I have cash on hand for a year+ of expenses. I can’t believe people want to buy now with anything they may need in the next 5 years.

When people stop looking for bargains and wonder how long they can hold on, that’s when I’ll start thinking about a bottom.

Wooof CCL $15, sold my puts wayyyy too early

Dow blew past worst days from 2008, have to go back to 1987.

I see three scenarios:

- hospital crunch causes more selling panic

- debt-crunch caused by economic downturn/stock plummeting causes new financial crisis = much more selling panic

- we skate by somehow w/o either

Only on #3 are you gonna be sad if you’re out of the market, and the odds of it shooting back up to 3 weeks ago levels any time soon seem low.

That said, this feels like it could be a panic bottom if we don’t get any worse news. The question for me is do I have the stomach to not sell the rest of what I have on a bounce tomorrow and risk no bad news on the weekend? If no bad news somehow comes it feels like next week could claw back a big chunk. I’m not buying again for a while. But if we test dow 15k I probably will.

Note my rambling thoughts are my own I make no pretense on being a market guru. Yes I am aware that it’s probably too late to sell. Unless we drop another 50% from here. Then it was a great time to sell.

Dow: 1500 pts more until Trump is in the red.

I don’t see us going half from here if for no reason other than even Cuck (And his “NY Constituents” aka Wall Street donors) and Nancy (and her Vulture Capital husband) will be on board for massive corporate bailouts by then. I think they are thrilled with what has happened so far, and even a few thousand further down, because it helps them in the 2020 election but they don’t want things to completely fall apart because then things get real for them too.

Recognizing the Dirty D sociopaths for what they are is helpful in this context.

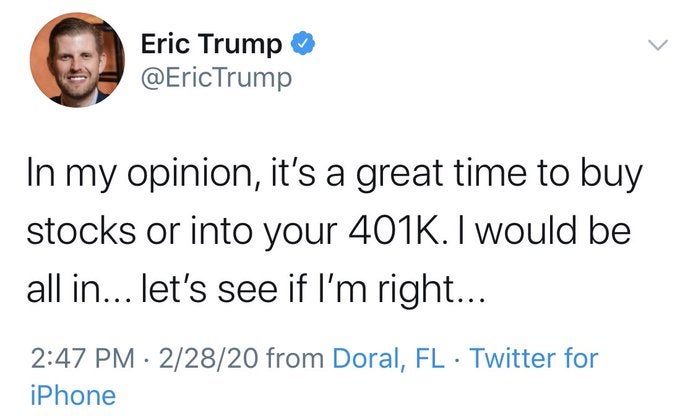

Luckily he and his father have no real money.

Dow futures went from down ~ 2 percent to up 2 percent within about 5 minutes or so. Another announcement of some sort?

Yeah, I have a year of expenses on hand, key to me as a poker pro. Also my entire bankroll is relatively liquid, and in an emergency I could use it to give myself more like a total of 2-2.5 years of emergency funds. Hard to say how long it would go, depends on how much I tighten the belt on expenses.

But if we have a long, flat recovery on this and I’m still able to find and play in good games, I’d consider decreasing my bankroll a bit and taking on a little more risk to get more money into the markets. If I had to move down to 2/5 or something, I’d still be able to cover my expenses so it would be ok.

This will happen, but I see it being short-lived. I’m not saying it’ll bounce right back after, but I’m saying it’ll at least flatten off and maybe we start to see some recovery. So if we have a hospital crunch for 1-2 weeks in NYC, once they’re in the clear and the next city or two to get hit don’t have a hospital crunch or not as bad of one, I think the market exhales and we’re at/near the bottom at that point as long as we didn’t trigger any other major crises.

Obviously this is possible, but I am pretty confident the Fed and the Treasury will go to the ends of the world to prevent a liquidity crisis.

I’ve got my plan spread out such that I won’t run out of dry powder until the markets hit 50% below all-time highs. Seems reasonable to me. I may leave some dry powder out, or I may run out right at the bottom, but my average cost of entry should be pretty good in the long run no matter what happens, and I should get a decent amount of cash into the market no matter what happens.

bitcoin down like 40% today

ha, not even close to #1 stock market crash take that

We blowing through 20k tomorrow boys? Futures at ~20600 atm. I’m thinking yes

This is going to be Buffett’s last hurrah. Can only imagine the opportunities he’s going to have.

I don’t do individual stocks but there are some insane bargains. Wells Fargo at 6.7x earnings and 7.5% dividend yield. Exxon at 11x earnings and 10% dividend yield. I’m quite confident large cap stocks will be fine in the long run. Well capitalized companies with liquidity are going to clean up.

I am selling the last of my funds if a significant bounce lasts until the end of the day.

It’s hard for me to imagine that there’s no way to time the market, in times of massive crisis that I can see coming for weeks, when apparently half the country picked today to finally panic and stock up on supplies.

Although it could be a good argument that we’ve reached peak panic and may be bottoming out for a bit.

Futures back down 2.5%.

Yawn. Amazing how many people say it was obvious after every single crash. Even at Bogleheads there is a parade of liars saying they went to cash 3 weeks ago.

I’m rebalancing and staying the course.

Aus markets jumping (from -7 to -4 lawl) on news we could ban gatherings over 500 people. When Trump makes a similar decision (if ever) could this stem the flow?

Some of the people said it was obvious weeks ago before the crash. And posted their moves weeks ago before the crash. I posted my moves here before it crashed.

Same here. I’m way in the black assuming I get back in before we go back up 10%.

Even though it feels like panic-selling, I think there’s going to be another wave when hospitals get overrun. If hospitals don’t get overrun we’re still going to have no economic activity and companies going belly up.

I was out the whole financial crisis (had much less to play with back then) and got right back in at the bottom (dumb luck - documented on 22). But then I got scared on the way back up and pissed a lot of the gains away.

I didn’t have any money during the dotcom crisis. But I deliberately looked for a job in web programming before the job market dried up, which I felt very sure was coming.