Perhaps the microchip company is really into batteries and space exploration? I hear those types of core competencies on the side can add quite a bit to the underlying value.

TSLA and AAPL down bigly in premarket. The thing that usually pops the bubble is that huge unrecoverable leg down not normally some shift in news. Bitcoin in late 2017 is a great example. It went from 20k to barely over 10k in a matter of days and then a couple months later was 4k.

Obviously we won’t see that kind of move here (well maybe in Tesla but not the overall market) but the triggering point for a move down to more reasonable levels will likely be triggered when/if retail investors get spooked.

Just do a lump sum if you really have a 20 year horizon

TSLA grinding it back as soon as the markets open lol… -8% or so premarket and now back to only -5%.

So I knew the market would tank as soon as I lump summed in a significant amount. It just gave me a one day tease before proceeding as expected.

Man not looking good here, 0 recovery just straight down

On the other hand, prices are now where they were like, 2 weeks ago?

But I’m anchored on yesterday’s close!

haha, i sold nearly all my AAPL and TSLA yesterday at basically their high points. I feel like a winner! Kept a little because I can’t get off of the heroin, man.

CNBC sounds like the realtor in The Big Short.

“It’s just a little gully!”

They’re pumping it as cycling from tech/wfh into leisure, finance and energy. Just a little profit taking, just giving back a little bit of the gains, no big deal!

But there has been plenty of cycling with pullbacks and then shortly after new all time highs. So it’s really hard to say without the benefit of hindsight if this was the top or just another pullback.

yep, which is why I kept some, lol

YTD AMZN is still up 77%. AAPL 64%.

Maybe the bottom doesn’t fall out today but these prices still seem crazy high. I can buy AMZN being worth more, but 77%? And AAPL needs to be selling phones and tablets and Apple TVs, so consumer confidence needs to return, right?

At some point they only have so much market share to gain and so many acquisitions to make.

The fiscal policy of this administration forced money into equities and at some point that bubble has to burst or nothing makes sense. Whether it happens today or tomorrow or next week or in November, who knows?

The trigger could be something rational like mass evictions, or it could be entirely emotional and appear random. A little hiccup like this could cause a huge panic-driven sell off.

The huge influx of retail STONKS gamblers over the past few months are going to be in for a world of surprise when they realize STONKS don’t normally go up 1% a day for months on end. That is the group of people who I think legitimately will trigger the next leg down. Once they take a big hit and the fun and games are over and no more TSLA 500% in a month or KODK 1000% in a day is happening these people will either be broke or move on.

Stocks should legitimately be well off their Covid lows. Both due to the monetary policy/stimulus but also just because USA #194 hasn’t give much a shit about Covid. That being said STONKS being up as much as they are this year makes little to no sense and the stocks driving the huge increases in the indexes are at insane valuations.

Then there is the fact the actual economy is in ruins. We are facing a slowing increase in the jobs numbers. We STILL have almost a million new people a week filing first time unemployment claims. We have a wave of small business bankruptcies coming now that PPP is over. We have a wave of people who have taken a massive income hit with the extra UE drying up. We have an unprecedented disaster of an election coming up. We still do not have a handle on Covid which is causing some of us to still behave differently than normal. None of that should be good for the stock market longer term.

But Dave Portnoy says stocks only go up. And he’s rich.

Also my buddy brought up an interesting point with the $600 extra per week going away about a month ago: anyone who had ~1 months expenses saved up for a rainy day just had to tap out. For some that’s being broke, for others it’s an emergency withdrawal from an IRA or 401k. Next month it’s everyone who had two months saved.

He thinks that’s possibly what caused the selloff today. I doubt it would be enough people to move the market that much, but the second and third level effects could be in play there.

Ultimately if a random piece of news doesn’t pop the bubble (which is most likely imo - it’ll be news of unpaid rents/evictions, mortgage defaults and foreclosures, low consumer confidence, etc), it’ll be REITs reporting their losses and some perhaps going to zero.

CNN had a headline today about 30-40M people facing evictions. That’s gotta absolutely crush most residential REITs, and I actually expect some commercial ones to be hit harder. But some of these REITs I’ve researched are poorly diversified both geographically and in terms of composition (for commercial retail ones).

I’m not informed/smart enough to know for sure, but my guess is that quite a few are at a high risk of going under.

So if nothing else crashes the market, some of the reporting of those financials is what I expect to do it.

I guess there’s a possibility that we bullshit our way through a few more months and can see daylight on the other side and contain those losses a bit, but who knows how many layers of it will have to be unwound with financial tools like credit default swaps and such.

Should they? Given this…

Like I know I know the S&P is only massive companies, but all those unemployment claims and failed businesses mean fewer consumers.

The bottom in the S&P was approx -34% from the Jan/Feb highs. I can buy that we should be above that. But surely our economy will contract a lot this year and it’ll take several years to get it back. So -10% to -20% off that peak seems realistic to me. So maybe S&P 2,800 to 2,900 is reasonable?

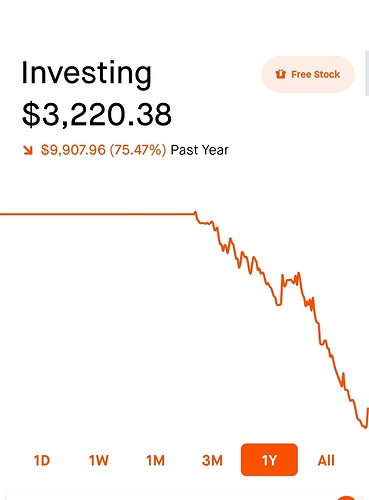

I’ve been buying calls on SPXS (3x inverse SPY ETF) since late April. Needless to say I have been getting destroyed. I will edit in my loss porn here shortly lol. Granted I have made many multiples of this is my tax advantaged accounts on the rebound but it still hurts:

So basically all it took to spook the market was Trump bragging about Dow 29k?

Just had to pop in with this huge LOL for you guys. Someone in my fantasy football league group text made a joke about taking our league money and investing it in cruise ships, air lines, and rental car companies, and the one idiotic trumper in our league chimed in with this

Someone: Airlines aren’t coming back

Trumper: A 30-40% jump will probably happen the moment the FDA approves a drug. Good chance that happens at the beginning of the year. But… I’d wait until October/November after the airlines PPP runs out and they layoff 50% of their staff. Buy that dip and then wait.