STONKS!

This book from the guy who brought us the cubit COVID curve remains a work of science fiction

DOW 36k has always been my mythical target to get out of the market or at least pull way back - as I’d have enough to mostly coast to my super cheap semi-retirement plans. I just didn’t expect it to happen this soon.

My recovery stonks - airline, oil, lol Carnival - are going bananas the last few weeks. I’ll be tempted to put my 20% that’s currently in cash in play if there’s a big pull back - which there has to be at some point.

“That’s a sacred number, 30,000. Nobody thought they’d ever see it.”

Riverman!

Just bought a chunk of AMC and RCL (Royal Caribbean). I’m down to 10% cash. yolo

I can’t find any hotel or restaurant stonks that aren’t basically all the way back to pre-covid. Eff that.

I’ve been adding quite a bit of SPG the last few months. I plan to just keep adding, it seems like a heck of a deal at these levels.

That’s getting up there to it’s pre-covid high but might still have some room. I suppose I should do my research and find out what the company actually does before investing in it.

PLAY…Dave and Busters

Even just hanging tight at 60:30:10 since mid to late summer (whenever it was that I gave up trying to figure out this market) has seen unreal gains for our portfolio.

The Tesla bubble has to burst at some point right? Like what in the absolute fuck

Yes, if they ever become the kind of boring company that earns profits and pays dividends. LAME.

Think about it this way. Apple is worth $2T because they have a dominant position in cell phones. If Tesla is able to establish a comparable position in cars and trucks, then that business will probably be worth even more, since cars are so much more valuable. But probably they’ll fail to achieve that goal, so the company will be worth somewhat less than it is now.

I don’t think that even the true believers see this as a possibility. Most people building narratives to support Teslas valuation seem to think that cars are only the beginning, the real money will come from the tech that is developed on the course if making the cars.

The super Elon stans could definitely imagine Tesla dominating the vehicle market, but idk how much those influence those guys have on the market.

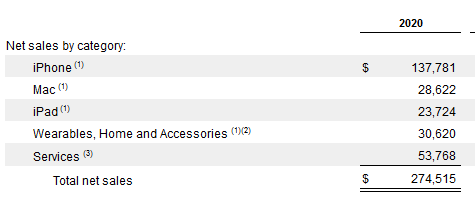

I think this makes the Apple comparison quite apt if you think about the iPhone as being the anchor of an Apple ecosystem that generates lots of affiliated income. Here’s Apple’s product-line revenue:

I think a big chunk of that $84 billion in revenue in the last two rows could be considered ecosystem-driven revenue in the same way that people might be viewing Tesla’s technology potential.

[To be clear, I am squarely in the camp of LOLOL at Tesla’s valuation, just too chicken (or smart?) to try to short it.]

To short TSLA you better be pretty sure the bubble is about to pop soon.