So how many Honda market caps is it worth?

At least 10-20, maybe 100 who knows. If they become the industry leader in 5-10 industries they don’t currently participate in imagine how much they could be worth! DoorDash coin announcement is worth at least 20x.

Thanks, Riverman, for giving me the opportunity to procrastinate from moderately important work that I owe to my coauthors by tomorrow morning!

This is pretty fascinating. The S-1 has some interesting data:

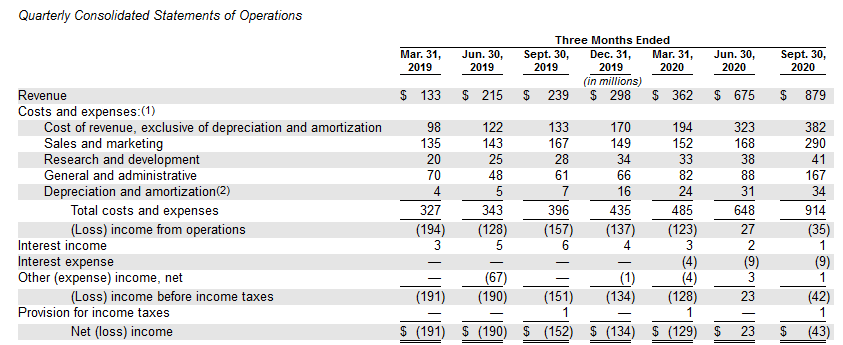

Revenue is much higher than I would have imagined - running at about $1.9 billion for 2020 to date. And this isn’t gross revenue (i.e., total cost of orders). It’s just the combination of merchant and consumer fees, offset by driver fees. I mean, that doesn’t make the company valuable, it’s just generating much more revenue than I would have guessed.

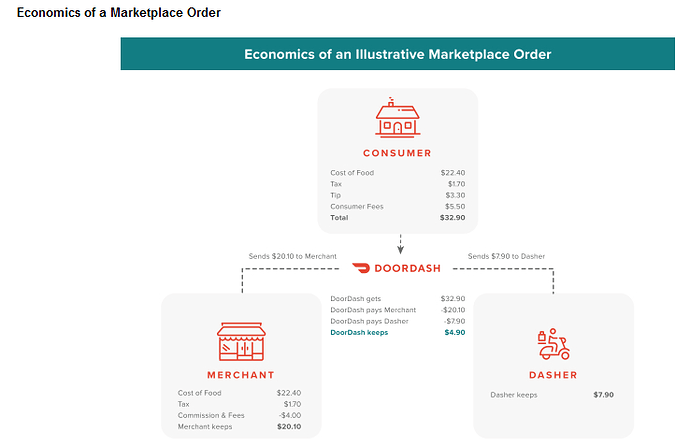

They also have a nice illustration of their unit economics:

Based on their revenue recognition description, I think this transaction would generate net revenue of $4.90, which is a little suprising to me. I would have expected them to report $5.50+$4.00=$9.50 in gross revenue, with an expense of $4.60 classified as costs of revenue (the driver fee) further down the Income Statement. Of course that results in the same net effect, but it changes the apparent margins. I suppose that recognizing the cost of drivers as a reduction to net revenue, rather than as a separate expense, has to do with the drivers’ classification as non-employees. (They have a stupid discussion about whether they’re a principal or agent in their transactions with merchants and consumers, but it’s really dumb and uninformative.)

The appeal to a company like this is that there really isn’t cost of sales in the traditional sense, because again all of their revenue is already reported net of the biggest economic costs (i.e., the costs of food and drivers). So if you were pitching this company, you’d say, “Yes, they’re losing money now. But as they grow their revenue, most of that revenue will flow down to net income because there aren’t the naturally-associated costs for that revenue the way there is for companies like Chipotle or Walmart.” And that would be somewhat true.

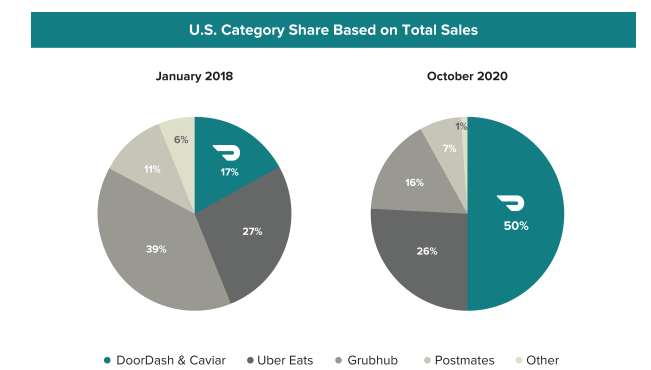

So the question is, how large can they get? Putting aside their accounting revenue, the relevant metric for assessing the industry is the dollars of food ordered. That number is somewhere around $16 billion for Door Dash in the 9 months through 9/30/2020. Apparently that reflects roughly 50% of the current competition.

If they totally take over that landscape, let’s say they’d roughly double their net revenue, going from $1.9 billion to $3.8 billion. Further, let’s say all of that incremental revenue flows through to the bottom line because it’s already net of food and driver costs. That brings them to pre-tax income of about $1.75 billion, so maybe about $1.2 billion-$1.4 billion after tax.

So that’s a P/E multiple of only 20 or so - cheap! (Oops, and I didn’t pro-rate this to an entire 12-month year, so it’s even cheaper!)

I mean, obviously there are some heroic assumptions to get there, and I’m pretty confident that investors at $25 billion will lose a substantial portion of their investment. But at least you can tell a hand-wavy story that arguably supports the valuation, which in my mind distinguishes it from most of the 90s IPO nonsense.

The obvious problem here is the substantial Cost of Revenue and Sales & Marketing line items. I suspect that a key selling point in this company is the idea that increases in net revenue will flow through the Income Statement, leading to ever-increasing net margins. (Like a software company or a royalty-based company.) But those line items are growing right along with revenue, which is a very bad sign for people making this assumption! (In fact, I would argue that the very existence of a “Cost of revenue” line item is somewhat nonsensical for a company that recognizes revenue on a net basis.)

Definitely look forward to watching this one implode.

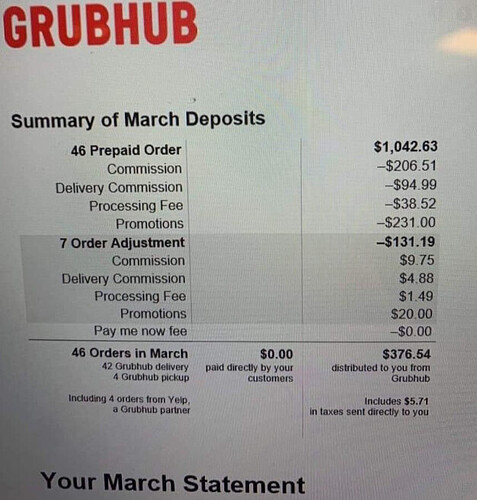

So in short, they’re buying market share with kickbacks and incentives, to obviously and transparently goose revenue in advance of the IPO?

Doesn’t seem great for the long term prospects of the company!

That seems like a fair interpretation.

Oh, hahahahaha, I had read that pizza arbitrage story before, but I didn’t realize it was literally talking about Doordash.

Ordinarily, with a pronouncement like this coming from Riverman, I’d be obligated to go long on DoorDash like a madman. Even though it would have worked great for Tesla, I couldn’t bring myself to pull the trigger there and I can’t do it here either. Someone else is gonna have to take this free money. I’m sure I’ll be kicking myself in a year or two.

I’ll be right about Tesla eventually!

I agree with the Pizza Arbitrage article and some of the spinoff discussion from it. I forget if it was from that article or a Twitter thread discussing it, but the main takeaway that I agree with is:

-For the longest time, Delivery of food was either only available in dense cities where it made sense due to short distance traveled making delivery cheap and keeping the food quality high

-The only exceptions to this were things like Pizza and Chinese food which worked well for delivery and carved out a niche market as being “The Delivery options” for all places except mega cities like NYC, Chicago, SF

-We’re now trying to expand food delivery into a bunch of places with a bunch of food options where it has either failed or hasn’t been proven to be a long term profitable enterprise

-Doordash’s gamble is that adding Smartphones to the mix has changed the economics of food delivery

-Looking at the problem from the 1000 foot view, it’s unlikely that Smartphones really change that much and they still run into the problem of: Delivering food to spread out suburban homes is a bad proposition because you either end up harming the quality of the product by doing multiple deliveries in one route, or doing a bunch of one-stop deliveries which is very inefficient

Bottom line is: Similar to Uber, their business model would probably be very tough to sustain if they were actually forced to pay minimum wages. And food delivery just isn’t important enough to the American consumer to allow the company to pay below minimum wage standards.

I’ll take one for the team.

In the long run we’ll all be dead.

I think another problem is that food delivery is a super hard market to corner and dominate. The brand is profoundly worthless - I couldn’t care less who gets the food from the restaurant to my door. Any random dude on any random bike is fine by me. Also the barriers to entry by competition seem pretty low, and its well known that restaurants actually hate these early mover companies that deliver food. So I would expect “race to the bottom” competition at the first whiff of actual profits.

The one thing going for them right now is that in the midst of a global pandemic the value of delivery services has never felt higher.

paying $17 for a $9 meal is crazy to me. After/if the pandemic ends i don’t see how they can keep up their business model

The problem with food delivery is everyone involved hates you.

Restaurants definitely hate you:

Drivers hate you, because the whole thing has no chance of working if drivers are paid anything close to market wages

And importantly, the end customer hates you because its expensive and the food inevitably gets cold or is wrong or whatever. And they have a moral problem because educated consumers know the restaurants and drivers are getting screwed.

This is a terrible business. Anyone can enter the market at any time and nobody has any actual competitive advantage. The business doesn’t scale well - you cant grow revenue without a corresponding linear growth in costs. They have little to no technology. This is WeWork, food edition.

Consumers are very lazy and literally addicted to clicking buttons on their cell phones.

This is really significant. It allows competitors that are friendlier to the restaurants an access point.

I think in the long run Big Delivery will only work when partnered with other net negative conglomerate dystopian nightmare companies like McDonald’s or whatever. For small businesses like mom and pop sandwiches or local cool taco places or moderately upscale comfort food the delivery model, if there continues to be one, will migrate to restaurant-run collectives or something like that.

Yeah it’s hard to overstate what a huge problem it is to have your vendors, employees (and the people who delivery the food are easily the most important employees of these apps), and customers all hate you. To keep that going you pretty much have to be a legitimate monopoly…

Which makes the fact that all of these food delivery apps are all trying to position themselves as monopolies on something that physically has very low barriers to entry pretty questionable.

Peter Thiel states that you can tell whether a company is a monopoly or not by how they describe their business. A non monopoly will attempt to claim that they are a monopoly and describe themselves as having a very large share of a smallish market (We’re the only Indian Restaurant in X town) in attempt to be valued like a monopoly, and a real monopoly will claim that they are a small sliver in a huge global market to avoid anti trust action (Google only controls XX% of the global advertising market).

This is one of two Peter Thiel takes that I’ve integrated successfully into how I see the world lol.

I agree and hate all food delivery services and just go pick up the food myself instead, but this will all change on a dime if/when someone is able to land a box of Chinese food on my balcony with a drone. The game will be changed forevermore at that point.

Of course, the real problem is Amazon will probably be the one to do it, and then every other competitor will become instantly and permanently obsolete.

Ghost Kitchens with hyper efficient delivery systems absolutely crush the normal delivery apps. We have one in Indy called ClusterTruck that will not start cooking until a driver is on their way and drivers only get 1 order at a time. I get my food 8 minutes after it’s done. It’s always hot, fresh, and reasonable priced at $14 all in. I know they expanded to a couple other cities.

I wonder if there is a space for delivery versions of cook-at-home food, ranging from meal kits like Blue Apron that are shipped via services like FedEx to take-and-bake operations like Papa Murphy’s. That would mitigate the problem of food quality affected by delivery.

I guess I’m ashamed to say that I’m clicking the button and getting a lot of food delivered to my front porch that I never had access to pre-pandemic. It’s expensive, but in the suburbs of a tier 2 city, my options have expanded from pizza and chinese type places to most of the restaurants in a 15 mile radius. I’ll order from a couple places that do their own delivery because I know that DoorDash/GrubHub isn’t great for them, but at least for now, it’s a service that I’m using quite often. Now I hate myself more than normal :(