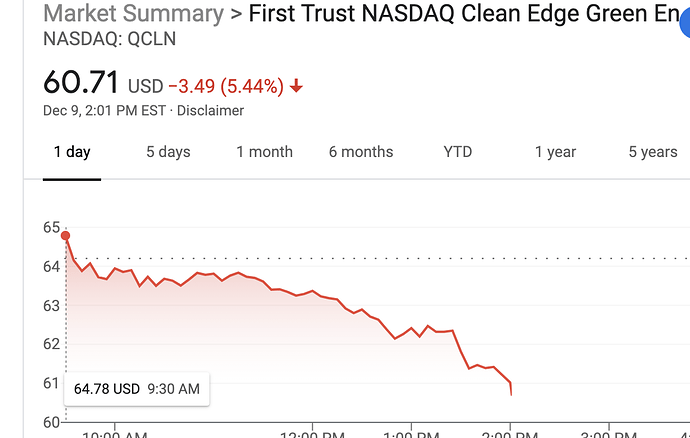

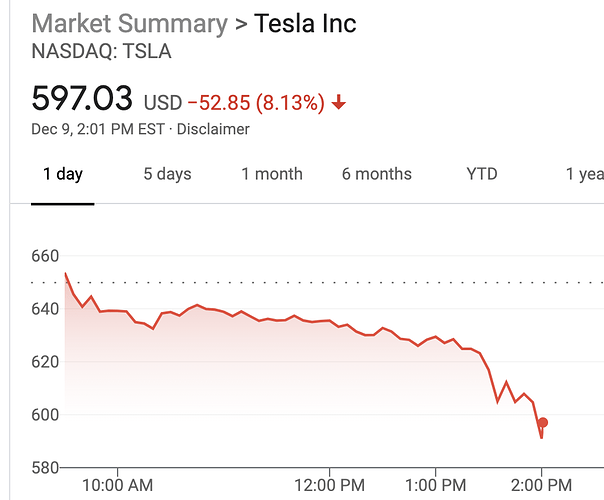

TSLA down 7%? Did I miss some news?

Investors started reading this thread, ldo.

I mean 7% swongs are just an average Wednesday for TSLA but normally it’s the other direction.

Lol 7% is equal to Ford. The whole company.

They are just down a casual Ford market cap today. Totally normal. You just don’t get EVs bro!

Had a checkin with one of my team members yesterday (Team Member). She’s probably ~25. She tells me that another member of our team (Other Team Member) got her into options. Apparently Other Team Member knew some guy who had made a bundle on some calls, and this guy is–of course–now offering tiers of option coaching (amazing grift). Team Member has taken some of the beginner’s coaching sessions and is now confident that she can try it. As the conversation continued, we started talking about other financial topics, and I learned that she didn’t know how Robin Hood makes money, doesn’t know what implied volatility is, and didn’t even know what an IRA was, yet felt confident based on this guy’s coaching that she could profitably trade options in a Robin Hood account.

This feels like peak cryptocurrency mania, just with real world stocks. What the fuck is going on.

Is there a way I can margin long a stonk that is based on the likelihood of Robinhood traders getting liquidated? stonkception

No the underwriters are doing that and collecting a fee for it. Rich guy #3 is not doing that. Rich guy #2 (the underwriter) is telling rich guy #3 what it’s worth and what he’ll be able to unload it for on Day 1. I have no issue with Rich Guy #2 collecting a fee for his work, that’s what he does.

I’m aware, but some of their equity was given away by arbitrarily devaluing the company relative to the market demand so that a bunch of VIPs can make 50, 60, 70% returns in a day, and so that the CEO or Board or whatever can be a VIP who makes 50, 60, 70% returns in a day in the future.

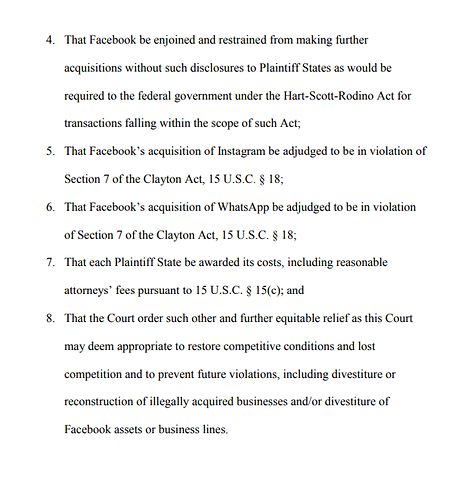

Seems important that they got 48 state attorney generals to sign on. The google antitrust lawsuit was only like 15, all Republican.

Anyone know why the Google suit would be filed by the Justice Department and the Facebook suit by the FTC?

Funny you bring that up, someone I know from the Baltimore poker scene is also offering paid coaching on futures day trading and an alert service when profitable futures trades are available. She cites her poker success (beat 1/3 NL) as part of her bio lol…

Is day trading futures and beating the market a thing people can do after a few hours of paid coaching? That’s how she got into it lol… Seems like pure grift.

Best part, her alerts are available from 9a - 11a in the Standard Room (Slack chat, $100/mo) and from 9a - 4p in the Champagne Room (Premium slack chat, $200/mo).

The agencies negotiated with each other and agreed one got Facebook and the other got Google

Can’t tell if this is a joke or serious, but either way the FTC has to be happy to going after Facebook rather than Google. No one knows who the head of Google is and everyone fucking hates Zuckerberg.

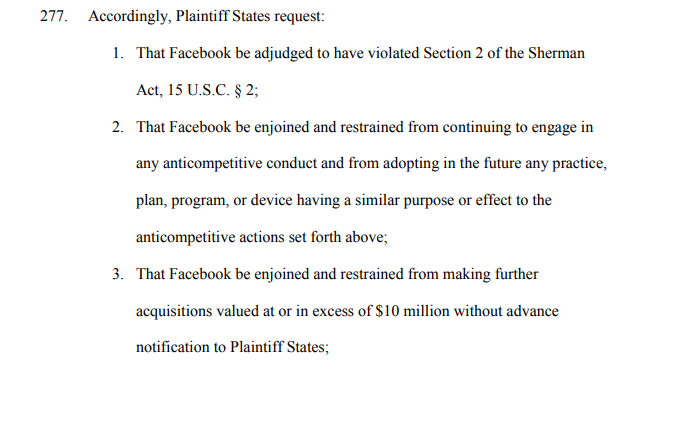

Seems like they’re asking for quite a bit:

Good lord I need to get better at grifting. You could probably program some simple TA analysis into a script that gets sent to the slack chat automatically and just print money from suckers willing to pay for it.

That’s actually how it works. Both agencies have jurisdiction in these types of cases, so they negotiate if something big is coming up. It also helps them not get overloaded because cases like this require large teams.

What they are asking for here is similar to the AT&T case and the Microsoft case from decades past.

Cool, thanks. Do you know if it’s significant that way fewer states signed on to the Google case?