I think the luxury market is at risk, but generally agree with you. The big boys learned how to do this last time around.

Meanwhile oil is below $20.

FXE is an FTE that basically tracks the Euro vs. the dollar. Not so much a hedge against inflation but a hedge against USA being uniquely terrible.

The easiest way is to buy inflation protected bonds. The Treasury sells em.

The ETF that tracks them is down during all this, though. That seems crazy… (VTIP)

The market is telling you it expects deflation. Nobody got rich doing what everyone does.

Market up 3.5% today showing I clearly don’t have any idea what i’m talking about. Good thing I am not trading!

the fucking “market”

If we continue the last three weeks trends, expect a sharp futures sell off tonight followed by a steady rise during the day tomorrow and a sharp sell off near the closing bell.

if mainstream Republicans figured out they can just ignore reality and assert facts into existence, I don’t see why something as opaque as ‘the market’ can’t have people doing the same thing to keep the perpetual magic money machine spinning

they didn’t work this hard to lie, cheat, and steal their way to wealth just to have it dribble away oh well nothing they can do.

TTT is a 3x short long treasury ETF. If there is significant inflation long duration treasuries will get destroyed.

I’m not trading in and out based on this, but I think the market is pretty clearly pricing in trillions (like $3-6 trillion) more in stimulus as WAAF massively even w/ the $2.2 trillion so far.

I think there will massive resistance to the needed stimulus from one side or another (probably liberals given that Rs will likely get the first cut at drafting the bill) based on how the initial stimulus package is drafted, which will cause the market to tank again big league. The big league tank will add a sense of urgency, a compromise will be had and the market will rebound.

To me the news that Wuhan can’t really open anything up except letting people go back to work and go for walks is pretty troubling. That was the big question mark and it’s not looking positive absent a summer pause or some kind of miracle treatment. Maybe antibodies.

What is 18 months+ w/o restaurants, bars, concerts, sports, movie theaters, gyms going to do to the overall economy? How long does it take to recover from that? No one has any idea because it’s never happened.

Thank you. Working Hard! Spend your money wisely.

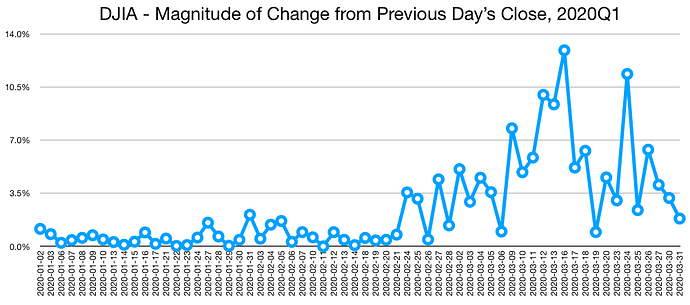

Lol, it’s like a fucking richter scale map after an earthquake

Sure, but with 10 year treasury yields at 0.7% right after a 2 trillion dollar bill is passed and with Trump saying he wants another 2 trillion spent on infrastructure then we are no where near the breaking point.

And this is one time where Trump is 100% right, spending a shit ton money on infrastructure when the economy needs stimulating and the government can borrow seemingly unlimited money for stunningly low interest rates makes a bunch of sense. Good time to be in the construction business imo.

Restaurants will deliver.

Bars take a big hit obviously, but I have a feeling some will get creative and cater to rich people or the upper middle class. As an example, Rao’s restaurant in NYC has like “owners” of tables on various nights. What if bars capped capacity at 25, and people could buy a table or a section of the bar every Thursday night, thus locking in that area and keeping social distance? There are challenges, but it’s doable if this goes on for a year. You could make each group have their own waitress, and charge accordingly.

We’ll see live to tv concerts with fan interaction (like randomly selecting fans to ask questions of the artist or have a song sung to them).

Some sports will be played without crowds, and TV drives most of the money anyway.

Movie theaters will likely adapt - fewer seats, more comfort/amenities and a higher ticket price.

Gyms will be creative too, giving people time slots and assigned equipment and disinfecting in between.

In most cases they’ll make less money but they may not go under, and in some cases some businesses will make more money. Like don’t be surprised if someone kicks Peloton’s ass in six months with a connected bike or treadmill for way less money that can be marketed more broadly.

Unfortunately these changes will cater to people who can afford to pay extra, and hopefully they all/mostly go away after this. But if they keep people employed and safe, l’ll take it.

That’s a good idea and worth doing, but in a lot of the complete breakdown scenarios we get hit with hyper inflation on key consumer staples so a couple of months cash becomes almost worthless.

It could become the golden age for the precious metal doomsdayer types. (Unless they held their metal in paper or bits.)