As long as you know its gambling and don’t take an unreasonable position.

Regular people were wrecked when they bought GME shares at 450 when they’re worth like a third of that. There was no ending where they weren’t going to get wrecked, except by finding a bigger fool to eat the loss. I guess people talked themselves into believing it would be institutional investors because they couldn’t carry a paper loss for a couple days?, but it was always going to be idiot retail investors.

I’ve only got a dime in but it’ll be a privilege to ride it to zero. This is absurd.

When I go to close my positions on rh I get an error. Fuck this sucks so bad.

TDA lagging HARD, I can’t even buy CLVS calls rn. Edit: LOL it went through and I purchased 200 weeklies. Welp, here we go.

Bought $900 of clvs. Pure gambling. If it goes to zero it’s a bad day at the casino. Won’t hurt me at all luckily.

Gambooooooll.

@Riverman did your friend know that RH had this up their sleeve today? Is that how he knew to go short?

Maybe so, but these “idiot retail investors” didn’t envision getting fucked in this way.

If it crashed because, well, Gamestop stock isn’t really worth $400, that’s one thing. This is different.

silver short squeezing now

SLV and AG

GME halted

Honestly, its possible. He is a pretty big fish.

The last 4 years have taught these people that they don’t even have to hide their criminality and corruption anymore.

My traders website is completely down. It won’t even load the page. This just reaffirms that I have absolutely no power and I should continue the passive investing approach and hope society doesn’t collapse.

holy shit

Even Marketwatch has crashed or at least keeps coming off and on throwing a 500 error.

Got out of BB and NOK at a tiny loss overall, bought more CLVS

Using etrade, it is slow but functioning

Positive for the day, appears to be halted again

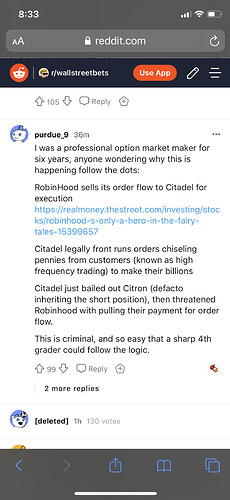

I’m not sure I buy the “Robinhood sells order flow to Citadel, Citadel bailed out a hedge fund with huge exposure, Robinhood nukes the stock to save the hedge fund” narrative.

They can sell their order flow to any number of high frequency traders. Its not worth pissing off substantially your entire customer base.

Feels like the SEC said “shut it down or we are going to look really hard at how badly you screw your customers.”

MEMES BACK ON THE MENU BOYS

DO NOT SELL

IF YOU SELL THEY WIN