Forming an opinion before knowing every possible fact is the same as believing jet fuel can’t melt steel beams, or so I’ve read in other threads here.

Ehh it’s kinda related to inequality in general. We have a bunch of people constantly yelling about how we need to keep capital gains rates low so that they can… invest billions of dollars in a bunch of companies that never have and probably never will make any money.

Except you can go read the IPO for yourself so there’s really no unknowns here. Nice try, though.

He was being sarcastic. Everyone, including the stratechery guy, is massively bearish on WeWork lol.

Were Mitts fancy pants advisors unaware of required minimum distributions?

For (b) the latter - especially if you are disciplined enough to toss a few bucks on your payment regularly.

More worrisome would be that you could be buying at the top of the market, I guess.

MM MD

Nobody knows anything re: interest rates. My semi-informed opinion is the all in rates will not go much lower because bond investors won’t buy sub-3% MBS. I’d transact.

WeWork seems like a crazy hill to die on, but woteva.

I’m about to lock in a 30 year fixed mortgage cash out refinance at 3.625% and I can’t imagine that I’m ever going to have much regret at that rate. Even in a world where I don’t get a tax deduction because I no longer itemize, that’s an amazingly low rate for a 30-year fixed period.

Whether it’s a good idea to buy a house in your market, now that’s a different question.

““They created a third mandate - the Fed wants to avoid the recession,” he said. “At the end of the day, there will be recession but the Fed is attempting to forestall it with rate cuts.””

https://twitter.com/jennablan/status/1164640713025511426?s=19

And he recommends: gold

Isn’t avoiding recessions one of the first two mandates?

naw, it’s full employment and low inflation. Fed just focusing on full employment while totally ignoring all those recessions that leave the unemployment rate unaffected. Bad!

So much for bringing the factory jobs back. I’ve watched multiple customers who import raw materials cut back production over the last few months while they try to find new vendors, mostly in Vietnam.

My biggest customer is a major building materials manufacturer and they’ve intentionally produced 15% less this year trying to maintain their pricing. I know the number they keep throwing around for what the average American family has lost to the trade war as <500… but I can tell you that I’ve personally lost at least low five figures in income in 2019 because of manufacturing slowing down.

Fuck Trump. Seriously.

I was gonna short some Herbalife in my IRA last night. Looks like it’s tanked 50% since January and I’m not going to try to catch that knife, but I probably should. I’d like a list of multilevel marketing companies so I could short a bunch of them. I think there is way too much consumer debt out there, and they’ve preyed on too many victims.

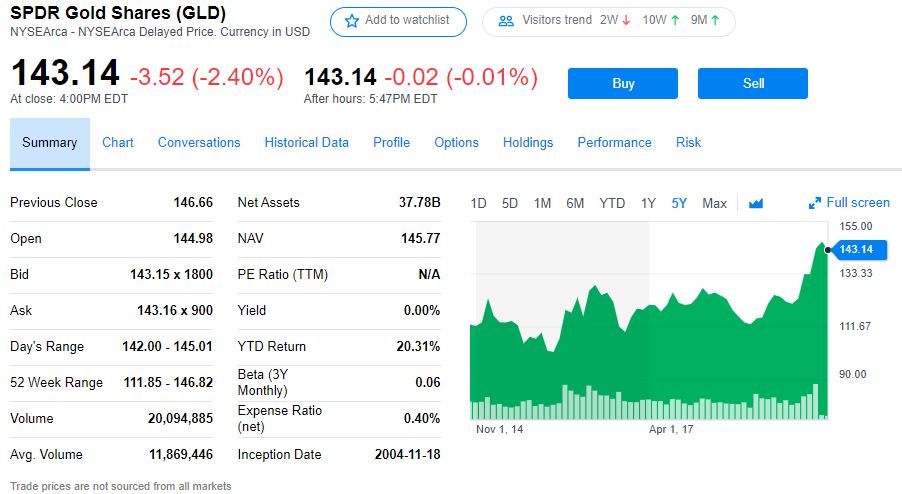

Anyone got any great short ideas? I also want to short the Nasdaq 100, but I’m not sure how. Oh, and I looked into buying a gold EFT, and it’s already up like 30% over the last year.

How do I profit from Trump’s inevitable failure? (Messing around with 5 figures in an IRA)

Eh I don’t think it’s generally a good idea to short buckets of companies. Individual stocks make much better short targets, but still require more than just a hunch. I wouldn’t recommend shorting anything–if you’re that pessimistic, move money from stocks into a high yield savings account or just leave it as cash in your IRA.

I assume that you can buy “put” options for the Nasdaq 100.