Green stuff has been priced in imo, look at the clean energy and solar ETFs or something like ENPH

Feels to me like there’s at least a chance tomorrow could be ugly. A lot of the most widely held stocks got dinged after hours, the indexes got hit after hours, futures are down… COVID cases hit a new high, Europe is in bad shape with COVID, more and more talk of lockdowns over there and the writing is on the wall here.

No chance of stimulus any time soon, maybe the market has figured that out finally.

If it opens down 1.5% we might not be that far above a panic selloff.

Fuck ya i can get to -30%!

Btw i agree. Not sure if that is good or bad.

Welp, my puts are fucked

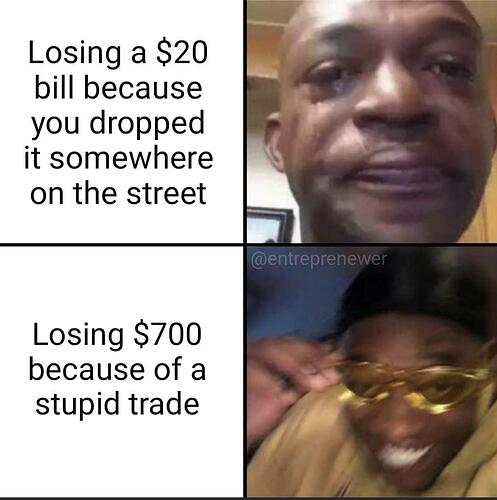

Nothing scratches the gambling itch harder than losing 80% of days. It’s a win win.

I agree 100%. My STONKS plays give me a rush now that I don’t have time to play poker. COVID has given me way too much time to stray from my index funds and do dumb shit too.

I think a panic selloff is both a retired term and a scare tactic to reduce the “mom and pops” bucks from digging into profits.

This isn’t 1999 where folks are staring frantically at their Pentiums screens not knowing the difference between Enron crashing and Microsoft splitting or the cleverly devised housing operation of 08.

Being able to convince enough people that the right move is wrong is important just as being able to know what the right move is.

underrated movie

No this is 2020 where folks buy bankrupt Hertz stock and run it up from 0.82 to almost $6 a share for no reason, where they think TSLA is the most valuable auto manufacturer in the world, and where oil goes negative because morons get stuck holding the bag barrel because they don’t know they’re obligated to go get their oil if they’re stuck with a contract they can’t roll over.

Was March not a panic sell off? Stuff that usually moves inversely all got crushed.

Futures melting

Down 500+ right now. Wouldnt be surprised to see it down 800 at the opening bell.

But, but… the Ministry of Plenty assured us that our GDP was up by a record 33.7%!

I must say, my wacko friend’s reversal algorithm has been running hot the past few months since being launched with zero out-of-sample testing. Yesterday it predicted the exact S&P bottom and exited at almost the peak. This morning it predicted another upward reversal when the futures price reached 3233 points (almost the bottom again), waited for some “confirmation” and entered at 3241. Now the price is 3254 in what could be another STONKS day.

Very small sample size since it doesn’t make many trades, but I don’t entirely rule out that a legit technical indicator might exist and that this guy luckboxed into finding one.

Lol gonna be green by open at this rate, amazing

[ √ ] Stonks

Eh, we’ll see. AAPL is set to open down over 4% and AMZN -1.6%. Retail investors have a lot of exposure to those. The S&P is down about 0.75% though. We may not be as close to a panic sell off as at -1.5% but the ingredients are still there.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

STONKS DRILLING.

wild start of the day, SPY pumped from ~322 overnight low to 329.5 at 9:35 only to drill to (now) 324 in an hour

STONKS