Looks like we’ve lost every dollar we gained year over year. 2/28/19 closed at 25,916

He’s probably on the phone screaming at the head of Goldman Sachs right now, “I gave you everything you wanted, and this is how you treat me?!?! Just keep it up until the election. Do it!”

Buy some puts. I’m sure they’re cheap.

Thanks OBAMA.

puts are insanely expensive on everything right now

we are still absolutely drilling in AH, SPY now down 5%

I was being sarcastic but it’s impossible to tell.

As much as the panicky side of me wants to sell something - I don’t think it makes sense to unload any of my main IRA that I can’t touch for 9 more years (or don’t plan to anyway).

The rest of my net worth (about 40-45%) is split between home equity (70%) and a brokerage fund (30%). I plan to sell the condo pretty soon so I look at that home equity as cash at the moment. So I don’t think it makes sense to unload anything in the brokerage account either. Not fun though.

I did plan on pulling out of stocks a decent sometime early in Trump’s second term (if it happens). I figured he’d do everything he could to keep it high until the election. If a generic dem won I might keep it in. If Bernie wins I have no idea what I’ll do but probably leave it in since I think Wall St. will come crawling back from an insta-crash.

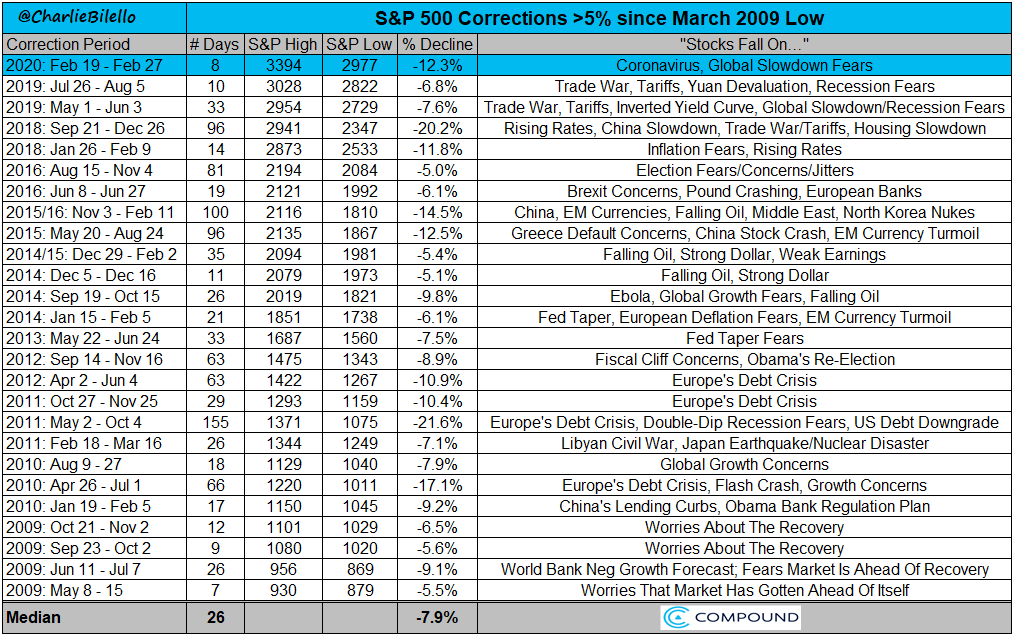

Fastest correction in history (whatever that means)!!!

Thank you, working hard!

S&P closed down -4.4% for its 6th straight negative day for the first time since Aug 5, 2019

-WTD: S&P is down -10.76% on pace for its worst week since Oct 10, 2008 when the S&P lost -18.2%

Dow closed down -4.4% for its 6th straight daily loss and its 9th negative day in 10

-WTD: Dow is down 11.13% on pace for its worst week since Oct 10, 2008 when the Dow lost -18.15%

I wonder how much money Bob would if he a) invested all his extra cash immediately and b) was the world’s best market timer and only jumped in at bottoms.

What would you do if a genie told you that 8 months from the 2024 presidential election (Mar 1, 2024) the stock market would be exactly even?

And same for the 2028 election?

Can’t find the answer to this question so I’m asking here: I know there are contribution limits to traditional IRA’s if I have a 401k. I currently participate in a 401k. I’m about to go to a new company that offers a 401k but also will pay their normal match in cash if I don’t participate. I’d prefer an IRA for the flexibility. What are my contribution limits for 2020 considering I’ve already participated in my current company’s 401k? How about for 2021 assuming I don’t use the new 401k?

Having a 401(k) never prevents you from contributing to an IRA. However, depending on your level of income you might not be able to deduct your IRA contributions.

It starts to phase out for a married couple at 119k AGI, or near there.

Past performance is no guarantee of future results ldo

Plus, ignoring that none of these involved either a global pandemic or a socialist candidate for pres, we are down that amount over a week. The only larger corrections on that list took place over several months.

imo we still haven’t seen the worst of this “correction”… imagine when the US has significant outbreaks all over. We have no hope of stopping this, and at the minimum thousands are going to die.

True but if the choice is using the new company’s 401k, effectively no match but deductible vs a more flexible but not deductible IRA, I’ll use the 401k. My question is whether having the 401k available but not using it triggers the lower limits on deductibility, and also how the 401k plan I’ve been using at my current company affects things in 2020.

This brings up the key weakness of so many peoples investments; the ability to see how they are doing.

Someone needs to make a portfolio you literally can’t track except maybe once a year. For the majority of people being able to see how your portfolio is doing leads to bad decisions.

I’m weird, but I can honestly say I haven’t looked at mine since I rebalanced last March. That includes this month. No idea where it is at.

It’s the rare case where total ignorance is a huge benefit.

2020 Limits for IRA and Roth IRA along with the general rules.