Zoom is up $100 premarket after crushing earnings

Isn’t teams the same product and free with Microsoft office?

And 1100 PE (now 1800)

That’s bullish. My new investment strategy is just buying the highest PE stocks.

They’re competing softwares but not identical. Weirdly, our IT team suggests that its easier to install and maintain Zoom on a large number of company devices, even though all those devices already have Office installed already. I know that old colleagues find Zoom easier to use as well.

My company uses WebEx. It seems ok for small gatherings but terrible once you get more than a few dozen people on a call.

And even the accounting on that seems sketchy.

Microsoft buying skype and them not being a factor at all during covid should be exhibit one that nothing they buy is ever going anywhere. Pray for github.

up up and away

I ended up liquidating all the preferred stocks and exchange traded debt that I posted about inheriting a couple of weeks ago. Felt pretty sick about it, but lump summed it all into our current AA today, so we can be sure this is the tippity top of the bubble.

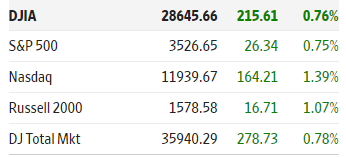

Massive private payrolls miss this AM. Futures are massively green anyways. NASDAQ Futures at 12440 after NASDAQ closed at 119xx yesterday. That would put NASDAQ up over 35% just in 2020. Insane.

They took the tech and put it into Teams and basically ended Skype for business. Teams is pretty big.

Some sobering stats from the downtown business district in DC

“DAYTIME POPULATION DROPPEDFROM 225,000 IN FEB TO 22,000 IN JULY -DOWN 90%.

METRORAIL WEEKDAY RIDERSHIP FROMAPRIL–JUNE 2020 WAS 3%OF APRIL–JUNE 2019 RIDERSHIP

THE RETAIL VACANCY RATE REACHED A RECORDHIGH OF 17.1% IN JULY 2020

DOWNTOWNDC RESTAURANT SALES WERE DOWN 80% IN JULY 2020 WHILE THE REGION WAS DOWN ONLY 52%"

ALL CAPS UPDATE ALERT!!!

It’s long past time.

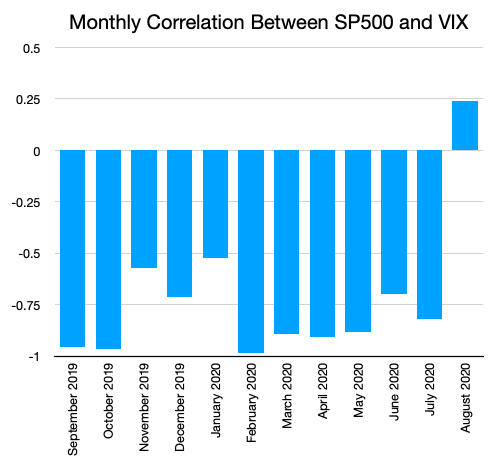

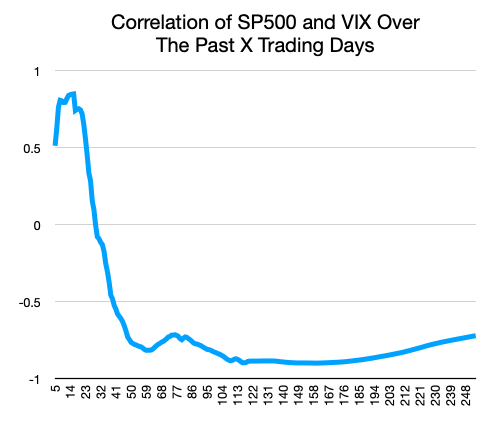

Vix continuing to rise as STONKS continue to surge seems odd. Usually they have an inverse relationship.

This is a curious phenomenon. No idea what it means.

What’s a hands-off strategy to invest a significant lump sum of money I don’t need for 20 years in the current environment without being too sensitive to the timing of the entry. I’d typically just dump it all in (time-in vs timing) but think some sort of cost averaging strategy might be appropriate. Something like X% per month, or X% every time RSI’s dip to a certain level? Then again, with a 20 year time-frame am I overthinking it?

I just went through this exercise with an inheritance and just decided to dump it all in at once. It wasn’t easy pulling the trigger though. But my AA is pretty conservative at 60:30:10 now so I’m less likely to have a huge loss. And I have somewhere between 5 and 10 years until retirement, but expect to keep invested for hopefully 30+ years.

I would be even more nervous dumping it all in if I had an aggressive AA like 80:20 or higher.

Just got called a F***OT on reddit for questioning the $750m valuation of an Australian microchip company that has generated $13k revenue in its 7 years of operation. Love the new discourse in financial circles.