I don’t think so. The types that choose to manage money for a living are emotionally invested in being able to outperform cash. They literally couldn’t live with themselves if it meant staying in cash for the long run.

This market isn’t nuts. It’s trading at 20x forward looking earnings which is historically high, but not when adjusted for interest rates and inflation being so far below historic averages.

When the risk free rate is less than one percent, 5-7% from stocks looks pretty good if you’ve got the runway to ride out the volatility.

Sure? I’m just saying that that backstop seems to exist and as far as I can tell the Fed can buy whatever corporate bonds they want to prop this sort of stuff up without the need for any Congressional approval. Whereas in 2008 they’d have to pay the mortgages of poors if they wanted to prop up CDOs. Which Ben Bernake was all ugh, I’m not paying those poors’ mortgages. Gross! But bailing out corporations is more the Fed’s speed.

Yeah I agree with this, but I think the issue is that forward looking earnings estimates for publicly traded companies might be too optimistic given the current economic situation. As Covid burns through the population with no vaccine it’s hard to imagine consumer confidence is going to remain super high.

But whatever, I don’t speculate one way or the other. The two things I know (structural pressures on stock prices are upward but the risk of a panic selloff are high) don’t help in short term forecasts anyway. Both of those things are standard operating procedure for the stock market anyway just exaggerated in the current environment.

Right. I’m not disagreeing with you. Just saying once again it’s corporate socialism where I get to keep all the profits on my risky bets, knowing the fed will bail me out if I lose.

Isn’t that just another way of saying “A is more attractive than B”?

Sure. But the upside is that it doesn’t seem too likely to lead to any financial collapse like in 2008.

Ya I’m not sure how accurate forward P/E is when a huge percentage of companies have pulled guidance and likely won’t be as profitable going forward as they would have been.

Yes and no. What @Riverman is describing in pretty standard valuation

My division usually makes like six or seven million bucks a month. Last month we made 250k.

I swear 10% more gain and I’m pulling back and maybe going to 2/3 cash. Which probably means there are a lot of people thinking like me right now, and I should pull back now.

This is just repeating @bobman0330 and @Riverman, but I think the way that bonds are discussed is so much healthier than the way stock prices are discussed.

For bonds, no one gives a shit about the nominal price - if you want to assess a bond or compare two bonds, you talk in terms of yields (i.e., forward-looking returns). So there’s no sense of “this price is unrealistic high”, it’s just “the expected return on this bond is pretty low”. But you need a benchmark for “pretty low”, which is why you talk in terms of credit spreads - the extent to which the bond yield exceeds the treasury yield for the same maturity. Now you’ve got a simple measure that gives you a relative attractiveness of the bond - the excess yield relative to a risk-free bond.

Even though things are more complicated, I think it’s helpful to think in the same terms for equities. If you take a model of expected future earnings and cash flows, what is the forward-looking return implied by current stock prices? You’d then compare that yield to alternative available investments to see if the relative yield compensates you for the risk.

If you go to Aswath Damodaran’s website (Damodaran Online: Home Page for Aswath Damodaran), you’ll see that he does this. His estimate as of June 1, 2020 is that stock prices imply an equity risk premium (return in excess of the risk-free return) of 5.35% assuming the following effects of COVID:

COVID ERP computed with 25% earnings drop in 2020 + 80% recovery by 2025+ Lower % returned in cash flows

Now, you can argue that his COVID aren’t sufficiently negative. But if you think those are reasonable approximations for the aggregate public market, then you’re looking at an expected risk premium (analogous to a credit spread) of 5.35%. That’s a perfectly healthy risk premium, and entirely consistent with prior prices and returns.

So it’s hard to see the argument for going to cash now and earning ~0% unless you have a strong reason to believe that aggregate earnings will be substantially worse than what he’s projecting.

Or unless you think that a second wave will present a better buying opportunity, right?

Well, sure. You can even expand that to say that will present a better buying opportunity.

Right. Thanks! That was a serious question and not a snarky rhetorical so I appreciate the insight. I get that this is the sort of thinking which causes people to lose out on growth, but I’m just making sure I understand the concepts.

Yep.

Problem is, if it plays out like the housing crisis, you may not be able to exit your position and take your win.

Yeah Burry was saying we were in an index bubble already. I think he said that late last year.

Buffet does not seem to be currently suffering from this underlying condition.

I mean if the Fed is literally already buying CLOs then the taxpayer is just going to bail out Wall Street again if they collapse, but this time without a noisy bill in Congress.

Great system, if you can get it.

A 10% increase from present means new ATH on the S&P.

Does a 25% earnings drop in 2020 factor in a second wave either causing another round of shutdowns or economic slowdowns from people reducing their consumption and staying home? (Or a combination of both… Seems like the blue states will almost certainly all end up shutting down again this fall/winter at some point, or never reopening all the way. The red states may not, but when the bodies start piling up people will probably make different decisions.)

Ok.I’m doing some “re-balancing” out of most of my US index funds into all intl and emerging markets funds. I know if the US goes down we drag the rest of the world down, but maybe not as bad.

If a huge crash happens while half my money is in “pending” mode or I’m dawdling to buy into those other funds, well that won’t be too terrible.

I can’t decide where I stand on Berkshire. It seems to be largely a proxy for the DOW. There are some days it does better or worse, but averaged it seems pretty similar.

A couple of things:

-

It looks like a 25% drop in earnings that only recovers 80% in the next 5 years. So that’s a pretty substantial sustained negative effect. I’m not sure he explicitly takes into account the possibility of a second wave, but this isn’t a projection of a simple one-time drop.

-

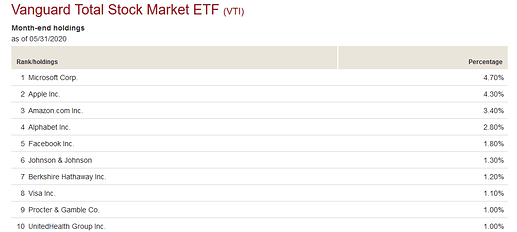

Echoing an earlier post I made in this thread, I think people are significantly understating the disconnect between firms that are most directly and visibly affected by the virus and the firms making up the bulk of the market. Movie theaters, gyms, restaurants, travel and leisure are all very much getting killed. But those aren’t the companies making up the public markets:

Here you’ve got 10 companies making up 20-25% of the market, and I’m not sure any of them are terribly damaged by the virus or the associated shutdowns.

I knew I shouldn’t have gotten back into all those index funds. Now I’m getting “potential roundtrip violation” for buying then selling in less than a month.

IIRC this is some outcrop of abuse in mutual fund trading by institutional investors - which of course only ends up screwing over individuals.

So I sold all my Berkshire and a couple of index funds which makes me about 30% cash at the moment. If the market doesn’t crash in the new few weeks I’m going to move that into international funds or stocks.

Is there a Euro equivalent of Berkshire I can move in and out of w/o all this roundtrip BS?