So perhaps a newb question here. How is it decided what time/day earnings get reported? BSET is supposed to report today, and the last couple of quarters they reported before open. They haven’t reported yet, so I assume it’s coming after close. Is that a decision they would have made way in advance, before knowing their numbers, or should I be concerned that they’re trying to take bad numbers out with the trash after close on a holiday weekend?

My understanding of Tesla is they’re following the Amazon plan right now where they’re dumping any revenues directly back into the company with things like their gigafactories that cost hundreds of millions and once they’ve finished setting up all their logistics infrastructure they’ll be able to flip the money printers on. I can’t imagine them ever actually being as valuable as companies that sell millions of cars per year though.

The company decides what time/day they release earnings. They don’t actually have to put out a press release at all, in fact. Their only requirement is that they file their quarterly and annual filings with the SEC within 40-45 days of the fiscal period end (quarterly) and 75-90 days (annual reports). Many companies host a conference call with analysts on the same day the earnings press release is issued; the timing of these calls is obviously set well in advance of the press release date.

For firms that publicly schedule their earnings announcements in advance, there is evidence that firms delay their press releases (i.e., schedule a longer lag between end of period and the dislcosure date) when they have bad news to report. And obviously when there’s a last-minute change in scheduling, that’s bad news.

For a company like BSET, there’s also the weird issue that their fiscal calendar isn’t constant over time. Rather than operating on 365-day fiscal years, they (and other retailers) operate on 52-week years. A consequence of that is that every 5-6 years, they have to catch up by reporting a 53-week year, which makes year-over-year comparisons more difficult and makes it harder to predict the earnings announcement date. It looks like BSET’s 53-week year was last year, so this year’s results are going to look mechanically worse by comparison. If you believed that BSET was traded by a bunch of absolute morons, you should short their stock prior to the earnings announcement and then sit back and laugh when people are surprised that their year-over-year YTD revenue and earnings declined because they went from 27 weeks to 26 weeks in that six month period.

There’s a niche group in academic accounting/finance that likes to argue about whether firms actually do try to schedule bad news releases for Friday afternoons, and whether that successfully fools investors. Regardless of what firms try to do, I’m pretty skeptical that it has any meaningful effect on stock prices.

Alright, thanks! This one’s been weird because a lot of places had it listed for 6/30, but they always seem to report on the first Tues/Thurs of the next month. On 6/30 Schwab updated the date to 7/2, but BSET has never announced a call or a time of day. It doesn’t appear that they usually do calls, anyway.

I expect them to beat projections, but still to report losing numbers. The estimate is -0.58 per share, I’m expecting more like -0.10 per share. But the fact that they didn’t report before open as they did the last couple of times does concern me.

I just keep checking the EDGAR search tool for a new 10-Q, I assume I’m correct that it’s the place to look for this? (I’m also checking their Investor Relations site for a press release, but I assume the 10-Q will go up first.)

The 10-Q is the mandatory filing, but most companies put out a less-formal press release well before the 10-Q filing summarizing their results.** That press release would be posted on the company’s website and would also have to be filed with the SEC on a form 8-K. You can find Bassett’s 8-Ks here:

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000010329&type=8-k&dateb=&owner=exclude&count=40

Here’s the filing with their prior earnings announcement:

https://www.sec.gov/Archives/edgar/data/10329/000143774920006847/0001437749-20-006847-index.htm

You want to be looking for 8-Ks with the following classifications:

Item 2.02: Results of Operations and Financial Condition

Item 9.01: Financial Statements and Exhibits

**Taking a quick look, it seems that Bassett is in a group of companies that issues their press release (and 8-K) on the same date that they file their 10-Q. I believe this is the minority, although the percentage of firms that does this has been increasing in the last several years.

Awesome, thanks. I didn’t realize I was looking for an 8-K, I thought I was looking for a 10-Q. Looks like the info in the 8-K from Items 2.02 and 9.01 are both in the 10-Q, but could be posted first in an 8-K.

Also based on the “time accepted” on the SEC site, it looks like they went up during the trading day last time, so I’ll keep a close eye on it today. I set up an alert for it the other day, too.

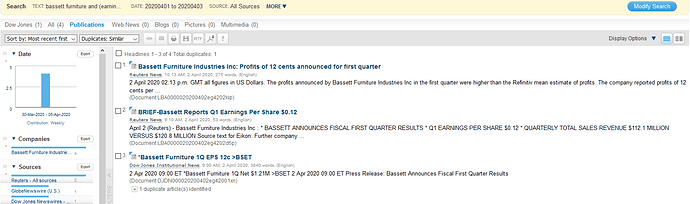

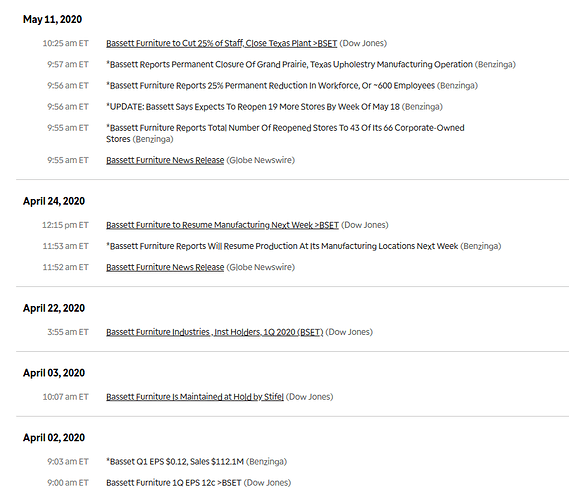

No, you shouldn’t rely on the time accepted on the SEC site. Firms aren’t required to file simultaneously with their press release issuance, nor does the SEC necessarily process everything immediately. When I look at the actual newswires from the prior earnings release, it looks like it came out at 9:00am:

Edit: LOL, you can’t see that at all, but the item at the bottom is stamped 9:00am.

Man, I could talk about this for hours.

Where’d you run that search?

I find it all interesting. So far I’ve been doing well picking value investments, but I could just be running hot over a small sample size obviously. Never the less, I’m continuing to learn more and this kind of stuff seems to be somewhat important to understand. Earnings reports can really move a stock, so if you’re taking significant exposure to individual stocks it seems like you need to be on top of when the information is coming out and be able to respond quickly.

My university account on Factiva. Assuming you have a brokerage account, I would expect that you can get news feeds there. In my Ameritrade account, I see this:

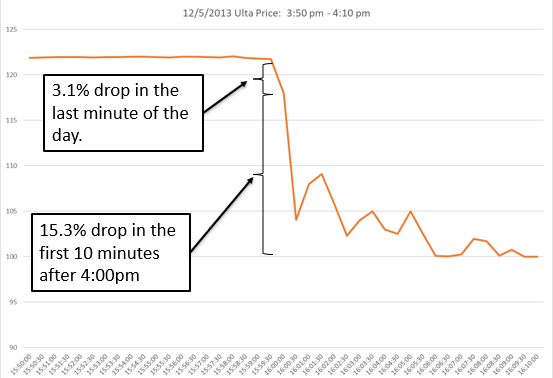

Earnings reports are the most important source of information for investors. (I am biased, as most of my research studies earnings reports.) But I think you’re drawing the wrong conclusion. You absolutely do not need to be on top of when the information is coming out because you will NEVER be able to respond more quickly than automated traders and institutional traders. Here’s an example from a presentation I gave a while ago:

This is a major quarterly earnings announcement from Ulta. The press release was issued precisely at 4:00pm. There was a 3.1% drop in the stock price in the last minute of trading because that last minute has an auction process that overlaps with 4:00pm by a matter of milliseconds. In the first 10 minutes, there’s a 15% drop in stock price. But the most interesting thing is that most of that drop happened in the first 30 seconds after the release of that news.

So my advice:

- Don’t trade individual stocks

- If you do trade individual stocks, do not pretend that you will ever have a timing advantage in obtaining, processing, and acting on news.

As toothless as enforcement currently is, it’s worth remembering that securities regulation (was) is an actual thing that makes America different and good.

So how does that work, there are automated algorithms that are able to input and process the information immediately?

BSET is by far my biggest position in an individual stock, and it accounts for like 6% of my portfolio and 2% of my net worth. So I’m not doing anything too crazy with regard to individual stocks. The most speculative thing I’m doing is buying puts on individual stocks, but that’s not something I plan on doing outside of a black swan event, and the biggest of those is about one-half of one percent of my portfolio.

I have no idea if they will or not. I’m not a Tesla bull or a serious analyst of Tesla stock or anything. I’m rooting for them to succeed because if they win then electric cars win and I want electric cars to be a thing. If Tesla goes down in flames that’ll delay electrification significantly. And then I’m also rooting for Tesla because idiots like that tooth sayer guy have been saying Tesla is doomed and going to zero since the stock hit 200 for the first time. It’s just funny when a whole community develops with a strong belief like TSLAQ and then the real world just shits all over them. It’s like watching a years-long personification of the wide world of sports agony of defeat clips.

I mean I agree TSLA’s stock price seems too high. But it seemed high yesterday too. And it’s going up today because a 5% year over year decrease in car deliveries is very good considering the covid nightmare that spring was, and that’s news today.

I would say that the causation is backwards here. Tesla will go down in flames (meaning, be worth way less than $200B) if electrification is delayed significantly. As a thought experiment, if Europe bans or prohibitively taxes the sale of new gas-burning cars, what car are you realistically going to buy if not a Model 3/Y? A Nissan Leaf?

Tesla’s business plan is explicitly predicated on gas-powered cars not being ecologically sustainable and building around becoming the dominant post-gas car company. A $200B valuation makes perfect sense if you believe they can execute on it.

So how does that work, there are automated algorithms that are able to input and process the information immediately?

Yes. Every press release or news item about a public security is instantaneously swept up by algorithmic trading shops, parsed by AI, and then the bid/asks are adjusted to reflect the estimated impact of the news. This all happens faster than it takes your brain to look at the earnings number itself, interpret what it means, and remember whether it’s better or worse than expectations. (Forget the process of opening the release, and scrolling down to the number. Just assume it was flashed in your face the instant it was available.)

That’s true but I think that it works both ways. The success of electric cars feeds on itself and builds the electrification narrative. The more cars Tesla sells and has out there the more people accept and want electric cars.

Europe isn’t going to ban hybrids. Toyota is already phasing out non-hybrid options over time pretty aggressively. Honda could go that way if they needed to. Certainly Toyota alone would be well positioned to vastly outproduce Tesla in that market. I’m sorry they are just way way way better at assembling everything but maybe batteries than Tesla.

There’s no case for Tesla at 200B. None. It’s just an extremely inefficient market where there’s a smallish supply of shares being traded back and forth rapidly by a large number of different players who are all wildly speculating. The longs are betting on how high it will rise before the balloon pops and the shorts are betting on when it will pop. Both groups are idiots who are being separated from their money by the insiders and the HFT’s arbing their trades.

Hybrids seem like a dead end. Lugging around an entire engine just so you can skimp on battery size only makes sense when batteries are really expensive.

It’s just an extremely inefficient market where there’s a smallish supply of shares being traded back and forth rapidly by a large number of different players who are all wildly speculating. The longs are betting on how high it will rise before the balloon pops and the shorts are betting on when it will pop. Both groups are idiots who are being separated from their money by the insiders and the HFT’s arbing their trades.

How is that different from any other stock?

Batteries ARE really expensive, or the capacity to build them is anyway. The reality is that the gap between a hybrid and a model S that is charged by coal power on emissions is not super large. Toyota is really really good at making hybrids and making them cheap… meanwhile Tesla has massive production quality problems and there’s absolutely no reason to believe that they can scale up to sell enough cars/batteries to be worth 200B without hitting several more major bottlenecks, each of which is a discrete risk to that valuation.

I’m sorry dude but any view of the future that has Tesla making as many cars as Toyota does today is at best highly uncertain… and it’s priced like it already happened.

If the bull case for Tesla is they are going to totally change the game or sell batteries or whatever the fuck, then a quarterly report where they (checks notes) sold less cars than the same quarter last year is not really relevant to the alleged investment thesis.

This company has yet to turn a profit and more importantly couldn’t do so if it needed to. The company is worth $0.