The airline thing is a pretty clear indication the old man has lost his fastball. He’s spent decades outlining why they are terrible investments. Buffet has an extraordinary record with acquisitions of private companies, but I’d be shocked if his stock picking has beaten VTSAX over the last 10-20 years.

Eh. Be careful about trash talking Warren Buffet near the all time highs when there’s a better than 50/50 shot his last hurrah is less than 90 days out.

The airline business model that WB invested in the last decade was a mild price fixing cartel that was generating excellent profits by cramming more and more people into tinier and tinier spaces. That’s clearly very over and they are clearly very fucked. I get him bailing out.

At the same time don’t be shocked if when this is all over he ends up owning an airline free and clear for pennies on the dollar somehow.

It’s an interesting situation because on the one hand a person needs a long track record for their investment track record to be statistically significant, however the longer the track record the more likely that parts is the good performance were achieved in an environment fundamentally than the present and immediate future. Obviously I speak as an investment agnostic indexer type, so I am inclined to skepticism on these matters.

There’s also way fewer opportunities for great plays when you’re managing hundreds of billions in assets. Buffett might be able to get 30% returns with 10 million even today but there’s no way to do that with 500 billion.

50% returns under 100m probably. The guy’s probably the greatest financial mind since Nathan Rothschild. The aw shucks Nebraska Grandpa act is just that… an act.

Its not even that I doubt that, I would just speculate that even for the sharpest mind if you hone your skills and instincts under one set of conditions its damned hard adapt, especially on the fly. In other words, the Buffet of the 2020s is probably not Warren Buffett.

I haven’t seen/listened to the annual meeting broadcast yet (it’s available in podcast form via Yahoo Finance), but it was pretty disappointing that Berkshire bought back basically no shares despite the pretty dramatic drop in stock price. This wasn’t because he was saving money for other purchases - they basically didn’t make any investments.

Some possible interpretations:

- Buffett will never buy back meaningful amounts of shares because he views that action as an admission of defeat.

- Buffett will not act aggressively in a crisis because in a crisis, he wants to make sure that Berkshire is fully solvent and liquid in all possible scenarios.

- Related to point 2, Buffett is managing Berkshire so that shareholders can stay rich, not so shareholders can get rich.

- The economic effects of the virus are going to be far worse than the market seems to be anticipating, and Berkshire (and other firms) have experienced a permanent drop in value.

I come away from this meeting (having heard only the highlights) much more negative than I had been before. Berkshire, through its vast operating companies, has more available data about the economy than almost any other firm. If Buffett is in “batten down the hatches” mode, it’s hard to feel good putting money anywhere really.

I think the environment since 2009 has been poor for his value style. Just not many traditional blue chip companies at attractive valuations due to interest rate environment. He also kind of bound himself in a bad spot with his long time position of never investing in tech because he didn’t understand it. When the highest valued companies in the US are all tech companies you need to learn something about the industry, you can’t just ignore it anymore.

Listening to him talk in some videos of the online Q&A, he definitely did not seem his sharp self from even 5 years ago. There seemed to be some stumbling over words and trouble sticking to the train of thought at times.

Still would not bet against Berkshire as a company well positioned to ride out the storm and scoop value on the other side.

I got my insurance bill today and it reminded me that I’ve had an umbrella policy for about 10 years now, and I’m really not sure why. I’m definitely not sure what the “right” amount would be.

What does an umbrella policy cover?

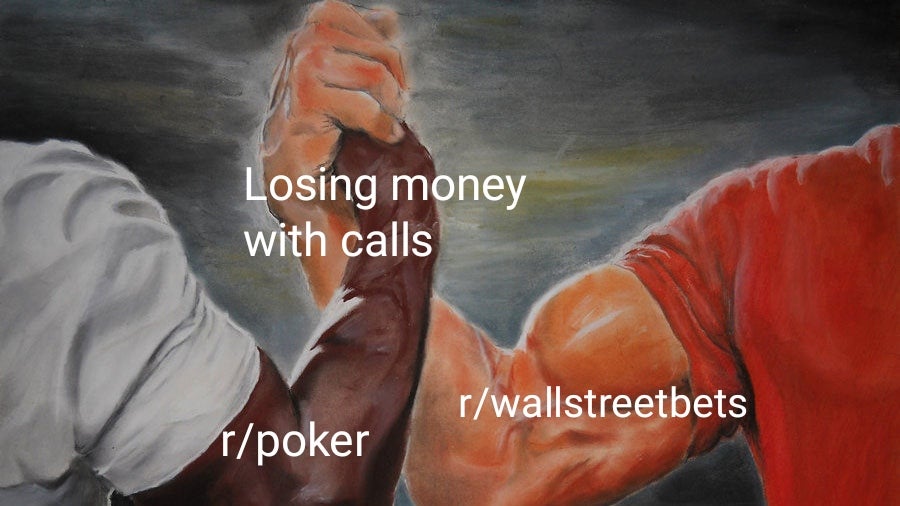

Also STONKS! Who’s with me?

Rain damage

Eyyyyyyy

Basically covers liability above and beyond what your auto and homeowner policies cover. They are cheap and a good idea if you have a lot of assets to protect.

Like my stonks?

Sorry no, but the Fed has got you covered there.

Update on stonks gambling for me is that I sold 60% of my puts on Friday. Waiting for S&P 500 to crack 3k before I fire up more July and later puts. 95% of what I have left are July 17 expiry.

Posted this in the COVID-19 thread, but the last one provides some insight into why the stock market has been perhaps more resilient than we would expect.

Imagine going to a fucking baseball game right now.

Sounds like Bill Maher will be on board with this plan.