Houses still up over Sept 2021 prices in the markets where prices are down the most since June.

https://www.realtor.com/news/trends/house-prices-are-dropping-heres-where-real-estate-is-declining-most/!Screen Shot 2022-10-13 at 1.28.02 AM|690x353

The townhouse next time mine in the 89169 zip code here in Vegas sold for $218k. It sold in March for 232K. They had it listed for 270 at one point. Bad timing on their flip attempt.

For those interested, beta application is up for the student loan forgiveness. Super simple and got the confirmation email I did it right. Now we play the waiting game.

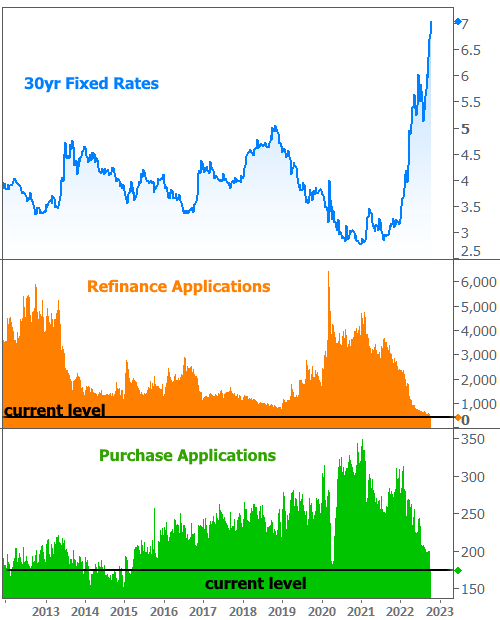

921 units is crazy

I feel like I know what that graph is implying, but dammed if I can read it.

You could think of it this way. If you take 100 random houses that are appraised, then you calculate the ratio of the appraisal price to the listing price, then make a bar chart showing how many times that ratio is within certain ranges (e.g., between 1.05 and 1.1) you would get that type of graph.

If you assume that the appraisal value equals the listing value plus some random error term, and that the appraisal is just as likely to be higher than the listing price as it is to be lower than the listing price, then you would expect to see the famous bell curve shape (think the IQ graph meme). But what we see here is a very different shape. It means the appraiser almost never pick a value lower than the listing price.

I have purchased 4 houses. The appraisal has matched the purchase price 4 times.

Kind of being argumentative, since I agree with the conclusion. But this is also what you’d expect if contracts don’t close if the appraisal comes in low, so those appraisals don’t show up in the sample. Basically survivorship bias.

I didn’t click through the link, so I don’t know how they constructed the dataset. But it seems at least banks should have data on appraisal and contract values whether the deal closed or not. Of course the researchers for this study may not have access to that data.

Is the bar on the far right a sum of all values >25% or is there a significant bias toward that number for some reason?

Our appraiser insisted on appraising us under by $35k in the market of March 2022

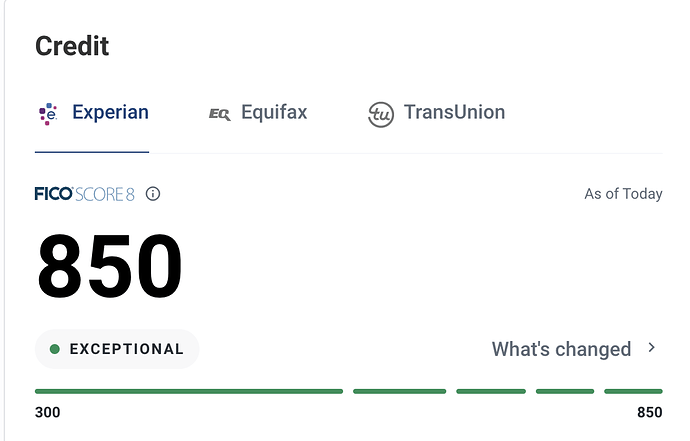

Boom! As much interest as I’ve paid credit card companies over the years, I gladly accept this award.

Do I get to fight some kind of boss now?

How is that even possible lol I can’t get above 800, been like 780 for 10+ years, no debt.

You weirdly get a higher score for having small balances than zero balances.

I don’t keep any balances. I do use my CC to pay for everything. I have a mortgage. Car paid off. That’s about it.

I do have 4 CCs for some dumb reason. Maybe that helps.

It does. More credit available is good