I looked up Groupon yesterday just to see if it was still alive. Their stock is at like 1 after trading around 30 in the early days. News blurbs about yet more layoffs and bad going to worse with covid. Market cap? Still $650M.

At this point the market puts its fingers in its ears, goes LALALALA and way overreacts to literally any positive news while barely reacting or just not reacting at all to more/bad news.

I’m re-thinking my bond strat and maybe getting back in because like in politics, “lol fuck you” might be an unbeatable strategy.

I mean this is true but the real question is can the optimism last long enough to get to a vaccine or more reliable cure? I am a firm believer that the situation both with Covid-19 and the economy is quite dire but reality doesn’t matter if people aren’t willing to believe it. I got sort of lucky that I sold about half of my puts last week during the dip and was able to rebuy my positions much cheaper today but I am pretty close to capitulation tbh. After having been involved with crypto fairly heavily you would think I would realize how irrational the markets can be, and yet somehow I still haven’t really learned that lesson.

The checks on this kind of nonsense are supposed to be human beings who would position themselves appropriately… but if too many of them are incentivized to put their fingers in their ears so not enough of them do it… who watches the watchman?

Value isn’t real, money’s not real, wealth isn’t real, it’s all made up if you get existential enough about it. What even is real at that point? Why bother adhering to logic or rules when its all fantasyland anyway? Might as well keep that friendly green line on your portfolio going up.

idk just musing.

Came across this article today which tried to rationalize some of the disparity between the overall state of things and stock market prices:

Still seems ridiculously optimistic to me but wtf do I know…

“Human ingenuity will allow for a gradual resumption of economic activity,” for all the negative recent developments, DeBusschere wrote. “We lean toward positive outcomes.”

So, handwaving and fairy dust, shit goes up because I hope it does, market goes BRRRR. Like I said.

Remember when startups were running around saying “we’re the Uber of X” to get funding? There were so many companies with vision statements about embracing technology to disrupt the market for bathtub mats or whatever.

Their entire business model only ever made economic sense if you assumed an eventual monopoly, which makes zero sense in a commodity industry with low barriers to entry.

I do think a lot of people were enamored with Uber at the beginning because taxi service included all the negative hallmarks of monopolies. Even today Uber outperforms traditional cab service on quality of product.

Good point. But even at the outset it should have been obvious that if it “worked” and wasn’t shut down by regulators, it would quickly become a highly competitive market with zero sustainable competitive advantage.

Yeah that’s mostly what I took out of it too…

So do we test all time highs this week or next? This seems absurd, the only reason I haven’t pulled everything out yet is that I’m reminding myself that this market is pricing in all the stimulus/bailouts that have already been put in motion and all the ones that will be if they’re needed.

Otherwise, you have to believe COVID-19 is only worth -13%. If you believe all the stimulus and handouts are worth like 10% of the original value of the indexes, then we’re more like -21% from that value. That seems more like it. On the other hand, if you thought the market was already overpriced by about 10-15%, then current values are even dumber.

One thing that’s clear right now is that the Trump administration has changed the fundamentals of the stock market through policy that basically forces money into the market to pump it up, whether that’s through tax cuts → stock buybacks or stimulus/bailouts. I’m going to bold this next part because it seems really important and I’m curious if others agree.

At this point, the stock market is not functioning as a measure of the value of the American economy, but rather as some artificially created investment tool. It might as well be a credit default swap or something. The question has stopped being is the S&P or DJIA worth $Y and instead is, “Is this a more profitable place to park my money than bonds or cash, with the understanding that everyone is going to face this same decision with manipulative government influence?”

Seems like there will have to be a reckoning at some point, but it could take different forms.

Fuck Uber, fuck the delivery apps, and fuck Amazon. Seriously all of these tech bros trying to compete in real world industries that are already very efficient and competitive are idiots. Go disrupt some shitty oligopoly lol.

Source: am in the most competitive business there is where net profit margins before tax are 1.5% to the shareholders and still we’ve got multiple tech firms idiotically trying to do ‘uber for trucks’ including Uber… who will have exited by the end of the 3rd quarter of this year if they know what’s good for them. You can’t price dump in trucking boys it’s like trying to drink the fucking ocean.

Last week I unloaded about 10% of my portfolio worth of DGX (Quest Diagnostics), I just unloaded another 8%. Also sold about 10% of my portfolio worth of AMZN and 15% worth of MSFT.

My working theory is that holding more than 20% of my portfolio in any one stonk that’s already at or near its all time high, in the time of coronavirus, seems crazy. Yes those stocks are a nice hedge against market collapse since they should fall the least - but so is cash. And how much upside do they really have right now? Only AMZN I could see massively breaking through because AMZN.

When Fidelity finally clears my pending money I’ll have to decide if I want to sit in cash or maybe put some more of it in index type funds. Although I really think this might be the one time you want to go with something managed over blind index funds. Also I may put some more in XOM (Exxon), which I currently have like 4% of my portfolio in.

If I decide to sit in cash there’s a fund that tracks the Euro vs. the dollar I’m going to put it in.

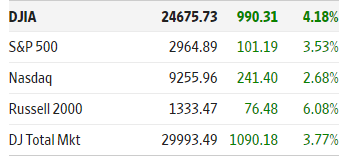

STONKS!!!

Stonks indeed.

Generally speaking, trying to get a taxi generally sucks, trying to get an Uber/Lyft generally does not. I’m still pretty surprised the taxi companies haven’t adopted technology to the extent of just building out an app that lets you hail a cab to your location via an app.

A lot of these tech startups might be better off on a SaaS model, though.

FXE?

Yeah, and it’s not like taxi companies are especially righteous, either. Using Lyft, it only takes a few button presses to get an accurate fare estimate, an accurate ETA for both pickup and dropoff, no-contact payment AND tip, and an automatic receipt for when I’m getting reimbursed through work. Taxis either don’t offer that or make it much more difficult.

Yup, plus in most places it’s not like you can just stand on the street and wait for a taxi to roll past and flag it down. In 2020, who wants to call and go through that hassle on the phone when you can do it on an app then watch for exactly when they’re going to pull up?