I’m planning to rent an apartment in Northern VA, since one of my kids lives in the area. I’ll think about buying another condo in a couple of years when the market calms down.

Well, I hope this happens, but I’m a housing market pessimist.

Yeah, this was my understanding as well. But if @Riverman says it’s not true, I assume he would know.

Just had a look at what zillow thinks my house is worth. It can’t possibly be true, even in this crazy market.

There is a house 2 doors down that I’d estimate should go for about 80%-90% of what my house would sell for. This house has been on the market for 6 weeks without selling.

During this six weeks, Zillow estimates that my home value has gone up 20%.

The house in question is listed for about 70% of what Zillow thinks my house is worth.

It’s no wonder Zillow lost a fuckton just by taking its own valuations seriously.

/lolZillow

It depends on the contract. In this market it’s pretty common for buyers to waive the financing, appraisal and inspection contingencies. As long as the contract says “non-refundable,” it is non-refundable.

It’s been a while since I’ve been in the game, but I’ve never seen a “non-refundable” clause before.

Hypothetically, let’s say the escrow company’s nearly useless title search actually turns up something that renders the seller unable to sell. Would it be refundable despite the “non-refundable” clause.

sustainable?

from:

If prices are still going up with interest rates up 2%… yeah that’s not a bubble.

The Bogleheads saga continues:

In our area, Albuquerque, NM, the earnest money is usually extremely low. Our $2500 was likely higher than most agreements. The agreement was written in a way that the money would go back to the buyer.

This seems like a pretty small deposit for a cash offer of $400k

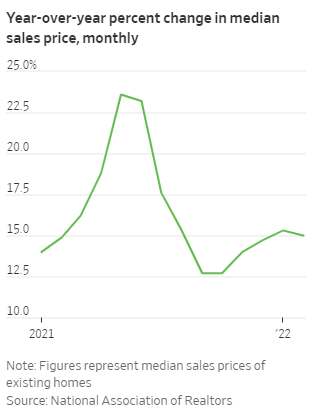

Rates could be locked in but that chart looks like super sus - when did home prices go from +23 to only +12.5 - I havent seen that trend elsewhere…

Not yet dammit. Just hold out one more year until I’m ready to sell.

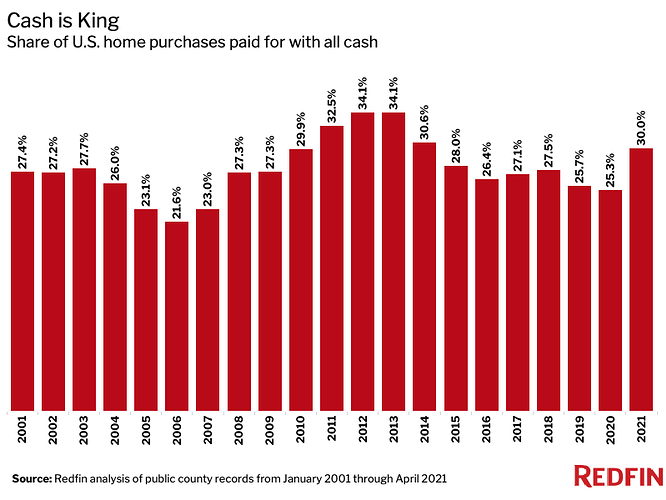

Uhhh exuberance wasn’t the reason for that bubble right? I’m not aware of the housing market being driven by subprime lending. Shit dude it’s all cash offers or waived contingencies and what not

Here is the report that the news article uses as source: Real-time market monitoring finds signs of brewing U.S. housing bubble - Dallasfed.org

Hard to say that subprime lending is happening since my understanding is that has to do with low credit scores. It does mention the price-to-income ratio is increasing pretty quickly but is not quite “exuberant” levels. To me (a lay person), this may indicate the banks are straying from some fundamentals related to sizes of loans but idk. The Fed also makes this point about disposable income increases as a result of pandemic related stimulus which is interesting.

The delay in elevation of this exuberance statistic is partly the consequence of a surge in real disposable income during the pandemic that led to slower growth rates in the price-to-income ratio. The surge in disposable income is mostly associated with pandemic-related fiscal and monetary stimulus efforts and reduced household consumption arising from mobility restrictions and lockdowns.

If disposable income increases turn out to be transitory—as fiscal stimulus wanes and the Federal Reserve reverses its accommodative monetary policy—recent patterns in the price-to-income ratio may prove a less-useful measure of housing affordability. Such transitory increases in disposable income are not strong determinants of long-term housing investment. Thus, the price-to-income ratio measure alone may produce overly conservative results when identifying housing market bubbles.

I’m more concerned about the pendulum swinging hard to the deflationary side which wouldn’t be at all surprising after this “exbuberance” caused by covid + a strengthening dollar and further increase in rates + how history has responded to those events in the past. Like, what is the bull case from this point? It gets you sustained prices?

Price to income ratios don’t matter when people are paying cash.

Back when I bought my house I put down only a slightly higher percentage than that (but less than 1%). And realtor assured me it would be easy to get back if I wanted to walk away from the deal. This was the buyer’s market of over a decade ago, so that probably had something to do with it.

The earnest money needs to go to the seller, not escrow.