Too late for the money printer go brrrrrr and basket-case US govt dollar to sink against the Euro? I keep thinking I should get out of cash - but then I make like .25%/day on my FXE, which reduces my sense of urgency.

TSLA adds on another $12,000,000,000 in market cap overnight. They are now worth 8 Hondas.

They’re up 438% year to date? Seems reasonable!

P/E ratio 971.06

how is this NOT a bubble how

It’s only up 4 Hondas worth of market cap in the last week on the news of (checks notes) a 5 for 1 stonks split. I’m guessing the morons driving the price don’t understand how that actually works.

Also obviously it is a bubble. Whether or not it ever pops who knows.

bump

They’re going to be so upset when it splits and they own five times as many shares worth 1/5th as much each.

“S&P 500 Hits record high, capping shortest bear market in history”

WE DID IT BOYS

$351,000,000,000 market cap seems reasonable for a company that has to blatantly cook the books to show a profit and even than has a P/E ratio of 971x

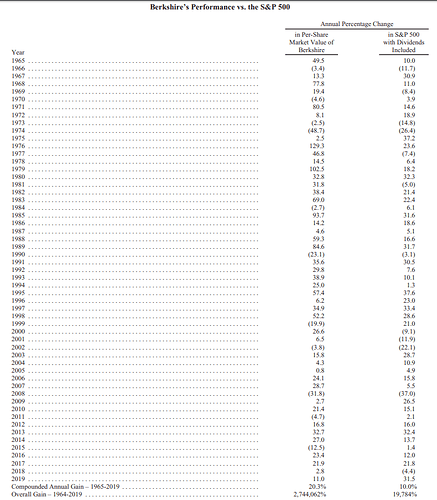

Berkshire Hathaway, an extremely diverse, exceptionally well-managed company, had 2019 earnings of $81 billion (admittedly $50 billion of this was increases in stocks they own, lol accounting) and has a current market cap of $500 billion.

Toyota, with net income of $17 billion, has a market cap of $221 billion.

I’m not saying it’s reasonable, I’m saying it’s hilarious. Just imagining those TSLAQ dudes like toothsayer betting against Tesla and getting crushed as it soars to ever more outlandish levels, well, that amuses me greatly.

And Berkshire owns shit like bottling plants and insulation factories and insurance companies. Profitable but little to no growth opportunity. Say what you will about Tesla, it’s plausible they sell twenty times more cars in a decade than now. Obviously not true of Toyota or Ford or certainly the companies Buffett owns.

My EMH faith was shaken when the stock shot up on the 5-1 split news, but it’s really beyond believable that the stock is up 30% on that (from an already insane level). It’s the 10th most valuable company in the US, not some penny stock! It’s worth considering that there’s insider info leaking out about some positive news that’s not public yet: batteries or self-driving or trucks or something. Hell, maybe they’re buying Honda.

Ford is probably a better fit.

Come to think of it

They could finally get their hands on that Focus fuel-cell tech!

Honestly, the best bet is probably to buy the cheapest OK car company you can find, send all the QA and production people over to Tesla, and then shutter operations. Or just sell the shell to a vulture fund or something. Maybe what I’m getting at is that Tesla probably shouldn’t buy a traditional car company and should just hire some experienced people?

I like to pop into BFI every now and then and see how the financial wizards over there are holding up.

I am a bit shook tbh. Currently my 1 2021 tesla put is down 400$. Unrecoverable losses.

over the huge runup i sold out of a good chunk of my jan 2021 puts for losses ofc. still feel like it crashes back down to earth sometime but who knows when and who knows what “earth” is? seems not great to buy options more than a few weeks out. puts when stock was at 1400 seemed like a good idea, but now they’re shot a week later bc lol meme stonk went up 500 on nothing.

But we do have some winners:

Sold all my stock at 1900. I’m a bull and didn’t think it would hit these heights unless battery day was ridiculous.

Will look to get back in at some point.

It is truly insane that they aren’t using their stock as currency to buy firms with cash flow.

Tesla is much more likely to not exist in 10 years than to be making and selling Toyota levels of vehicles.

Why would Tesla do this? If a shareholder wants to own a value stock, they can sell their shares and buy something with cash flow. If Tesla were to buy Ford, they’re saddling shareholders with an investment they don’t necessarily want, and potentially distracting management from the core business. It’s OK for Berkshire because Berkshire is a PE fund, but Tesla is either a tech company or a manufacturing company.