Yeah, but anything short of total collapse and the billionaires will always find a place to happily live out their retirement years.

There aren’t many straight up exchanges in the US for a reason. Though I believe paypal/square do it now too.

So are these other exchanges legal in other countries and just not the US or are they more or less illegal everywhere?

And if they do exist, what is to stop an American from just going to the website and using it. Are they less secure? Are they so illegal that you’re going to be sweating jail time?

There’s a BTC ATM in a gas station by my house. I have no idea how it works or what it does.

There are many exchanges that do not accept US customers the same way some poker or gambling sites do not.

I use Blockfi… Voyager and Uphold are easy too. If you’re not concerned with actually holding the BTC on your own drive the cash app is easy hell to buy on.

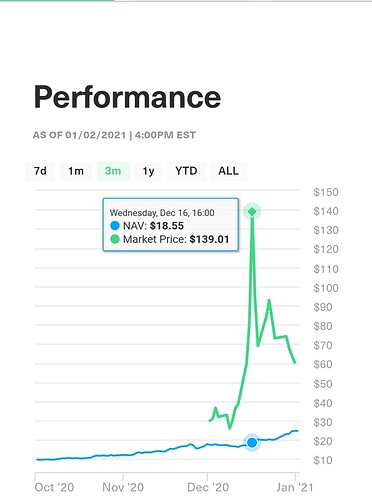

Also there is an ETF - GBTC. However, it can trade at a massive premium to it’s actual NAV when the supply/demand dynamics pump the ETF price more than the underlying reserves.

A really egregious example of this is BITW which is a top 10 crypto ETF:

Yeah… just a slight premium.

Also the ETFs don’t trade on the weekends but crypto does, so if a black swan event occurs when stonks are closed… everyone else is going to have a huge head start on making you a huge bagholder.

So is the only advantages of these other exchanges the anonymity factor. If I don’t care, is coinbase just as good? Does coinbase have worse rates or some other disadvantage?

Are you trying to buy it anon? If not, you can buy bitcoin on brokers like robinhood and its FDIC’s insured.

I’m fairly certain that FDIC insurance doesn’t cover Bitcoin. FDIC only covers bank deposits, brokerages like Robinhood provide SIPC insurance, but Robinhood explicitly says this insurance doesn’t cover crypto (which makes sense since SIPC covers your cash and securities held by a broker and most crypto are not securities).

“Cryptocurrency investments through Robinhood Crypto are not protected by SIPC and that Robinhood Crypto is not a member of FINRA or SIPC.”

I don’t care about anonymity. I’m a bitcoin newb and at this point I have no actual plans to buy. I’m just trying to figure out how it works.

Do these brokers offer worse rates than places like coinbase?

Also I think the anonymity is somewhat of an issue when it comes to the value of bitcoin itself. I’m under the impression that bitcoin at least derives some of its value from the fact that transactions can be anonymous. If lots of people can’t actually do that, it would seem that would devalue bitcoin. Of course, I imagine this effect is already priced in.

yeah, you’re right.

Bitcoin already crashed down to like 4k once, who knows what will happen but mega volatility is all but assured.

But everything is always perfectly rationally priced at every instant. So the ETFs might be doing you a favor.

yeahh btc has lost ~75% of its value at least 3 times probably more like 5.

This is a direct quote from the Bloomberg article I linked just upthread:

For years, regulators have quashed hopes of a Bitcoin exchange-traded fund, citing worries about everything from market volatility and industry manipulation to thin liquidity.

Just like Bitcoin itself, issuers keep fighting back.

VanEck Associates Corp. has started a new push to launch an ETF tracking the world’s largest digital currency, according to a filing Wednesday to the U.S. Securities and Exchange Commission. The VanEck Bitcoin Trust would reflect the performance of the MVIS CryptoCompare Bitcoin Benchmark Rate.

It’s a bold move for the New York-based firm. There have been multiple applications for crypto-tracking ETFs over the years, and the SEC has denied them all.

I posted another Saylor video here several days ago and it was met with indifference, though I found it informative.

It’s never going to function as an actual currency until the fluctuations die down. So instead it’s basically a store of value powered by true believers and goodwill. It has no intrinsic value or explicit backing by a nation-state. We used to call those pyramid schemes.

Excuse me - it’s a trust not an ETF but it is registered with the SEC:

Anyhow, I’m not quite sure what your point was though? Someone asked so I provided an option you can currently buy and provided the downsides along with it.

My point was that I was confused how there could be crypto ETFs when I just read that there were no crypto ETFs. That’s all.

Fair enough. Sorry I took it the wrong way.