Well what’s even the point then w/o yachts? Lame.

That’s why he’s got to get to 30 million!

I mean, holding a large chunk of your wealth in ANY publicly traded stock is insane in almost all cases, doing it with Tesla specifically is completely indefensible. And if he holds a year and pays LTCG that’s only 20%. If he then just runs with a 70/30, $12 million portfolio, he’s set. As things stand now he has a reasonable chance of being broke like within 5 years.

Serious question: In this hypothetical scenario, you would still allocate 30% in bonds given your current opinion on bonds?

Yeah, and I think it’s even more so now. When you have so much consolidation today, your ten stocks could get all get swallowed by Amazon, Netflix, FB or Tesla and end up with the dow at 50k and your portfolio in the dirt.

He clearly meant 30% in BTC.

That’s why your portfolio is only TAANG (fuck Zuck) and Microsoft . Chessmate index fund bros.

Rent it when you have higher T, the payoff will be greater.

I don’t really get you guys

- I dabble in individual stonks and I max my 401k and IRA every year.

- I dabble in individual stonks and I do not max my 401k and IRA every year.

- I do not dabble in stonks

0 voters

are you even allowed to max out both 401k and IRA?

Yes if you’re under Roth income limit

Ok. i also dont get the poll bc you can “dabble” in stocks inside an IRA. If you are taking home run shots a roth IRA is probably the best place to buy them

You can max both, but once you’re over the income limits your IRA is ether non-deductible or you do the IRA contribution and immediately convert it to a Roth. This is known as a backdoor Roth and basically gets around the IRA and Roth income limits. IRS seems ok with it.

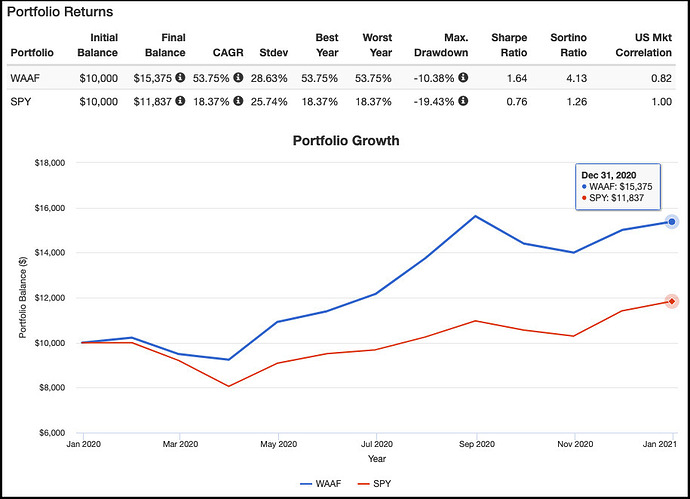

I’ve referred to my “WAAF” portfolio as a joke before, but it would have crushed the market again in 2020.

(1/4 each walmart, apple, amazon, facebook if anybody wants to go for it)

Max 401k , IRA, HSA annually split between US and intl index funds at ~70/30 split. no individual stonks

And also if you are above the limit.

you know what i meant

I just dump my ira into rando funds.

There’s no income limit for contributing to a Traditional IRA, you just cant deduct it from your income if your income is over a certain amount. It’s still worth doing though because you can convert to Roth via dat backdoor… i think.

I need a “Used to dabble in individual stocks, but I stopped. Now, despite using them for charitable donations, they have grown to comprise a significant part of portfolio, but I don’t want to sell them and trigger a huge tax bill*, so I’m just holding and thus have a vested interest in STONKS.”

*I know this is not a great decision