@Danspartan how old are you and what’s your current stonk/bond ratio? There are people on this board way smarter than I when it comes to investing, so I’d prob wait for them to chime in, but if I was going to move away from stonks I’d just shift those monies to a vanguard bond fund and then move them back when you think the time is right.

But can you find some doofus on Robinhood to buy your overpriced GM stocks later?

Thank you Goebs80

I stuck to my guns and sold a bunch of my DGX when it hit 122 again. I still have some in my brokerage account that I can’t sell due to short term capital gains hit.

My portfolio is now about 70% cash with most of that in FXE (like having it in Euros basically).

- Wife is 9 years younger and will work after I hit retirement age though I plan to consult part time. I have to assume I’m hitting 85+ based on family history. If possible I’ll delay drawing SS. as long as possible.

I’d have to look among funds but I’m over 80/20 stocks (some funds are blended). Prolly a little under 900k based on current stonks. All 401k except for a tiny pension and wife’s smallish IRA.

Since I basically started over in 2005 when I got divorced (I kept 90k retirement she kept the house), feel like I’m not doing too bad.

TSLA coming back to earth a bit up less than 6% now today after being up 13% earlier.

I have a theory that you can never time the top of a bubble, but you can time that first massive fall where the bloom is finally off the rose - like when the NASDAQ dropped 1k points in a day in April 2000. I knew the dotcom bubble was over at that point.

You just have to be willing to eat that first fall.

Of course if this was tuplipmania the bubble could literally out-survive you.

Most definitely. The old adage about the market staying irrational longer than you can stay solvent is true. I am not sure the whole market is in a bubble so much as a handful of companies some of whom are large drivers of the entire indexes. AMZN seems like the obvious one that while they are a large, profitable and growing company but have little chance to ever pay off their current valuation.

Then you have some stocks that are what the kids call “meme stocks” and are essentially this years version of 2017 shitcoins mania. TSLA and NKLA seem like obvious bubble stocks at this point but there were people saying that about TSLA years ago and they probably long ago went broke trying to figure out when the collapse was coming. TSLA has no good path to making tons of money (and especially not being worth it’s current valuation) and NKLA literally has no product or production.

Yeah TSLA for sure. Which is why I’m saying the best strategy might be just to own it, wait for that one giant drop, then sell. And then if you want to get crazy with puts and shorts it might be a good time.

Trying to time the top (like I just did selling my AMZN) in a bubbly stock or market seems next to impossible. But I feel like knowing when the bloom is off the rose might be doable (70% of the time it works or w/e).

Getting a kick out of the BFI thread and TS loudly insisting that he’s been right all along about TSLA stonks.

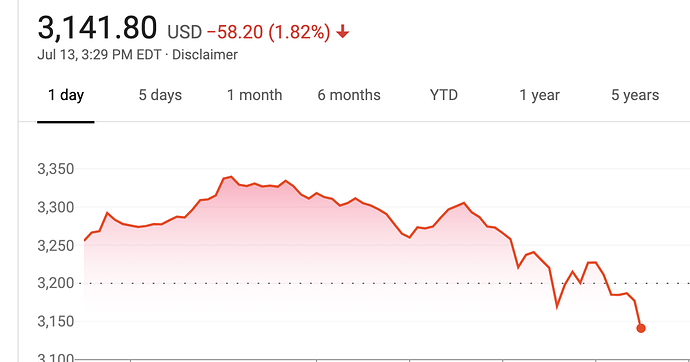

AMZN having quite the day - 6%+ swong.

And now it’s down another 2% almost in like a minute. It’s now below where I sold a few days ago. I can stop kicking myself I guess.

wild day, wonder if this is the start of the next leg down

So Tesla was up 16% today and finished down?

Good reading on the WaPo article this morning calling out the market. I always enjoy hacker news takes.

The one constant in bubbles seems to be there always has to be some totally new element - dotcom stocks, MBSs, bitcoin, maybe this time it’s all the robinhood kids - although I doubt they could drive the overall market. But maybe they’re triggering a bigger FOMO in the wider casual investor pool.

Efficient market baby

I think wallstreetbets subreddit is a more likely reason than RH traders alone. That is like seeing directly into the inner sanctum of the insanity driving the markets right now. People regularly buying 5 and 6 figures with of final day options and the like. For anyone who didn’t experience crypto in late 2017/early 2018 the nonsensical mania is exactly the same.

What the hell was that at ~ 11 AM?

An portal to hell briefly opening up?

Do they talk about MSFT much? I like MSFT because it’s steady and boring and doesn’t seem to get as much of the TSLA, FAANG, etc. manic-ness.

the worse things get, the more a bailout is expected and bigger, the more stocks go up