S&P market cap is about 28 trillion, not billion. The fed stimulus is nowhere near that significant a chunk of the total market cap. Isn’t it something like 1-2 trillion? (At one point they had announced they were prepared to inject 1 trillion and then they didn’t even have to do it because the market responded just to the announcement that they were prepared to do it. So it’s hard to figure out how much they’ve actually injected.)

I assumed he meant total stimulus (fed and government) as I remember a number around 6tn being cited.

Yes you’re right its trillions, that’s a typo.

Correct.

No doubt the unprecedented amount of stimulus is propping the market up. That being said isn’t the market in kind of a bizarro catch-22 right now? If things truly do follow the best case scenario and let’s say there is no second wave here and we have a vaccine ready by the end of the year then that means no more stimulus for anyone. It seems you would still have all the economic damage to clean up for a couple years minimum as transitioning back to closer to full employment isn’t a snap your fingers proposition most times.

On the other hand if we get a worst case scenario or even just one of the likely bad ones like a second wave there might be more stimulus but the economic cost of things getting so bad we had a 2nd shutdown or widespread fear/death would be immense. Add in the fact most US corps are global and this could be happening all over the world to varying degrees for a long time and it is hard to see huge chunks of the S&P 500 like Amazon being worth P/Es over 100 in those scenerios.

Now I suppose you would argue the market can’t lose in either scenario just as easily as it can’t win. But I don’t see any scenerio where there aren’t long lasting negative consequences to the economy from what has happened over the past three months. Are stock prices supposed to reflect the value of the underlying companies or not? Having a huge percentage of the population being more economically insecure today than a year ago will eventually have an impact.

And as I said back in early April if it is as easy as just printing 10T and saying some magic words to fix the economic fallout of all of this then LOL at the entire economic theory and monetary policy that has been used for the last 100+ years.

Ahh, ok. I was talking about just what the Fed has injected directly.

I think the missing ingredient in this analysis is that in 2020 corporate profits do not depend on a healthy economy and vice versa. It seems insane, but the system is a totally broken kleptocracy with the top 5% selling out their values at the behest of the top of the top 0.1%, at the expense of everyone else. The US political and legal system is a wealth transfer system now, and the market reflects expectations about wealth transfers to large corporations, NOT future growth expectations.

I don’t disagree with you but doesn’t Trump probably being more likely to lose than 3 months ago threaten to at least slow down the rate of wealth transfer? I’m obviously under no illusion that Biden is anything other than a bought and paid for stooge but Biden’s base should keep him more accountable than Trump’s certainly.

I also don’t think if we have 10% unemployment still in a year with ATH stock prices that there will be much of an appetite for more corporate freebies but I might be naive there.

Lastly I disagree that a company like Amazon won’t suffer if we have large scale economic problems for the next few years. Amazon pretty much thrives on suburbanites who are probably pretty likely to take a large financial haircut if the economy stays bad for any length of time. That segment is all upper-middle class middle management types that are going to be some of the jobs that are expendable in a longer downturn.

Who’s gonna stop them?

Maybe no one? Like I said I might be naive but once people realize this is likely going to be a long slog rather than a quick recovery I think people will turn on the corporations like they did in 2009. A lot of people think they are about to get that call to go back to work any day now. A lot of those phone calls won’t be coming. I think we could see sentiment for giving more trillions to the people who already have the trillions and are doing just fine really shift as a result. Even a simpleton can understand they got screwed when the corporations got all the benefit of the bailouts AGAIN and all they got was a measly $1,200. That may not fully come into focus until they realize they are now unemployed for the foreseeable future.

When you really think about it, it is pretty sickening how many “good” jobs really just enable people with hundreds of millions of dollars or more to vacuum up even more.

These are great points and I’m not convinced that I’m right and your wrong. Obviously I hope that you’re right!

I don’t think we fundamentally disagree by much. I completely agree that it is a rigged game and that lol STONKS are not a good proxy for the economy. That being said how wide can that divide between the working class and the ownership class get? There has to be a breaking point there somewhere. If we see widespread unemployment and underemployment with the stock market at ATHs and the rich living it up I would at least hope that pisses a lot of people off.

Unfortunately I am not sure I trust Biden to beat that drum.

Right. Unfortunately I think history tells us that structural inequalities can persist for quite a long time. My pessimistic instincts are that it requires something like a political revolution. Bernie could have been that, maybe AOC will be that.

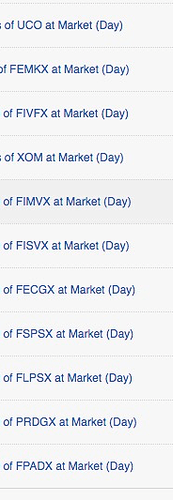

Ok YOLO - my rebalance out of those few stocks I had is complete. I put my money back in most of the mutual funds I had before - trying to emphasize international. And I doubled up my Exxon which still is less than 5% of the portfolio. Feels weird to be basically back to buy and hold but like I’m taking a massive risk.

I was hoping the market would muddle for a couple more weeks while I watch the covid #s. But if it’s just gonna be stupid, I don’t want to miss the train leaving the station.

I also still hold huge chunks of BRK.B, DGX, and smaller chunks of AMZN and MSFT. The last 3 seem to fall the least and bounce back the quickest - except for DGX (Quest Diagnostics) which has had its own rollercoaster ride.

I put the Roth in UCO - a leveraged long oil ETF. The Roth is less than 1% of my portfolio - but we’re gonna see if we can get a quick double up or two - and try to run it up to a nice amount to have free and clear. I probably should have bet against the market as a hedge. But it’s not like it would make a dent in my losses if the market tanks again.

I am currently about 8% above my previous peak in Feb before the market started tanking. If and/or when the market fully recovers, I’ll probably end up gaining about 40% since Feb. Market timing ftmfw. I got really lucky in the timing, and in that small basket of stocks leading the market’s upswing (DGX which I had weighted heaviest, is up 55%). Now if the world would ever go back to normal so I can quit my job and enjoy my money.

Up another 2%! STONKSSSSSSSS

The more certain I am that we’re all gonna die the higher the market goes!

BUY STONKS! DIE RICH!

Good thing MB doesn’t read this thread.

It’s still a pretty small amount. Just seems like there’s a lot of upside if oil/gas demand returns to normal.