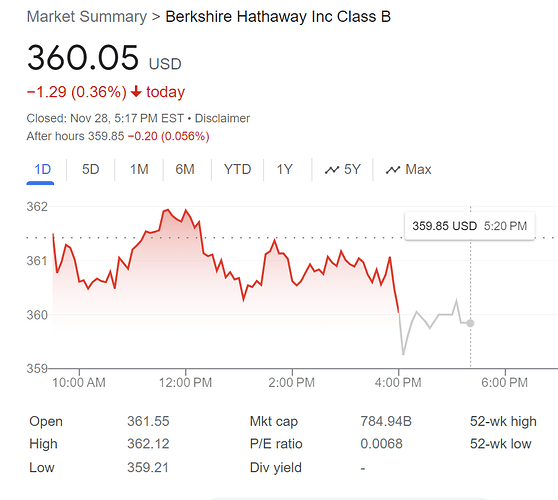

I wonder if they announced his death right at market close on purpose or if that was just a coincidence? pretty small movement all things considered

Charlie Munger has died. What happens to Berkshire Hathaway when Buffet joins him? I know the fund continues under new/existing management minus those two and the portfolio composition remains the same. But does it crash, at least temporarily, on the loss of Buffet’s name alone?

My wife has been hammering me with this question for years, and my consistent response has been, “Nothing material is going to happen to the stock price. Everyone knows that the expected tenure of an 80-year old [when these questions started] CEO is quite short, so no one is going to be surprised when that CEO steps down. Moreover, the company is sitting on an insane amount of cash, and the stock price is not overvalued. So if the stock price does drop significantly, the firm is likely to step in with substantial repurchases. Those repurchases may not immediately stabilize the stock price, but would add value over the long run.”

We’ll see what happens when it happens. I can assure you that I will be bombarded with "I told you so"s if the stock price does drop.

How much of a decline do you consider a crash? I’m sure it will go down a little but crash? A significant decline might be a buy the dip opportunity because they have pretty solid business at pretty good valuation already. Buffett doesn’t really give any operational input to the businesses Berkshire owns, so none of them should be adversely impacted. He’s really built something that should sustain just fine without his presence

In my opinion Apple would be way more impacted by a Tim Cook retirement than Berkshire would be impacted by a Buffett retirement as one example. I still doubt their stock would go down too much if Tim Cook retired.

This is 100% the answer. I remember about 15 months ago when Biden’s radical socialist policies were causing gas prices to go through the roof, well gas is back down to $2.55 in my area I just paid $34 to fill up my Camry which is less than I was paying when I got my first car in 2006 and guess what? Absolute crickets from the media, we are already on to the housing crisis now. As long as the media can just pick and choose any one of the 10,000 sectors of the economy that happen to be doing poorly at any given time (egg prices $2 under Trump, now $8 under Biden!) it’s going to literally be impossible to have a robust economy when a Democrat is in office.

Yup.

just declared a special dividend of $8. share price was $7.50.

Some recent business book reads that I’ll put here since I’m so behind on the book thread and don’t want to lose my place.

Going Infinite by Michael Lewis

I don’t have much to say about this that hasn’t been said. It’s not very good. It’s extremely credulous about SBF’s motivations and actions. And, despite Lewis being embedded at FTX, it has surprisingly little detail about what actually happened in the final days/weeks. Huge disappointment.

Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall by Zeke Faux

This is a book that was ostensibly about bitcoin and crypto and Sam Bankman-Fried, written by a skeptic. Here’s a quick blurb from Amazon:

The “rollicking” (The Economist), “masterfully written” (The Washington Post) account of the crypto delusion, and how Sam Bankman-Fried and a cast of fellow nerds and hustlers turned useless virtual coins into trillions of dollars—hailed by Ezra Klein in The New York Times as “One of the Best Books that Explain Where We Are in 2023”

Great, right up my alley. In fact, many reviews of Going Infinite pointed to this one as the better book - the one that you should read. But I cannot understand why this book is so highly rated. First, it seems like it’s mostly driven by Faux’s skepticism about Tether, and it only tangentially touches on SBF. That’s a problem when his punchline about Tether is “ehh, it seems pretty sketchy!”, which is exactly where he started. But the bigger issue is that it’s written in a “let me walk you through all of my investigative efforts, where I am actually the main character in this book” way. Good and interesting books can be written like that (e.g., Liar’s Poker). But this wasn’t good. If you’re looking for a rambling collection of stories about a guy traveling places to interview people under the umbrella of “crypto is bad”, this is your book.

The Fund: Ray Dalio, Bridgewater Associates, and the Unraveling of a Wall Street Legend

This book, on the other hand, is fucking amazing. Ray Dalio ran the biggest hedge fund in the world, but was probably better known for his “Principles”, which were supposed to be both the underlying driver of his business and the way that people should live their lives. I know people who are big fans, and who view Dalio and his Principles as icons. The book is a well-written and well-researched investigation into that idea and, whoooooo boy does it come off as a cult. Matt Levine has written a little about one of the chapters, but I really don’t want to spoil anything. I would be stunned if anyone here regretted reading this.

(There are a bunch of one-star reviews on Amazon allegedly written by Bridgewater employees, claiming that it’s a completely one-sided and unrepresentative picture of Dalio. Still an incredibly good and damning read even if you discount things by 10-20%.)

Edit: Oh hell yeah. I just read the NYT review of The Fund. It’s perfectly consistent with my takeaway. Here’s the opener:

Ray Dalio is the titan behind the world’s biggest hedge fund — a deep thinker and confidant of some of Earth’s most powerful people. Now 74, he has worked diligently over the past few years to publicize his “Principles,” perhaps in the hope that his name will live on.

In “The Fund,” Rob Copeland has done him the favor of assuring that it will — attached to one of the pettiest bullies you’ll ever meet on the page. This is a terrific dagger of a book packed with cringey detail, just long enough to efficiently disembowel its subject.

Most of “The Fund” doesn’t feel like a book about finance. Instead, it is about how a man of surpassing mediocrity used money to control and humiliate, and how much people abased themselves for it. Which, come to think of it, makes it one of the better books ever written about Wall Street.