Honestly that’s the one I’m “proudest” of. I bought it when it was in the mid $100s, rode it through the E. coli stuff, and here we are.

If you want to divest, the optimal situation would be to tax-loss harvest (or better yet have already tax-loss harvested) and and use the losses to offset the capital gains from sale. Then you can invest in something you feel better about right now.

I don’t really have any deep thoughts about the individual stonks themselves. I nearly never invest in individual stocks.

yeah, i was thinking of moving to a fund (index or bonds, even), I just need to hunker down and do the research.

Research is for donks (not really, but kind of).

Stocks - Vanguard total market

Bonds - Vanguard total bond

How you distribute between the two is depending on things like age, risk tolerance, rest of portfolio, etc.

Picking these over any other stock and bond funds is at worst a small mistake and likely far better than anything else you might choose to do after your research.

If you want to keep it super simple and want a portfolio that is risk adjusted to all ecominc conditions (other than complete WAAF economic collapse), you could do:

SPY 25%

TLT 25%

GLD 25%

Money Markets (Cash) 25%

Historical returns 6-9% which is less than equities but I sleep well at night. In 2008, this portfolio lost 2% against ~50% equities loss.

You rebalance when any position falls below 15% or exceeds 25%. Minimizes trade fees.

It’s called the “permanent portfolio” if are interested in researching further. Purists advocate holding physical gold rather than GLD but physical gold creates hassles that I’m too lazy to deal with.

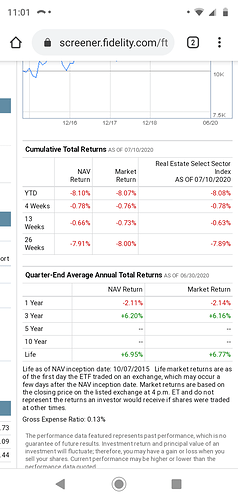

In reviewing my portfolio last night, I realized that right before Christmas I bought XLRE (passive RE SPDR). Its performance is shown below:

It comprises just 3% of my portfolio. I’m wondering if I should still dump it before shit gets worse for REITs.

Question for the stonks guys here, especially the ‘don’t buy individual stocks’ crowd:

Is there a consensus opinion on MPT and roboinvesting?

Along these lines,

I’m being super smart and will definitely be rich one day by just maxing out my employer match + a little extra every two weeks into my Vanguard 2050 Target Retirement fund, and never watching the news, right?

Like, definitely smarter than taking that same amount of money I can allocate for retirement and hiring an actively managing broker to make picks. Or doing my own research and GAMBOL

…Which is all exponentially smarter than not saving, now that I’ve finally decided to grow up and get serious and start saving, since I started late in my early 30’s

Right?

I will say it’s refreshing to read through this and be like “oh cool, AMZN doubled since January? I didn’t make that call, but it’s cool, I WIN”

TSLA going to the moon? Gravy, I got a piece.

FAANG kicking ass? Sweet, more for me

Right on all counts imo.

Berkshire Hathaway apparently repurchased about 5 billion worth of stock recently. About time.

TSLA more than double its value since Musk described it as overvalued. Genius marketing.

Tesla market cap now >$300 billion

Tesla 2019 net income: -$862,000,000

STONKS

I read someone estimates their EPS this time around at $0.50. Bullish.

General Motors market cap: $35 billion

General Motors 2019 net income: $6.5 billion

AMZN gonna go to $2T market cap with 200 P/E ratio.

At least they actually have earnings

Welp… Fucking STONKS!

I understand the arguments (which I think are correct) about interest rates driving the stock market but what is happening especially with tech stocks seems a lot like like a FOMO bubble to me. I have had several people that I would have bet a lot of money never owned a stock in their life wanting to talk to me about their stock portfolio and all their shares of TSLA and the like that they had bought. Will any of that matter? Who knows.

Cross Post from DJT thread…