AMCX (AMC channel) is finally doing something long after I dumped it.

He likes the stock

I’ve posted this before but it is such an awesome example of how stupid some of these obscenely paid executives and corporate boards can be.

In 2015, AT&T bought DirecTV for $67 billion. It was obvious at the time that streaming was the future, think of how much Netflix you were already watching in 2015.

They are now selling DirecTV at an enterprise value of $16 billion (possibly less, its a super complex transaction, but whatever).

Here’s the genius behind the buy:

Just a fundamentally broken country.

@spidercrab annual letter is up, as im sure you know

I chuckled at “too many CEOs blindly buy back their stock no matter the price” followed immediately by “we love Apple buying back its stock and it has stated it will continue to do so, which is great for us.”

Lol blindly. I know nobody at BH is that stupid so that’s some interesting industry codespeak.

Yup, not a terribly informative letter, but I’m very happy to see continued repurchases at these prices. I’m probably going to increase Berkshire to somewhere around 25-30% of my investments in the next week or so, which comes pretty close to the point of making me uncomfortable. I think there’s a very high likelihood of 8-10% returns over the next 10 years, which I don’t see as very likely for the aggregate market. But it’s still a lot of money to stick in a single stock.

And just to share a little bit from the spidercrab household: This leads to the occasional dustup with mrs. spidercrab. She’s generally hands-off/ignorant when it comes to our finances, but when I bring up something about Berkshire, her immediate response is:

- Don’t you always tell me that we should be diversified and not own individual stocks? (Yes, 10 points to her)

- Isn’t the stock going to crash when he dies, and he’s like 90 years old? (I don’t think so, and I am confident the market already knows how old he is, but I wouldn’t be stunned if there’s a short-term drop)

In any event, I think Berkshire is very likely to outperform SPY over the next 10 years. I just don’t have a good feel for how much of our assets should be invested in it. (I have a bizarre mental accounting issue where we have lots of different accounts for money that’s meant for different purposes, and that doesn’t help things.)

30% is nuts man, and I love Buffet (but not as much as you). I’m at about 6% of investable assets and I’m not good with much more. Can’t sell because I’d take a massive tax hit (it’s all in a taxable account), so I’ll just dilute it by buying other stuff.

I hear ya hustler. Sometimes the fam can be pain.

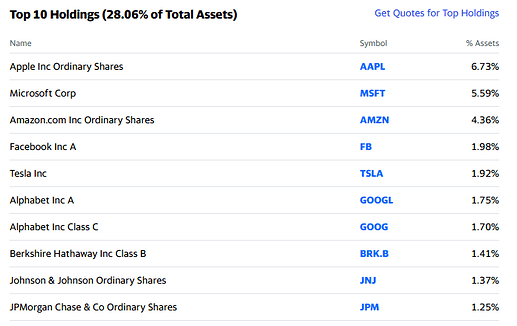

I don’t know, I mean even with the S&P 500, you’re getting pretty large concentrations in just a couple of firms:

Is it worth the risk to try to squeeze out an extra 2-5% per year (my guess of Berkshire outperformance)? Maybe not. Once you include the likelihood that I’m just flat out wrong about that outperformance, probably not. But won’t it be cool to have bragging rights if Berkshire moons?

And this is probably a matter for a different thread, because it’s not STONKS, but planning is super complicated for me. I’ve got 3 kids, with the oldest in 9th grade, but I have no idea what their college needs are going to be. (Their educational needs and performance to date have been extremely diverse.) I’ve been aggressively saving since the first one was born, but if they all end up going to relatively cheap schools for 4 years, I’m probably going to have a good chunk of money left over. And I don’t really have much interest in early retirement, because my job is pretty flexible and well suited for living a good life and vacationing without having to retire - it’s not very costly to work for an extra couple of years. So the ambiguity of what I’m actually saving for makes me want to throw up my hands and treat investing like a game of Top Shot.

Yeah, that’s not great either. I’m not exactly a 3 fund portfolio guy, so I’ve got enough small and mid cap funds to dilute the effect of the Apples, Microsofts, etc. Also I think there is some middle ground between 6% and 30%.

Actually, my biggest holding isn’t even BRK. One of the last individual stonks I bought was NVDA. I didn’t buy a lot but enough that through incredible stonking, it has surpassed my BRK. I’m trying to TLH it down, but not enough losses, once again, thanks to stonking. Nice problem to have, I suppose.

Holding NVDA myself but wondering what your thesis was on it if you care to share.

TSLA is the 5th most valuable company in the US? JFC thats insane.

For your 401k pretax is better than Roth because if you retire early you can convert your 401k money to Roth money at your marginal tax rate. Which, if you don’t have a job, is pretty low. So if you also have taxable accounts (not Roth, just accounts that you’ve paid taxes on and invested into whatever), you can live off those. You’ll have to pay capital gains, but capital gains are separate from ordinary income. So your 401k to Roth conversion will count as ordinary income. So if you don’t have any income you’ll be able to cram some 401k money into Roth taxed at 0%, some more at 10%, more at 12%, etc. Like tens of thousands of dollars at 0-12% every year you don’t have an income. Roth IRAs are good for young people who don’t make that much money (low current marginal rate) and are worried about not being able to access the money (contributions are always available for withdrawal penalty free). But for higher earners 401k is better because your marginal rate is probably higher than what it will be in retirement. And if it isn’t then who cares, if that’s the case then you’re rich anyway.

Yes, as long as you can roll over the 457 to a traditional ira, which I think you can but I’m not certain. That’s the first step in the 401k conversion scheme I described above, roll the whole thing over to a traditional ira.

People who make $125k or more can’t get a roth.

They can do a backdoor Roth. But that’s kind of irrelevant to my post, if you make over 125k and have the choice between a roth type contribution and a pre tax contribution you should definitely choose the pre tax. Because your retirement tax rate will probably be lower and there’s a good chance you can convert some of it to a Roth at a low marginal rate down the road.

Fair enough. IDK if I’m dumb or just lazy but all I do with my money is max traditional IRA and 401k and put the rest into random vanguard indexes a few times a year and pay some extra to mortgage. No individual stonks, seems crazy risky.

That’s definitely not dumb at all. And ultimately your saving rate is far more important than what bucket you put money in.

Pretax is better practically always because the utility you have for money right now is always higher vs money in 35 years. At least IMO.