Can someone link the WSB discord again. I need to get in there to spam (legally according to the UP legal team) CLVS over and over.

CLVS up 7% AH.

Can someone link the WSB discord again. I need to get in there to spam (legally according to the UP legal team) CLVS over and over.

CLVS up 7% AH.

You’re not. Go back to your fake money.

Work in some dank memes featuring AMCX. The kids like memes I hear.

I’m on there, and there isn’t a single mention of CLVS. I searched it and no results. I think we may seriously be in on the ground floor. Also worried though, because it might not be meme enough and that’s why it isn’t being mentioned.

Imagine my nba gifs.

everyone: “this is the stupidest thing i’ve ever heard”

also everyone: “i bought $2000 shares of NAKD because Thicc Dad Club wrote about it to the moon”

Worth mentioning that it’s currently at a market cap of like 800MM and stonks under 1B are banned from WSB apparently. So if it goes up another 20% it will be permitted to get mentioned on WSB (at least based on screenshot that was shared in here earlier today)

That was the screenshot I posted but I think that line was in jest because of GME. I’ve seen NAKD mentioned plenty and it’s not $1B.

@spidercrab , what do I need to do for this scenario:

I own 200 shares of NAKD.

I want to sell my 200 shares if the stock hits $1.5 or $8. I think TD Ameritrade spits out an error if I put those both in as stop limit sales… Is there some other strategy?

CLVS isn’t a meme stock, it’s the third of three on the AMC/KOSS/CLVS list of under $10 stocks that are solidly shorted. The other two mooned

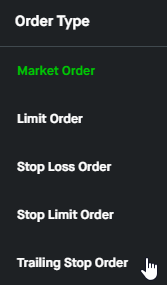

I’m also interested in this. I don’t know what the difference is between all of these.

First two i know.

Market Order = sell at whatever, you get filled where you get filled. Could be lower than current price is volume is low.

Limit Order = sell, but not under a certain price that you set.

Fidelity wasn’t letting me set a sell limit order greater than 50% of the current ask price. I dunno if other brokers do the same.

Yeah and on https://www.highshortinterest.com/ it is the lowest market cap option out when you sort by short %, in that all of the stonks that are more shorted all have higher market value. I think this means it has more room to run. It’s also way down from its all time high.

So basically just trying to guess what the crowd is going to buy next, based on what has mooned so far, it seems like a good pick. A

Stoploss is an automatically-triggered market order when it drops to a price you specify.

Stop-limit is two prices: a limit order to sell at X or higher, and a stop price which is the price that triggers the limit order to fire.

Trailing stop order is a stoploss that moves up as the price does.

That’s my worry as well

WSB didn’t touch KOSS and that went from 3 to 90 (came back down a bit from there)

you just need whoever just took profits on KOSS to find it

I thought wsb was how koss entered my radar, but I don’t remember. Maybe it was you guys because searching “koss” in wsb is turning up nothing.

there’s a V2 I’m actually in it watching and maybe a V3 by now