And correct me if I’m wrong, but charging a bunch of people with just probable cause and not enough evidence for a conviction is a great way of shaking loose a mountain of new evidence, right?

Riverman porn:

Goodbye to all that … stock

The wave of tech layoffs this year is adding to shockwaves in the private markets, as many workers look to sell their company stock just as valuations are collapsing.

Why it matters: Say goodbye to the golden age of employee stock options. This is part of a big unraveling happening for tech workers, many living through their first downturn and experiencing unfamiliar job woes like layoffs, hiring freezes, and the diminishing value of their stock compensation.

It’s also an example of the real-world impact of the market selloff prompted by the Fed’s aggressive rate hiking campaign.

Plus: Those big stock payouts — and record low interest rates — helped drive the housing boom in 2021.

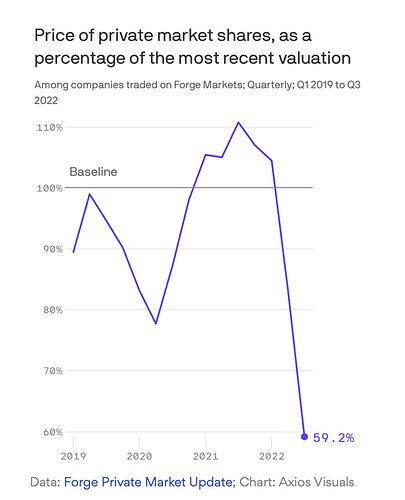

By the numbers: In Q3, shares of private tech companies traded at a median discount of over 40% compared with their most recent primary fund-raising valuation (see the chart below), according to Forge, a private-market trading platform.

In October, that discount grew to 47%.

Flashback: A year ago, rates were low, capital was aplenty and private company valuations were skyrocketing.

All manner of investors — venture capital, private equity, mutual funds, family offices — were interested in private shares, Greg Martin and Glen Anderson, co-founders of Rainmaker Securities, tell Axios. Rainmaker is a small investment bank that focuses exclusively on private market transactions.

But demand has fallen off, and now sellers exceed buyers, according to Rainmaker’s data.

Back in December 2021, the ratio of sellers to buyers was 1:1 — but it shot up to 4 sellers to every one buyer this past summer. It’s come back a bit since then, but there are still 2.5 sellers for each buyer on Rainmaker’s platform.

How it works: Companies like Forge and Carta provide platforms that match buyers and sellers; others like SecFi and Quid offer loans to tech employees who use their stock options as collateral.

Startups typically give employees stock options as part of their compensation. Employees can “exercise” them — or buy the shares — at a low price and then, ideally, sell them for a higher price when the company goes public or is sold.

Back when valuations were moving up and to the right, all was well. An IPO blitz last year allowed loads of startup employees to cash out some of their shares.

The valuation drop is painful for laid-off tech workers. Most only have a short 90-day window to exercise their options — though a handful of employers have extended the time frame.

And because they need money, some wind up selling those shares for far less than they’d hoped — and less than they might be worth if and when the market recovers.

"The desperation seller is starting to hit the market," says Martin. “The ability to hang on to price starts to fade when your options expire next week.”

Workers at crypto companies are even worse off. “Demand for anything that touches crypto is almost nonexistent right now,” Anderson adds.

What we’re watching: The vibe shift is a reckoning of sorts for some tech employees who’ve grown to feel entitled to making loads of money off stock options.

“In compensation conversations between engineers, they were just, like, savage in their greed,” says a tech employee who’s worked in the startup world for a decade, speaking to Axios anonymously.

“What’s the word of the year, goblin? It was like goblins,” she says.

Sort of outside the purview of bankruptcy court but might make sense.

The California budget cuts to come out of this should be a treat for everyone.

So I want to kind of expound on this a little bit. The first bullet point that everyone agrees on is “SBF deserves a harsh sentence.” Why is this? Because he did a bad or criminally negligent thing and hurt a bunch of people. That’s what should motivate the prosecution, not how hard it is to prove under whatever theory of fraud they’d have to apply. It seems almost certain that they would have probable cause to bring wire fraud charges against him under SOME theory of law, and in my opinion it’s very important that they do that.

I’ll briefly talk about another case that could maybe flesh this thought out a bit. The Rittenhouse murder trial was a very tough case to prove, and many conservatives thought that Rittenhouse’s self defense claim was sufficiently strong that it was outrageous that the case was brought. I watched a substantial fraction of that trial and I think if I were on the jury I probably would have voted for acquittal. But I still think it was very very important that Rittenhouse was tried for murder, because to not try someone who killed two and maimed a third person on a public street would lead to a breach in public trust. He’s got a right to the presumption of innocence, but the state certainly has probable cause to try him for murder (he’s on video killing people), and testing his self defense claim in open court is the best way to make sure people have confidence in the justice system.

So to me the “incompetent businessman” defense Sam is publicly putting forward is much the same thing. Yes, that’s certainly a possible defense for his crime. Yes, that defense will make the fraud case against him more challenging. But just like it was important to test Rittenhouse’s self defense claim in open court, it’s important to test Sam’s incompetence defense in court. Because if it isn’t and he gets a cupcake deal, people will say look at what happens when the rich and powerful and influential steal tens of billions: a slap on the wrist. Oopsie, I had a bad month. It happens to all of us.

And that’s why SBF is talking to the press right now, and why I think it’s smart. He’s getting that defense out in the media and public consciousness so the Feds, directed by the politicians he bribed, will have the pretext to letting him off the hook. It’s gonna suck!

Update on Activision

https://twitter.com/Cat_Zakrzewski/status/1600928302260449280

The reasons it’s probably discounted from what it should actually be worth are:

- It might take 15 months to go through, and 14% a year isn’t good enough for some hedges?

- Hedges may think they can get in later at a similar annualized return.

- Hedges may have caps on the size of the position they can take in one issue.

- It gets pulled down by selloffs on the S&P index funds and QQQ, as it’s in both.

On the other hand, perhaps I’m underestimating the risk of the FTC shutting the acquisition down. I read all the SEC filings and two or three legal analyses of the deal.

I agree with basically everything you said, with the exception of the above quote. I just think that when you have constrained resources, like the SEC or DoJ or whatever, that you need to prioritize your effort. And part of that means taking into account the likelihood of winning the case. If you believe that there are major benefits to just bringing the case in the first place (and I do!), you can take those benefits into account as part of the cost-benefit analysis.

There’s a famous anecdote (but not famous enough that I can find it even after tens of seconds of googling) that’s relevant here. Some guy, I think a US Attorney General, went to some gathering of US Attorneys. Probably have the details wrong but basically he’s in charge of these guys trying cases. He asked a question: raise your hand if you’ve never lost a trial. Some number of hands went up with predictable smug expressions. OK, says the boss, you guys are gutless losers who never try difficult cases. Gutless losers who only bring cases to trial when you’re sure you can win. What cases are easiest to win? The cases against the poor and marginalized. If you’re bringing cases against the rich and powerful, guess what? You’re gonna lose some.

Disclaimer: I may have made up some or all of this anecdote, or even more embarrassingly, stolen it from a TV show or movie.

Any idea who it’s only down to ~$75? It’s hard for me to imagine that ATVI’s underlying business is doing so well that it would be bucking the overall market trend since February. It seems the market is still pricing in a substantial chance that the deal still goes through, but like, the FTC suing to block the deal seems like the worst case scenario?

A fair amount of confidence both sides are still committed to the deal and a reasonable probability the government will lose the case being priced in. FTC suing not totally unexpected.

The complaint hasn’t been posted yet, but based on this quote from the press release it seems like the FTC is defining an antitrust product market that only includes X-Box and PlayStation.

Microsoft’s Xbox Series S and Series X are one of only two types of high performance video game consoles.

Poor Nintendo is getting caught in the middle of it with Microsoft saying “We’ll put COD on Nintendo systems for at least 10 years” and Sony replying “Those gimped out Nintendo consoles can’t even run your games”

Ok, I guess I don’t know much about FTC/antitrust if this is considered somewhat expected.

In this case its kind of been expected for months. I dont think it was necessarily expected by the parties when they cut the deal, but they do seems relatively committed to fighting which doesnt always happen in these situations.

Are we 100% certain that Bankrun-Fraud isn’t doing a Brewsters Millions situation?

Sorry for the time gap in my posts. Had some family obligations this afternoon. I thought about just dropping this because I respect your opinions and you surely know more about this topic than me, but it is an interesting discussion and maybe I will learn something by continuing.

Why does it seem terrible? It’s unlawful by whose laws? Portugal’s? If Bank of America has those assets in Portugal then they could be seized there and kept for domestic creditors. That’s arguably the right thing for Portugal’s government to do for their citizens. Why would it not be?

It wouldn’t be right for Portugal to say seize the bank’s assets and pay out domestic equity investors while stiffing foreign depositors. But that’s not what I’m talking about. In general the bankruptcy court should prioritize depositors before debt holders before equity investors but within those classes I don’t see any issue with the nation governing the bankruptcy prioritizing domestic members of the class over foreign.

There’s some aspect of might makes right here. Or the means to seize assets and provide a venue for bankruptcy proceedings gives a country an unfair advantage but that’s just how the world works. Why should the bankruptcy be tried in the USA using our judicial and government resources when the company was based on the Bahamas? What is the benefit for the US to doing that?

Yes it does! In the context of FTX the court could say “the assets were comingled in violation of US law and we will prioritize depositors of the US entity who were interacting with this business in compliance with US law over customers who wired money to a hedge fund who then deposited the money into a Bahamas exchange in order to circumvent US law.”

It’s discussed in the book “The Chickenshit Club”. The Chickenshit Club: The Justice Department and Its Failure to Prosecute White Collar Criminals by Jesse Eisinger

Thanks!

FTC complaint in Microsoft/Activision is out: https://www.ftc.gov/system/files/ftc_gov/pdf/D09412MicrosoftActivisionAdministrativeComplaintPublicVersionFinal.pdf

It’s not every day that you get to read about Call of Duty and Assassin’s Creed in antitrust proceedings.