Yeah that’s pretty bad. An investment committee doing their job should be able to negotiate a better fee than that.

Is the 0.8% the fee for the fund, or is it an AUM fee? The way you phrased it suggests the former, which is different from what Riverman was talking about it.

Either way it’s horrible, and your employer should have been able to do a lot better.

Yeah, it’s really bad. The very worst funds in my 401k are half of that. And most are roughly about a quarter of that or less.

I think a lot of small companies don’t really understand what they’re doing and just hire a management company to do their 401k program so they can not worry about it.

I know of one company that offered a bunch of expensive actively managed funds and one S&P500 index fund. This index fund (PEOPX) has an expense ratio of 0.5%, literally 10X what it should be. There is no reason any sane person would buy this fund, and yet it has $2B in assets. I’m pretty confident this is almost exclusively people trapped in bad 401ks.

However, I can’t remember who said it (maybe John Bogle), but even really bad 401ks can eventually be turned into good IRAs. So it may still be in your long-term interests to contribute as much as possible, painful as it is to pay those expensive fees.

Yeah it’s a good point. I would invest up to the match, then invest into an HSA if available to the max, then an IRA or Roth to the max, and then if I still had money to invest I would go back to the bad 401k to the max.

Yeah, even with the 0.8% fee, maxing the 401K is still better than just accumulating the money in a taxable account.

I’d like to subscribe to your newsletter.

Dumb Hypo:

I own option to purchase 100 shares at 3.50 for company currently valued at 4.10. Is there any benefit to not exercising option now?

Why wouldn’t you keep the $350 in your bank account and let the “free” investment ride at no cost? I mean, unless you need the $60 (minus taxes) right now? I would not exercise and hold when I could let it ride for free, unless they were close to expiring in which case I would either exercise to sell or exercise to hold depending on what I think of the company.

Edit: sorry I assumed employee stock options

For publicly traded options it is approximately never the right decision to exercise them early. It’s virtually always better to sell the option than to exercise early. If not publicly traded it’s more complicated, and presumably has tax considerations if they represent compensation.

Exactly. If you want to cash out the profit now then just sell your options.

However, if you’re planning to actually buy and hold the stock, there is no reason to exercise early, since the stock price could end up below the strike price on the day the options expire.

Thanks, everyone.

Since when can W4 employees not change their Federal allowances? I went to change my allowances from 0 to 1 after running my tax estimates and determining I’m going to be withholding too much Federal tax this year, and apparently the only way to change your Federal withholdings is to fill out a long IRS questionnaire including a bunch of questions about my spouses income and withholdings. I’m not even sure that you can just directly enter the number of allowances you want to claim because I didn’t make it all the way through the process. You just have to enter all the info and the Feds will apparently decide for you. I finally said fuck it and just closed the window after deciding this was bullshit.

Are you doing this through some online link your employer set up so employees can access their payroll and benefits?

In our small office I’m sure I can just tell the office manager to change my withholding.

Yeah, through ADP which is a large payroll company. I used to go there and basically just change my number of federal allowances and hit submit. Now it says IRS requires me to fill out this form. I click that and it redirects me to the IRS website and it says if I do not fill out this form my employer is required to withhold at the maximum rate. I started entering all the crap they wanted and then there was stuff I wasn’t sure about because I didn’t have my wife’s last pay stub handy, so I just said fuck it. I’ve never seen any of this before. (I don’t think I’ve adjusted my allowance since 2018 though.)

But for like 25 years once or twice a year I estimate my tax liability and check everything out and adjust allowances if necessary and it was all very simple. This process is like some big brother shit. If this change happened under a Democrat they would be calling for a civil war on Fox News.

For publicly traded options it is approximately never the right decision to exercise them early. It’s virtually always better to sell the option than to exercise early.

Can you (or someone else) explain exactly why this is? It seems like both transactions should yield the same amount of profit.

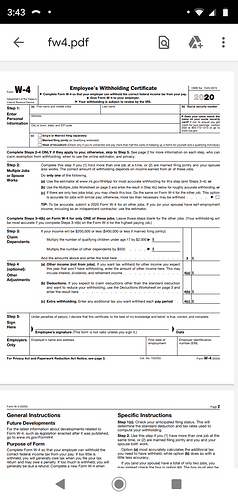

When you tried to change your withholding online, were the questions similar to those on the IRS paper form?

I think so, if you consider that you need to go on to other pages if you have a spouse that works or you have other deductions such as 401k, etc.

You will notice nowhere on this form can you now claim allowances. You will enter your income and your wife’s income, your dependents, and your withholdings and then the IRS will decide what to withhold.

This is going to fuck me up because I get bonuses but don’t always know the amounts until I get them so sometimes I need to adjust along the way. This process wants you to know everything up front.

As long as you withheld at least as much as you did in 2019 by year’s end then you won’t get hit with a penalty if your income jumps this year and you owe money next April.