Where’s the option for I’m a poor so lol at the idea of maxing anything, but put away enough of a pittance in 401k to at least get employer match?

I swore off stonks but now I’m back to stonking some of the time. I don’t have a 401(k) so I max a Roth and throw whatever else I can afford into a taxable account and ETH/BTC. I’ll go back to 100% index funds when I get bored or tired of having to actually pay attention.

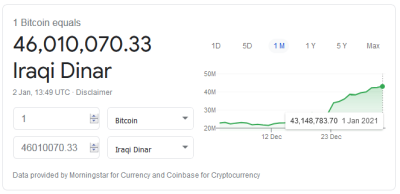

Also I present to you “investing” in 2021:

https://www.reddit.com/r/investing/comments/komdbd/the_proven_power_of_buying_and_holding

Also the article he included about Teslanaires.

Damn, if Unstuck is even feeling bullish going into 2021, this has to be year the market crashes.

I can’t speak for anyone else, but I’m definitely not bullish.

I just buy, hold, and stay the course. But I’m bracing myself for some serious pain.

I think the next decade will return something like 3-5% annually with enormous volatility but I don’t see any better options.

I’m bullish for the next decade but not doing anything differently than if I was bearish.

My employer halted their 401k match in June. I wonder how much money that cost me.

you can see what they contributed before that on your 401k statements. My match comes out to about $1k for a maxed yearly contribution which is probably pretty low

Point is it might be $50k by the time you would withdraw it.

BTC 30k

31k

Now I really want a follow up piece on those insane dinar people

Only $369k until we hit the Guggenheim price target!

I am definitely not bullish. I think next 10 year returns will average less than 6%. I’m really overweight Berkshire, so I’m hoping to do better than that. (Berkshire and some small shorts in Apple and, now, Chipotle are the only individual stocks I own.) If returns are ~5% per year in a world where 10-year Treasuries average <2%, I’m pretty ok with life. On the other hand, I’d prefer to never experience 2008-level or early-2019 level volatility again.

33k

That would be very, very likely if companies were required to generate equity returns by doing stuff like generating goods and services for consumers. But I think the next decade will be dictated more by bailout/stimulus ad infinitum and companies won’t even really be expected to do a good job at anything other than financial engineering on the balance sheet and arbitragey stuff like buy backs. As the American empire continues on it’s inevitable trajectory to failure, there will certainly be some interesting impacts on equities. One possibility is a full on bull market for a decade as the US government tries desperately over and over again to recapture the good old days by giving large corporations unfathomable amounts of money. Would we really be that shocked to see QE in 2031 take the form of direct purchases of common shares?

I also think that coming out of the pandemic we could have a roaring '20s type situation with tons of pent up demand, plenty of cheap cash available, and people wanting to live it up. (Although maybe since half the country never stopped living it up this situation won’t materialize.)

I feel like I should be more aggressive than the index fund stuff I do, but I don’t think I’m capable of beating the market even if I had time to really work on it.

So did bitcoin go up like 5 grand in 6 hours or something?