Aus markets nearing positive territory after being down 8% earlier

Anyone disagree that we’re going to see a contraction in the US economy over the next 2 quarters?

Aus exchange enda up 4.4%. 12% intraday swing.

In retrospect we all should have gotten out the first community spread case in the US. There was no reason other than wishful thinking to believe that it wouldn’t get as bad as China or worse. The power of not wanting to believe it’s true.

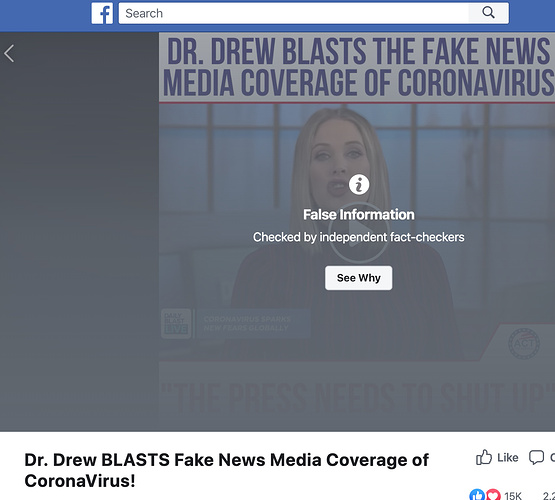

Dr Drew to “Fake News” Media: Exponential growth, what is it?

I assume we’re going to see a ton of volatility tomorrow, I’ve seen futures up at least 500 and down at least 500 tonight. But every time I look, whether they’re up or down, September futures are in better shape than March and June. The opposite was true the past couple days (or at least one of them). That tells me that the market is starting to think this is going to be a massive, but short, hit on the economy and then things will start moving back up.

I’m not saying the market is right about that, but it seems to be what’s being priced in.

Crap meant that for the LC thread.

Ignoring the long-term chain of events that could trigger a recession and growing unemployment and all the problems that go with that and just focusing on the economic fallout of the novel coronavirus crisis…

I disagree that the virus alone will cause companies to go belly up from a lack of economic activity. Obviously some will be directly hit, like cruise companies, and they could go belly up. But the rest of the economy is basically going to have the emergency brake thrown on for, most likely, a period of 2-6 weeks. It won’t be at a complete halt, but entertainment, travel, small businesses, restaurants, bars, they’re going to get hammered.

However, as long as people don’t get laid off, when we resume “normal” behavior (which may still be a little different, like no crowds at sports events or something), we’ll basically be able to pick up at 80-90% speed. So the government just has to provide enough incentive and/or liquidity to get through that 2-6 week period without massive layoffs. Essentially, if they pay people not to work, or pay companies to pay people not to work, especially small businesses that don’t have the cash to ride this out, I think we’re okay.

The question is whether Pelosi and McConnell can cut a deal. The GOP wants to flow all the money through businesses, and the Dems want to flow all the money through the working people. I could put together a plan on either side that I would be fine with personally. The Democrats solutions would all cost the government money, the GOP’s solutions would all increase the deficit via tax cuts being tied into it. I’d say let’s meet in the middle, let’s give no-interest loans to the businesses and let them pay it over a period of like 3 years, so they can spread the hit around, they can keep paying employees, and yet we don’t actually spend any government money in the long run because probably 95-99% will be repaid.

Throw in some reassurances for food stamps and assistance programs, which the GOP will hate, and throw in a temporary payroll tax cut for 3 months after the shutdown, which Trump should like, to hopefully boost consumer spending a bit.

Everyone gets a little something that fits with their worldview, it works, it helps the people and the economy.

Feels like you are suggesting things like:

Low or no-interest loans to companies of all sizes that have been negatively affected by coronavirus-related supply chain disruptions, and that will use the money to avoid layoffs and hours reductions, not to provide executive compensation, dividends, or share buybacks.

Unemployment insurance and other direct payments to households, with the exact amounts tied to unemployment levels and wage growth.

Question from a finance dumbass.

The 1.5 trillion from the fed is just them " printing " 1.5 trillion dollars and lighting it on fire right?

Like could they have just used that 1.5 trillion for social services? Offering everyone in the country paid sick leave? Or free healthcare for people suspected of the CV? That would need to pass congress though, why didn’t this? Fed is outside of congress so it can just print and burn as much money as it wants into the stock market?

I am not a leading expert on monetary policy, but from my understanding the core answer to your question in that the Fed doesn’t actually print money and distribute it around the economy. The mechanism under which $1.5 trillion dollars is created is to simply give banks that much credit at the Fed which they can then rely on as a bank reserve to support actual lending to other market participants. This means that it doesn’t require congressional approval because it’s not a public expenditure. This also means that it can’t go straight into the hands of the public, because members of the public don’t have credit accounts at the Fed LDO.

Another important thing to remember is that this happens every day. The Fed has a full time job evaluating the money supply and economic factors, and deciding if they should create or destroy bank credit reserves as a matter of policy. It only makes the news when there’s a crisis situation and then the media reports on the Fed printing $X dollars and everyone says “where’s my $X”?

Take this all with a small grain of salt, there may be someone here that is much more knowledgeable than I am and can point out where my understanding is superficial or even just plain wrong.

This is 100% a “I could feel the flush card coming” post.

Yes but not really, the Fed is using the $1.5 trillion to buy short term US government bonds from private sector market participants to temporarily boost cash liquidity. So those bonds will mature in the next few months to year, and the Fed will get a total of ~$1.5 trillion in principal from the US govt that otherwise would have gone to the previous owner of the bonds.

It’s not $1.5 trillion of “spending” by any reasonable definition.

More like the dealer flashed the flush card and I saw it.

Again, China shut down. Even if the virus had turned out to be no big deal, that was going to result in interrupted supply chains and be at least a short-term drag on the world economy. All this while the market was setting all time highs.

Do you know exactly what it is? My understanding is that it would involve just directly giving qualified banks an additional $1.5 trillion of Federal Bank reserves, which would empower them to do more lending and theoretically boost the economy. It may also involve separate open market operations but I am not sure about that.

Are you sure about that? It may be the case but I have not seen details on how the $1.5 trillion will be created. Do you have a link to an article that describes the intent to coordinate with the US Treasury and buy bonds? I’m not disputing your assertion, I just don’t know.

I mean, sports are a huge mover of money in the country, and we’ve essentially shut them down for at least a month. Who knows what the effect of only that would be on an economy, but it isnt small.

https://twitter.com/adam_tooze/status/1238445958133764096?s=20

The FT article is kinda complex and niche on bonds.

The Bloomberg article is interesting and presents a variety of data suggesting the market will go lower.

The key questions is “Are leveraged players under pressure?” and the answer seems to be “yes” for almost everyone who isn’t Buffett.